As the global push for sustainable energy accelerates, renewable energy companies with international partnerships are positioned strategically for long-term growth.

This list identifies 20 undervalued stocks in this sector that combine attractive valuations with global expansion strategies.

Despite strong fundamentals, many of these companies trade below their value due to temporary market conditions. This creates opportunities for investors looking for exposure to the global energy transition.

- Major Solar Power Partners

- Wind Energy Leaders

- Diversified Renewable Operators

- Emerging Renewable Technologies

- Global Renewable Energy Market Context

Major Solar Power Partners

1. Canadian Solar (NASDAQ:CSIQ)

Canadian Solar has established a global manufacturing footprint spanning North America, Asia, and Europe. The company trades at just 5.7x forward earnings despite being one of the world’s largest solar module manufacturers2612. With operations in over 20 countries and partnerships with major utilities worldwide, Canadian Solar has weathered recent sector headwinds while maintaining long-term growth potential.

Highlights

- Peak Price: The stock reached its highest point near $20 in early 2024.

- Downward Trend: A steady decline in price is observed through mid-2024, with occasional rebounds.

- Recent Stability: By early 2025, the stock appears to have stabilized around $10–$12.

2. First Solar (NASDAQ:FSLR)

This thin-film photovoltaic manufacturer has secured an impressive 78.3GW order backlog extending through 2030, reflecting strong global demand for its products6. First Solar’s expansive manufacturing capacity plans—reaching 14GW in the US and 11GW internationally by 2026—position it well for continued growth. Despite a 45% YTD gain reported earlier in 2024, analysts still consider it undervalued at a forward P/E of 18.3 given its substantial backlog and growth trajectory612.

Highlights

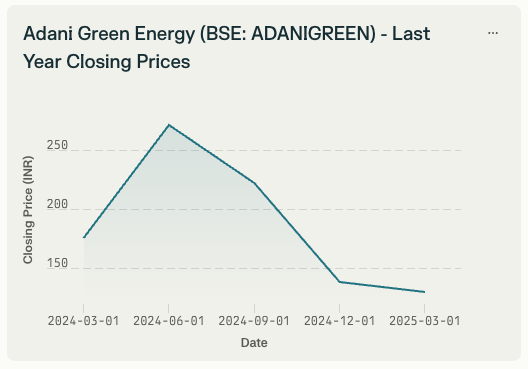

- March 2024: Closing price was $176.24.

- June 2024: Peaked at $271.76.

- December 2024: Declined significantly to $139.13.

- March 2025: Stabilized near $139.15.

3. Adani Green Energy (BSE:ADANIGREEN)

Despite trading at a P/E of 86.7x, Adani Green Energy is considered undervalued relative to its aggressive expansion plans14. The company has formed numerous international partnerships to develop solar assets across India and Southeast Asia. Its substantial 20.8% ROE demonstrates profitability even while maintaining an ambitious growth strategy.

