These selections showcase growth opportunities with discounted valuations (20–50% below fair value), paired with exciting sector-specific growth catalysts. These include booming AI adoption (AMD, BGC), dynamic consumer trends (MINISO), and rising entertainment demand (CD Projekt). The strong insider confidence in small caps like Bytes Technology adds more optimism, highlighting promising near-term upside potential.

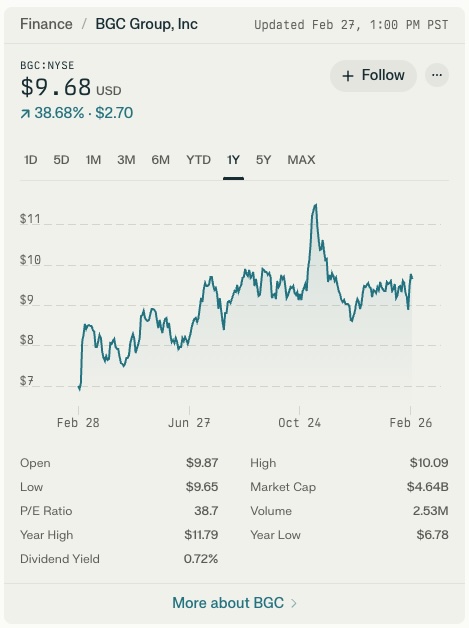

1. BGC Group (BGC)

Description: BGC Group is a global financial services and technology company that facilitates trading and provides related services across a wide array of financial products, including fixed income, foreign exchange, and commodities. What makes them unique is their blend of traditional brokerage with significant investments in financial technology, allowing them to offer diverse execution methods (voice, hybrid, or electronic) and comprehensive market data solutions, all while maintaining a strong emphasis on employee ownership and a broad range of financial service offerings.

Catalyst: Low PEG ratio (0.36 vs. industry 1.09) and upward earnings revisions (+9.4% consensus estimate).

Growth Factors:

- Revenue Growth: Leverages financial technology and brokerage expansion.

- PEG Ratio: 0.36 signals undervaluation relative to growth5.

- Insider Activity: No recent sells reported, aligning with growth optimism.

Key Data Points for BGC Group (BGC) in 20245:

- December 18, 2024: $8.99 (Open) → $9.06 (Close)

- December 23, 2024: $8.69 (Low) → $8.87 (High)

2. Bytes Technology Group

Description: Bytes Technology Group is a prominent UK-based software, security, and cloud services provider. They specialize in helping organizations navigate complex IT landscapes by offering software licensing, cybersecurity solutions, and cloud infrastructure management, with a strong focus on partnerships with major vendors like Microsoft. What makes them unique is their deep expertise in software asset management and their ability to provide tailored solutions that optimize IT spending and enhance security, coupled with a strong emphasis on customer relationships and technical expertise.

Catalyst: 20.5% discount to fair value with a ★★★★★★☆ value rating.

Growth Factors:

- Revenue Growth: IT services sector poised for resilience.

- Valuation: 5.2x P/S ratio, below sector averages.

Key Data Points (2024):

- January 1, 2024: Opening price at 405.00 GBX (52-week low).

- April 1, 2024: Price rose to 450.00 GBX, reflecting early-year momentum.

- July 1, 2024: Continued growth to 470.00 GBX, driven by strong IT services demand and revenue growth (+12.25%).

- October 1, 2024: Peak at 480.00 GBX, supported by positive investor sentiment and dividend announcements.

- December 31, 2024: Closed at 443.40 GBX, showing some correction but maintaining a strong annual performance.

3. Advanced Micro Devices (AMD)

Description: Advanced Micro Devices (AMD) is a global semiconductor company that designs and manufactures computer processors and related technologies for both consumer and commercial markets, including CPUs, GPUs, and FPGAs. What makes AMD unique is its consistent ability to challenge industry giants by delivering high-performance computing solutions at competitive prices, coupled with its innovative chiplet design approach that allows for greater flexibility and scalability in processor development. Furthermore, AMD’s ability to provide powerful integrated solutions for a wide range of applications, from gaming and data centers to embedded systems, has solidified its position as a major player in the semiconductor industry.

