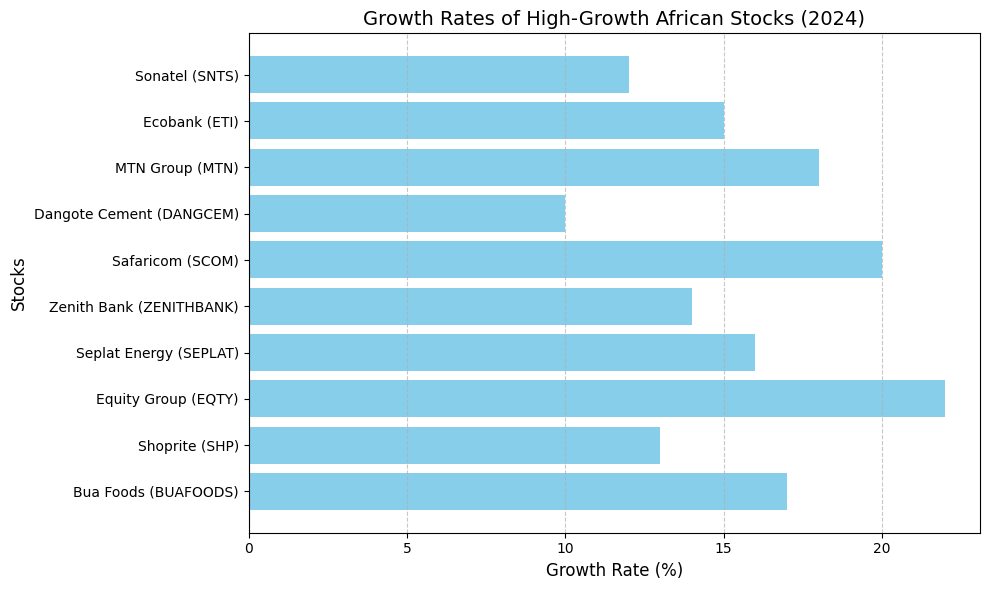

Here is a list of 10 high-growth African stocks that demonstrated sustained growth in 2024. These companies represent Africa’s dynamic economic landscape, offering diverse opportunities for investors seeking exposure to emerging markets with high-growth potential.

1. Sonatel (SNTS)

Description: Sonatel is a prominent telecommunications provider in West Africa, delivering essential services in countries like Senegal, Mali, Guinea, and other nations within the West African Economic and Monetary Union (WAEMU). Over the past few years, the company has experienced significant growth in its stock value, reflecting its strong market position and the increasing demand for mobile and internet services in the region. Investors have shown confidence in Sonatel’s ability to expand its operations and enhance its technology, which has contributed to its upward trajectory in the stock market. This growth not only highlights the potential for further development in the rapidly evolving telecommunications landscape in West Africa.

Growth Factors:

- Revenue growth was driven by increased mobile data usage and expansion of fiber-optic networks.

- Benefited from rising smartphone penetration and digital transformation initiatives across the region.

- Strong dividend yield attracted both local and international investors.

2. Ecobank Transnational Incorporated (ETI)

Description: Ecobank Transnational Incorporated is a pan-African banking group with operations in over 30 countries, this bank has seen remarkable growth in its stock value over recent years. As it expands its services across the continent, more customers are choosing to bank with them, which has contributed to its rising success. This growth reflects the bank’s commitment to providing quality financial services and its ability to adapt to the needs of various markets.

Growth Factors:

- Achieved double-digit loan book growth, especially in trade finance.

- Benefited from increased cross-border trade within the African Continental Free Trade Area (AfCFTA).

- Digital banking services saw rapid adoption, contributing to higher transaction volumes.

3. MTN Group (MTN)

Description: MTN Group is Africa’s largest telecom operator, with a presence in over 20 countries. Over the past few years, the company has experienced remarkable growth in its stock value, reflecting its expansion and increasing customer base. As more people in Africa gain access to mobile services, MTN has been positioned at the forefront, allowing them to provide innovative communication solutions.

Growth Factors:

- Expanded its fintech ecosystem, including mobile money services, which grew by 30% YoY.

- Benefited from increased demand for data services amid digitalization trends across Africa.

- Strategic partnerships with tech giants like Google boosted service offerings.