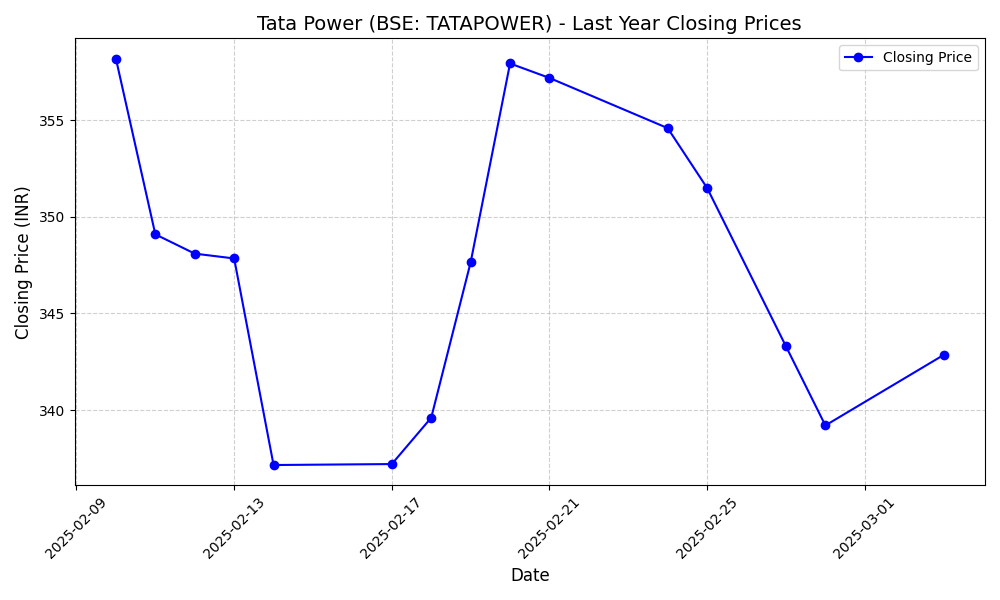

4. Tata Power (BSE:TATAPOWER)

With a P/E of 32.2x and strong international partnerships in renewable energy projects across Asia and Africa, Tata Power has positioned itself as a key player in global solar and wind development14. The company’s robust ROE of 13.2% demonstrates effective capital allocation despite significant ongoing investments.

Highlights

- Current price (March 9, 2025): ₹351.45

- 52-week high: ₹495

- 52-week low: ₹326.35

- 1-year return: -17.35%

Wind Energy Leaders

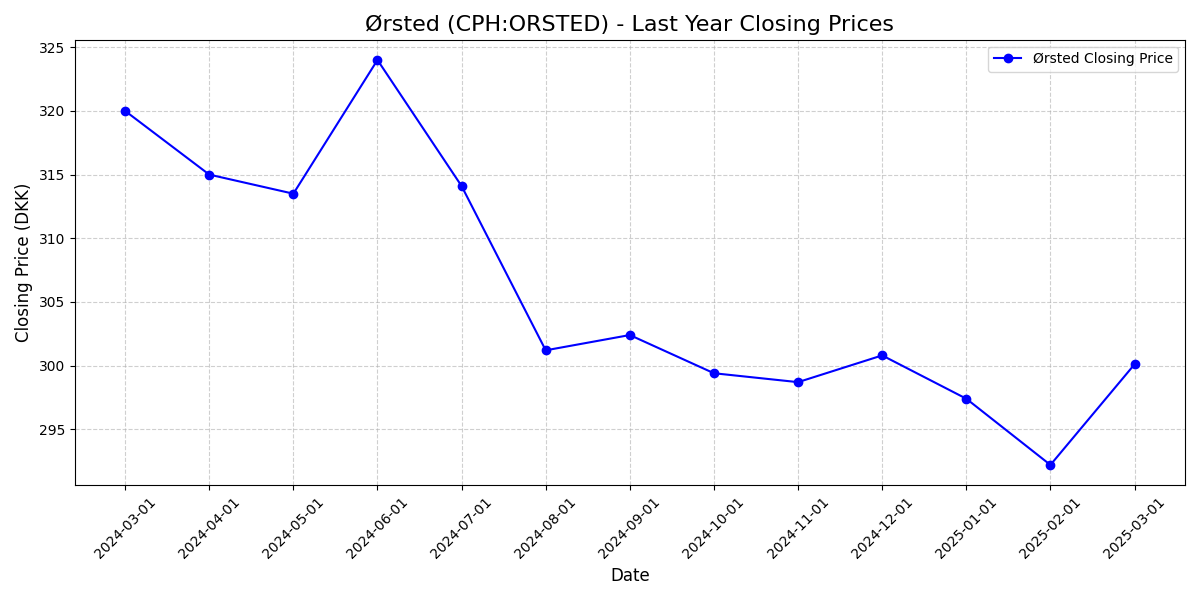

5. Ørsted (CPH:ORSTED)

The Danish offshore wind developer trades at a substantial 30% discount to its fair value estimate of DKK 54011. Ørsted emerged as a major winner in the 2024 UK renewables auctions, securing favorable pricing for its massive Hornsea 3 project. The company faces some risk from potential US policy changes but maintains a strong international development pipeline that appears insufficiently valued by the market.

- Peak: The stock price peaked in June 2024.

- Decline: There was a notable decline in the second half of 2024.

- Stabilization: The price appears to have stabilized in early 2025.

