Ubisoft, the French gaming giant, finds itself at a critical juncture with the release of Assassin’s Creed Shadows. As the company grapples with declining revenues and stock price, plus whispers of a potential takeover, all eyes are on this latest installment in the beloved franchise.

With a reported development and marketing budget of around $400 million, Shadows isn’t just another game launch—it’s a high-stakes gamble that could make or break Ubisoft’s financial future. Let’s dive into the numbers and potential outcomes.

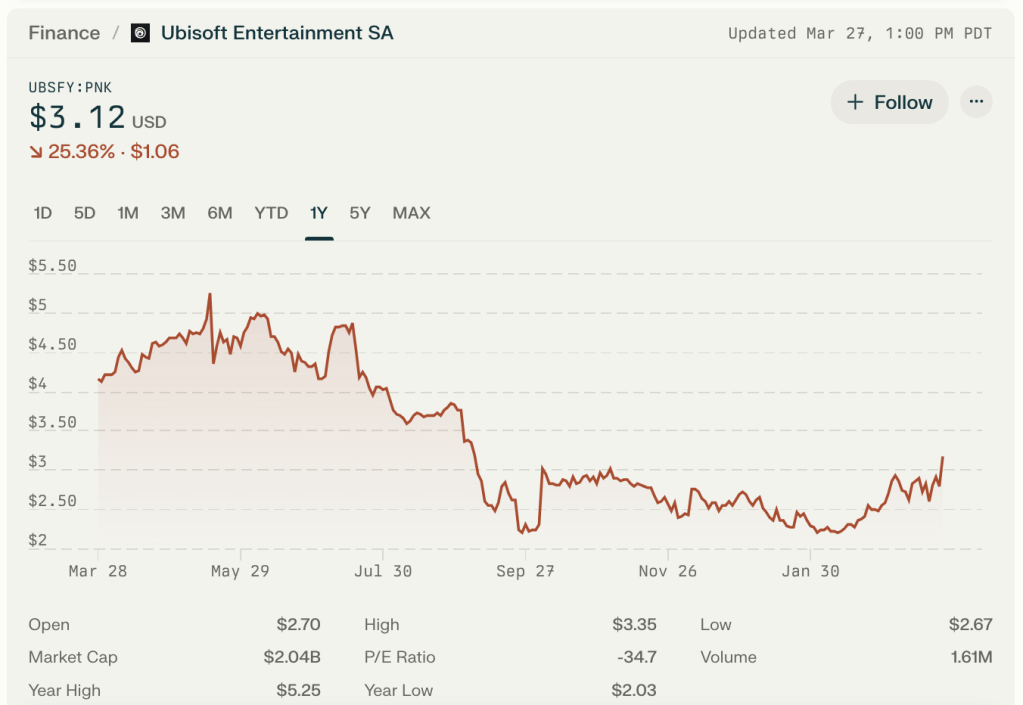

Ubisoft (UBSFY) Current Financial Situation

- Market Value: Ubisoft is worth about $2.04 billion.

- Profitability: The company is currently not profitable, losing about $54.6 million in 2024.

- Cash Position: Ubisoft has net bookings of $933.1 million, a 34.8% decrease from 2023.

- Debt: The company’s debt is relatively high at 137.73% of its equity.

Recent Performance and Valuation

- Stock Price: UBSFY has been trading between $2.03 and $5.25 over the past year, and is currently priced at $2.78 (March 27, 2025).

- Valuation: Ubisoft appears undervalued based on some metrics:

- Price-to-Sales ratio of 1.03 (relatively low for a tech company)

- Enterprise Value/EBITDA of 3.52 (suggests potential undervaluation)

Growth and Future Prospects

Assassin’s Creed Shadows:

- The March 20, 2025 game release could boost revenues.

- The game has received positive and negative publicity for the game’s historical accuracy and portrayal of Yasuke, a Black samurai in 16th century Japan3.

Market Reaction:

- Ubisoft’s high trading volume (1,612,520 vs. avg. 441,638) which suggests high investor interest.

Industry Position:

- Ubisoft remains a major player in the gaming industry.

- The company’s ability to generate buzz (even controversial) shows its cultural relevance.

Financial Forecasts:

- Forward P/E of 26.45 indicate investors expect improved profitability.

- PEG Ratio of 2.14 indicates the stock might be slightly overvalued relative to its growth rate.

Risks and Challenges

Profitability Issues:

- Current losses and negative free cash flow (-$234.58M) are concerning.

- The company needs to turn these losses around to justify its valuation.

Market Volatility:

- The gaming industry is hit-driven, making consistent profits challenging.

- Ubisoft’s stock has been quite volatile (52-week range: $2.03 – $5.25).

Public Relations:

- The recent controversy could impact game sales and brand perception.

- However, it also generated significant publicity for the new game.

Bottom Line for Investors

Ubisoft presents a high-risk, potentially high-reward investment:

- Positives: Strong brand, cash reserves, and potential for hit games.

- Negatives: Current unprofitability, high debt, and industry volatility.

For the average investor:

- Short-term: The stock might see a boost from Assassin’s Creed Shadows sales.

- Long-term: Ubisoft needs to demonstrate consistent profitability to be a stable investment.

Investors should watch for:

- Upcoming earnings report (May 13-19, 2025)

- Sales figures for Assassin’s Creed Shadows

- Any strategic changes to address profitability issues