4. Dangote Cement (DANGCEM)

Description: Dangote Cement is Nigeria’s largest cement producer and plays a big role in the African construction industry. They create a lot of cement that is used to build homes, schools, and roads, helping to improve infrastructure and support economic growth. With their many factories and a strong distribution network, Dangote Cement can meet the growing demand for high-quality cement across different countries in Africa. This company not only builds up structures but also contributes to job creation and development in the regions where they operate, making them an important part of Nigeria and the continent’s progress.

Growth Factors:

- Increased infrastructure spending in Nigeria and other African countries drove higher cement demand.

- Export revenues grew as the company expanded its footprint into new markets like Ghana and Sierra Leone.

5. Safaricom (SCOM)

Description: Safaricom is the biggest telecom company in Kenya, and it operates M-Pesa, a popular mobile money platform. M-Pesa allows people to send and receive money using their mobile phones, making it easier for people to manage their finances. With this service, users can pay for things, buy airtime, and transfer money to their friends and family, even if they don’t have a bank account. Safaricom has played a big role in helping Kenyans stay connected and improving their financial situations, especially in areas where traditional banking services are hard to access.

Growth Factors:

- M-Pesa revenue surged due to increased adoption of digital payments in Kenya and Tanzania.

- Expanded into Ethiopia, adding millions of new subscribers to its network.

6. Zenith Bank (ZENITHBANK)

Description: Zenith Bank is one of the largest banks in Nigeria and it plays a very important role in the country’s economy. The bank has a strong focus on corporate banking, which means it helps big businesses manage their money and finances. In addition to corporate banking, Zenith Bank is also working hard to expand its services to regular people, making it easier for individuals to open accounts, save money, and get loans. This combination of helping businesses and individuals makes Zenith Bank a key player in the financial world of Nigeria.

Growth Factors:

- Strong earnings growth due to higher interest income from rising rates.

- Digital banking platforms saw significant user growth, enhancing fee-based income.

7. Seplat Energy (SEPLAT)

Description: Seplat Energy is a leading energy company in Nigeria that focuses on discovering and producing oil and gas. They work hard to find new sources of oil and gas to help power homes, businesses, and industries. Seplat Energy is important because it helps provide the energy that people need for everyday life. The company not only aims to produce energy, but also strives to do so in cooperation with the local communities where they operate.

Growth Factors:

- Benefited from rising global oil prices and increased production capacity at its key fields.

- Diversified into renewable energy projects, attracting ESG-focused investors.

8. Equity Group Holdings (EQTY)

Description: Equity Group Holdings is a large financial services company based in Kenya. This company provides a variety of banking and financial services not just in Kenya, but also across East Africa, including countries like Uganda, Tanzania, and Rwanda. They help people manage their money, take loans, and save for the future, making it easier for individuals and businesses to grow and succeed.

Growth Factors:

- Loan book grew by over 20% YoY, driven by SME lending and regional expansion into DR Congo and Rwanda.

- Digital banking platforms contributed significantly to non-interest income.

9. Shoprite Holdings (SHP)

Description: Shoprite Holdings is the largest retail chain in Africa, and it has many stores located throughout Southern Africa and even in some other regions. This company offers a wide variety of products, including groceries, clothing, and household items, making it a go-to place for shopping. Shoprite is known for providing affordable prices and a convenient shopping experience, serving millions of customers every week. Whether you need food for your family, new clothes, or everyday household supplies, Shoprite aims to have everything you need in one place.

Growth Factors:

- Revenue grew due to higher consumer spending in South Africa post-pandemic recovery.

- Expansion into underserved rural areas boosted market share.

10. Bua Foods (BUAFOODS)

Description: Bua Foods is a well-known food processing company based in Nigeria. They focus on creating various essential food products that many people use every day. Some of the main items they produce include sugar, which is used to sweeten our drinks and desserts, flour, which is a key ingredient in bread and other baked goods, pasta, a popular meal choice that comes in different shapes and sizes, and rice, a staple food enjoyed by millions.

Growth Factors:

- Benefited from increased food demand amid population growth in Nigeria and export markets like Ghana and Cameroon.

- Expanded production capacity to meet rising domestic demand for essential food products.

Key Insights from African Stock Growth Trends

- Digital Transformation: Companies like Safaricom, MTN Group, and Ecobank are driving financial inclusion through mobile money platforms.