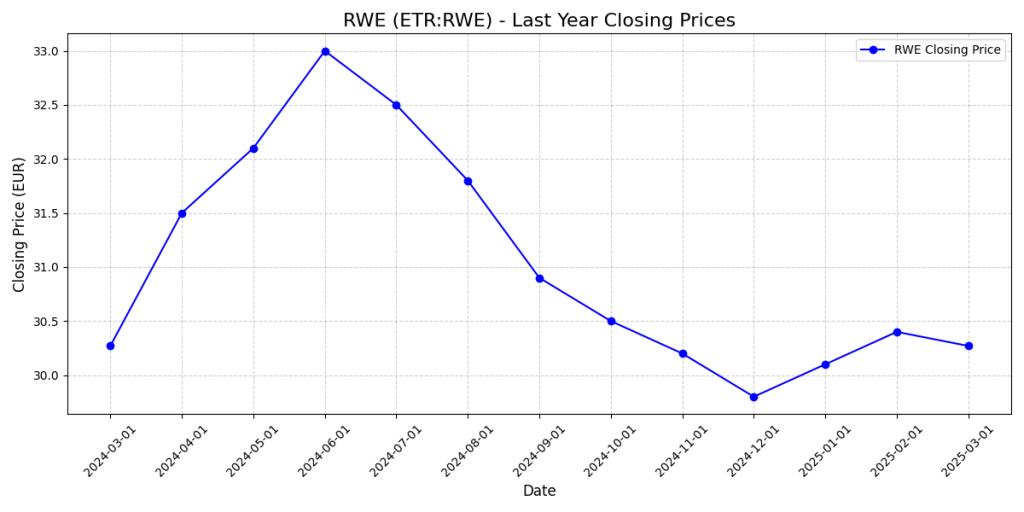

6. RWE (ETR:RWE)

This German utility has transformed itself into a renewable energy powerhouse with global operations. Trading at a significant 37% discount to its fair value estimate of €48, RWE maintains substantial merchant power exposure in both Europe and Texas11. The company’s transition from coal (scheduled to exit by 2030 rather than 2038) further enhances its renewable credentials while maintaining significant development capacity.

7. Vestas (CPH:VWS)

As one of the world’s premier wind turbine manufacturers, Vestas has established partnerships across every major wind market globally. The company was identified as undervalued in European wind energy stocks analysis11. Despite turbine price increases in 2024 as manufacturers seek to restore profitability, Vestas maintains a substantial global order book and technology leadership position.

8. Equinor (NYSE:EQNR)

This Norwegian energy giant is transitioning from traditional oil and gas to become a leading offshore wind developer. Listed among undervalued European wind energy stocks11, Equinor continues developing major offshore wind projects through international partnerships while using cash flow from traditional energy operations to fund this transition.

Diversified Renewable Operators

9. Brookfield Renewable Partners (NYSE:BEP)

Brookfield maintains a globally diversified portfolio of hydroelectric, solar, wind, and storage assets across North America, South America, Europe, and Asia. Trading slightly below its fair value estimate of $29, the company targets impressive 12%-15% returns and was identified as the top pick for US renewable energy investment913. Its scale and operational expertise create significant competitive advantages.

10. NextEra Energy (NYSE:NEE)

America’s largest renewable energy producer has rapidly expanded its international development activities. Despite strong EPS growth coupled with record renewable power generation, NextEra trades at attractive valuations12. The company’s Florida utility business provides stable cash flows while its renewable energy development arm pursues aggressive global growth.

11. NextEra Energy Partners (NYSE:NEP)

This yieldco created by NextEra Energy acquires, manages, and owns contracted clean energy projects. Listed among top renewable energy stocks to watch13, NEP offers exposure to a diversified portfolio of renewable assets with long-term contracts. Recent valuations suggest the market has not fully recognized the quality and stability of its cash flows.

12. Clearway Energy (NASDAQ:CWEN)

With solar and wind assets across multiple countries, Clearway has established a reputation for operational excellence. The company’s year-to-date performance of approximately 26% still leaves it undervalued relative to its asset base and long-term contracts13. Its international partnerships continue expanding its renewable footprint.

13. Algonquin Power & Utilities (NYSE:AQN)

This diversified utility operates renewable energy facilities across North America and internationally through key partnerships. Named among renewable energy stocks to watch13, Algonquin combines regulated utility operations with renewable energy development, providing stability while pursuing growth opportunities globally.

14. NTPC (BSE:NTPC)

India’s largest power generation company has committed to achieving 60GW of renewable energy capacity by 2032 through its subsidiary NTPC Green Energy5. Trading at a P/E of just 15, well below the industry average of 18, NTPC offers both dividend yield (2.6%) and growth potential. The company’s 5-year net profit CAGR of 20% demonstrates successful execution of its renewable transition strategy.