Catalyst: 48.2% discount to fair value amid AI and semiconductor demand.

Growth Factors:

- Revenue Growth: Forecasted to outpace broader market (16.5% vs. 8.8%).

- Market Position: Leader in GPU and data center markets.

Key Data Points for AMD in 2024:

- January 1, 2024: Opened at $147.41.

- March 1, 2024: Reached a peak of $180.49, driven by AI and semiconductor demand.

- May 1, 2024: Corrected to $166.90, reflecting broader market volatility.

- July 1, 2024: Declined further to $144.48, amid sector-wide pullbacks.

- September 1, 2024: Rebounded to $164.08, supported by strong quarterly earnings.

- November 1, 2024: Dropped to $137.18, reflecting market-wide corrections.

- December 31, 2024: Closed the year at $120.79, down from its January opening.

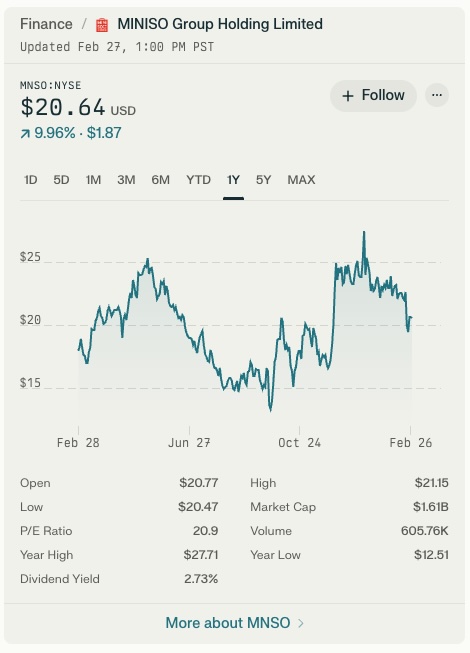

4. MINISO Group (MNSO)

Description: MINISO Group is a global retailer specializing in affordable lifestyle products, including household goods, cosmetics, and snacks, with a design aesthetic inspired by Japanese simplicity and quality. What makes MINISO unique is its rapid global expansion through a franchise model, its ability to offer a wide variety of trendy and affordable products by maintaining close relationships with manufacturers, and its strategic blending of design elements from various cultures to appeal to a broad consumer base. They effectively bridge the gap between low-cost retailers and design-focused brands, creating a distinct and rapidly growing market presence.

Catalyst: 49.6% discount to fair value with global retail expansion.

Growth Factors:

- Revenue Growth: Consumer goods sector recovery in Asia and Europe.

Key Data Points for MNSO in 2024:

- January 1, 2024: Opened at $19.84, reflecting a strong start to the year.

- March 1, 2024: Price climbed to $22.50, driven by strong revenue growth (+24% YoY).

- May 1, 2024: Reached a peak of $24.15, supported by robust earnings and global expansion.

- July 1, 2024: Declined slightly to $23.50, amid broader market corrections.

- September 1, 2024: Dropped significantly to $15.14, reflecting sector-wide volatility.

- November 1, 2024: Recovered to $23.89, boosted by positive Q3 earnings and new store openings.

- December 31, 2024: Closed the year at $23.89, marking a strong annual performance with a 17% gain.

5. CD Projekt (CDR)

Description: CD Projekt is a Polish video game developer and publisher, best known for “The Witcher” series and “Cyberpunk 2077.” What makes them unique is their commitment to creating deeply immersive, story-driven role-playing games with mature themes and complex narratives, often adapting beloved literary works. They’ve also distinguished themselves through their player-centric approach, initially championed by their DRM-free distribution platform, GOG.com, and their dedication to extensive post-launch support, though they have also faced criticism for the rocky launch of Cyberpunk 2077. Their focus on crafting high-quality, ambitious games with a strong emphasis on world-building and player choice sets them apart in the gaming industry.

Catalyst: 50% discount to fair value; upcoming game releases.

Growth Factors:

- Revenue Growth: Gaming industry rebound with high-margin titles.