- Infrastructure Boom: Dangote Cement and Seplat Energy are capitalizing on Africa’s urbanization trends.

- Consumer Growth: Shoprite Holdings and Bua Foods benefit from rising middle-class consumption patterns.

Citations:

- https://www.african-markets.com/en/news/africa/top-5-best-performing-african-stock-markets-in-2024

- https://dabafinance.com/en/news/african-stock-markets-shine-in-2024-despite-macro-challenges

- https://www.laterite.com/blog/africas-fastest-growing-companies-2024/

- https://nairametrics.com/2025/01/03/top-5-best-performing-african-stock-markets-in-2024/

- https://businessempires.africa/emerging-giants-7-african-companies-to-watch-in-2024/

- https://dabafinance.com/en/insights/the-best-african-stock-markets-of-2024

- https://r.statista.com/en/growth-champions/africas-fastest-growing-companies-2024/ranking/

- https://africa.businessinsider.com/local/markets/best-performing-african-stock-index-seen-extending-gains-in-2025/k15b63d

- https://thewanderinginvestor.com/alternative-investments/outlook-for-investing-in-african-stock-markets-in-2024/

- https://empowerafrica.com/the-top-10-fastest-growing-sectors-in-africa-2024/

- https://www.cnn.com/2024/11/28/world/video/marketplace-africa-stock-exchanges-south-africa-morocco-spc

- https://africa.businessinsider.com/local/markets/10-fastest-growing-african-companies-in-2024/n302lte

- https://www.moneyweb.co.za/news/markets/jses-best-and-worst-shares-of-2024/

- https://luckboxmagazine.com/trades/from-africa-to-asia-top-performing-global-stock-markets-2024/

- https://www.ft.com/content/449e7e1a-2f67-48f6-84f2-a398dddc5784

- https://www.afsic.net/best-stocks-to-invest-in-2024-in-africa/

- https://empowerafrica.com/top-20-fastest-growing-companies-in-africa-2024/

- https://african.business/2024/05/trade-investment/africas-top-companies-2024-listings-show-some-growth-against-a-still-difficult-backdrop

- https://www.ft.com/content/a1bc5d2e-046e-499b-b27e-4d057f9d8477

- https://finance.yahoo.com/news/nice-nice-best-middle-east-034433204.html

- https://www.ft.com/content/40076a79-5ada-4c70-a9df-b3e5fe33bfb2

- https://www.linkedin.com/pulse/africas-top-companies-2024-ranking-afif-ben-lqwwe

- https://www.ft.com/content/3c596610-7be2-4670-9284-f6ec89fd8365

- https://afdb-org.cn/wp-content/uploads/2025/01/african_economic_outlook_aeo_2024_-_highlights_0-1.pdf

- https://finance.yahoo.com/news/africa-oil-release-fourth-quarter-213000963.html

- https://www.henleyglobal.com/publications/africa-wealth-report-2024/african-investment-mosaic-patterns-pitfalls-promises

- https://finance.yahoo.com/news/10-best-african-stocks-invest-123456542.html

- https://assets.kpmg.com/content/dam/kpmg/ng/pdf/2024/11/Doing%20Deals%20in%20Sub-Saharan%20Africa%202024%20FINAL.pdf

- https://finance.yahoo.com/news/africa-oil-announces-results-share-070000188.html

- https://www.afdb.org/sites/default/files/documents/publications/african_economic_outlook_aeo_2024_0.pdf

- https://finance.yahoo.com/quote/AAGR/

- https://finance.yahoo.com/quote/WFRSF/

- https://finance.yahoo.com/quote/RECAF/

- https://africanmanagers.com/all/news/african-management-institute-named-to-financial-times-2024-fastest-growing-businesses-in-africa/

- https://r.statista.com/wp-content/uploads/AfricasFastestGrowingCompanies_Questionnaire_2024_EN.pdf

- https://www.africanexponent.com/top-10-african-companies-to-work-with-in-2024/

- https://businessday.ng/technology/article/top-10-african-startups-that-raised-the-most-funding-in-2024/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC11066148/

- https://www.fnb.co.za/blog/investments/articles/EquityInsights-20240130/?blog=investments&category=Latest&articleName=EquityInsights-20240130

- https://finance.yahoo.com/news/africa-company-reports-database-2024-082800778.html

- https://africanfinancials.com/african-listed-companies/