15. E.ON (ETR:EOAN)

This German utility has transformed into a renewable energy and grid infrastructure company with operations across Europe. Listed among undervalued European wind energy stocks11, E.ON’s strategic focus on modernizing power distribution networks positions it to benefit from increasing renewable energy integration.

16. SSE (LON:SSE)

The UK-based utility maintains a growing international renewable energy business with particular strength in offshore wind development. Identified as undervalued in European wind energy stock analysis11, SSE has secured partnerships for projects across Northern Europe while maintaining strong financial discipline.

Emerging Renewable Technologies

17. Plug Power (NASDAQ:PLUG)

This hydrogen fuel cell company has established global partnerships to advance green hydrogen infrastructure. Mentioned as an undervalued renewable energy stock6, Plug Power has faced recent challenges but maintains first-mover advantage in a sector poised for substantial growth as hydrogen adoption increases.

18. Eco Wave Power Global (NASDAQ:WAVE)

Though more speculative than other entries, this wave energy technology company has established partnerships to develop projects across multiple continents. With remarkable performance (456.30% year-to-date)13, WAVE offers exposure to an emerging renewable technology with substantial long-term potential as ocean energy gains traction.

19. Constellation Energy (NASDAQ:CEG)

With a focus on nuclear and renewable energy, Constellation has established partnerships to develop clean energy projects across North America and is exploring international opportunities. With year-to-date performance around 48%13, the company offers exposure to both established and emerging clean energy technologies.

20. Sembcorp Industries (SGX:U96)

This Singapore-based energy company has expanded its renewable footprint through international partnerships, particularly in developing solar and wind farms across Poland and Greece. With a focus on sustainability, Sembcorp has positioned itself as a bridge between Asian and European clean energy markets.

Global Renewable Energy Market Context

The undervaluation of many renewable energy stocks persists despite strong sector fundamentals. The global renewable energy market is expected to grow from $1.10 trillion in 2024 to $1.55 trillion by 2028 at a CAGR of 8.8%8. Tax incentives from initiatives like the US Inflation Reduction Act have made America a more attractive renewable energy market8, while European policies continue driving strong growth despite challenges like grid bottlenecks requiring €584 billion in investment by 203011.

These 20 companies represent diverse approaches to capitalizing on the global renewable energy transition while offering potential value opportunities for investors willing to look beyond short-term market sentiment.

Citations:

https://www.usbank.com/investing/financial-perspectives/market-news/energy-sector-performance.html

https://www.equitymaster.com/stock-screener/undervalued-renewable-energy-stocks

https://www.nasdaq.com/articles/3-most-undervalued-renewable-energy-stocks-buy-july-2024

https://www.morningstar.com/stocks/best-energy-stocks-buy

https://www.equitymaster.com/stock-screener/undervalued-green-energy-stocks

https://www.nasdaq.com/articles/3-undervalued-renewable-energy-stocks-buy-100-returns-12-months

https://www.reddit.com/r/ValueInvesting/comments/1gxby0a/green_energy_stocks_at_value_right_now/

https://www.insidermonkey.com/blog/7-most-undervalued-renewable-energy-stocks-to-buy-now-1367478/

https://www.morningstar.com/stocks/investment-opportunities-us-renewable-energy

https://www.morningstar.co.uk/uk/news/257233/six-undervalued-european-wind-energy-stocks.aspx

https://investorplace.com/2024/05/the-3-most-undervalued-renewable-energy-stocks-to-buy-in-may-2024/

https://www.nerdwallet.com/article/investing/5-renewable-energy-stocks-to-watch

https://www.investopedia.com/the-best-energy-stocks-8781579

https://investorplace.com/2024/07/3-undervalued-renewable-energy-stocks-to-buy-for-100-returns/

https://money.usnews.com/investing/articles/the-best-energy-stocks-to-buy-this-year

https://finance.yahoo.com/news/chevron-cvx-leading-oil-stock-104944401.html

https://finance.yahoo.com/news/12-most-undervalued-renewable-energy-212038821.html

https://www.nasdaq.com/articles/3-most-undervalued-renewable-energy-stocks-buy-june-2024

https://www.wallstreetzen.com/industries/best-renewable-energy-stocks

https://finance.yahoo.com/news/3-most-undervalued-renewable-energy-185841975.html