Inverse ETFs for Apple Stock are investment tools designed to help investors profit when Apple share prices decline. Unlike traditional short-selling, these ETFs move in the opposite direction of Apple’s stock price, using financial derivatives like futures and options. For example, if Apple’s stock price falls by 1%, the value of the inverse ETF could rise by 1%. This approach offers a unique opportunity for investors to profit even during downturns in Apple’s market performance.

Inverse ETFs for Apple Stock

Direxion Daily AAPL Bear 1X Shares (AAPD)

AAPD provides -1x inverse exposure to Apple’s daily performance. The high cash allocation suggests a conservative strategy

Key Metrics:

- Expense Ratio: 0.97% (net)1.

- Assets Under Management (AUM): Not explicitly listed, but the fund holds a significant portion in cash (88.8%)2.

- Performance: Recently returned -2.47% in February 2025, with a YTD return of 15.92% and a 12-month return of -17.38%3.

- Dividend Yield: 4.63% (trailing).

- Portfolio Turnover: 0%, indicating it holds assets for extended periods.

GraniteShares 3x Short Apple ETP (3SAP)

3SAP offers a more aggressive -3x inverse exposure to Apple, amplifying potential gains but also increasing risk. It’s suitable for traders with higher risk tolerance and is available in multiple currencies (USD, EUR, GBX).

Key Metrics:

- Expense Ratio: 0.0083% (very low)4.

- Assets Under Management (AUM): Not specified in the search results.

- Performance: Tracks -3x the daily performance of Apple shares. If Apple rises by 1%, 3SAP falls by 3%, and vice versa.

- Collateralization: Backed by collateral to protect investors in case of default.

Why Could Apple APPL Stock Decline in 2025?

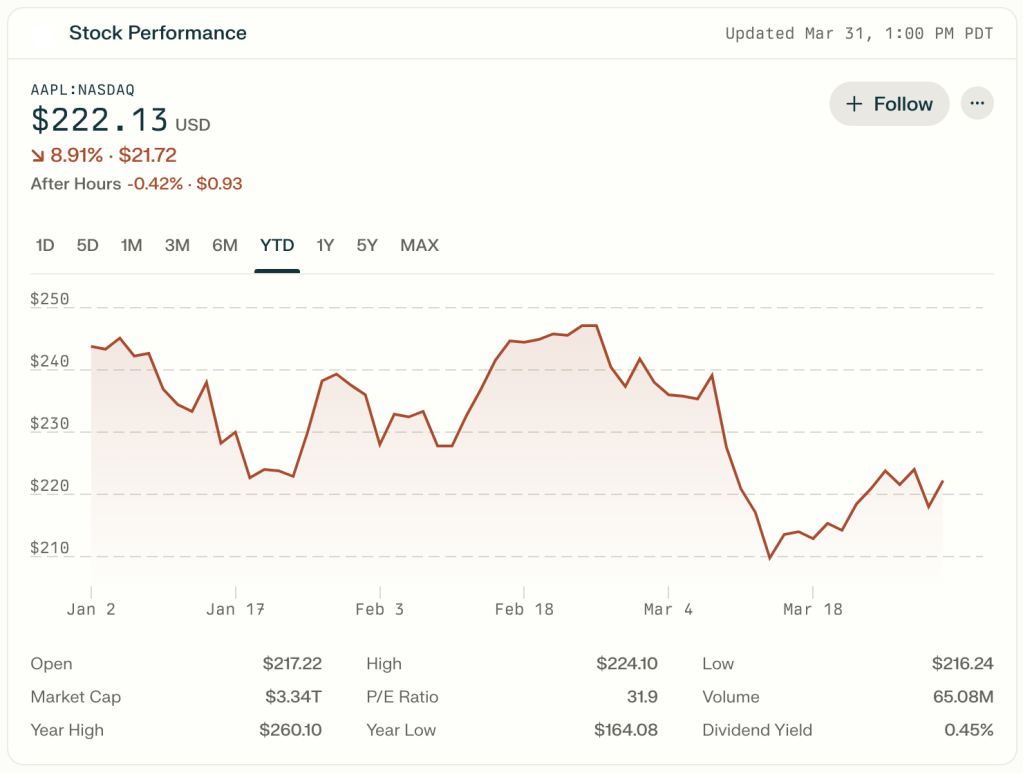

The AAPL Nasdaq 2025 YTD graph above shows Apple’s closing stock prices from January to April 2025.

Here’s a simple explanation of the trends and explanation of why Apple stock could continue to decline in 2025:

Early 2025 (January–February):

- Apple’s stock started strong, trading above $240 in January, with peaks near $250.

- This period reflects optimism, possibly due to strong earnings or favorable market conditions.

March Decline:

- A steep drop occurred mid-March, with the stock falling from $239 to as low as $209.

- This decline suggests increased uncertainty, possibly driven by macroeconomic factors like trade wars or weaker demand for Apple products.

Late March Recovery:

- After hitting lows near $209, Apple rebounded slightly, closing at $223.19 on April 1, 2025.

- The recovery indicates that investors may be regaining confidence, but the price remains well below earlier highs.

Recent Trends (March 10 – April 1, 2025)

| Date | Closing Price (USD) | % Change |

|---|---|---|

| Mar 19, 2025 | 215.24 | +1.20% |

| Mar 20, 2025 | 214.10 | -0.53% |

| Mar 21, 2025 | 218.27 | +1.95% |

| Mar 24, 2025 | 220.73 | +1.13% |

| Mar 25, 2025 | 223.75 | +1.37% |

| Mar 26, 2025 | 221.53 | -0.99% |

| Mar 27, 2025 | 223.85 | +1.05% |

| Mar 28, 2025 | 217.90 | -2.66% |

| Mar 31, 2025 | 222.13 | +1.94% |

| Apr 1, 2025 | 223.19 | +0.48% |

The stock has shown mixed performance recently:

- Several days of small gains (+1–2%), indicating recovery attempts.

- Occasional drops (-2–3%), showing lingering volatility.

Factors That Could Lead to Further Decline

- Macroeconomic Uncertainty:

- Trade wars and tariffs could weigh on consumer spending and Apple’s global sales.

- With 90% of iPhones produced in China and 40% of its income from U.S. sales, proposed tariffs could reduce profits by 1.7 percentage points unless prices are raised.

- Weak Product Demand:

- Apple’s iPhone business, accounting for 52% of its FY2024 revenue, is experiencing decreased demand.

- Counterpoint Research reports a 2% drop in global sales.

- If consumers delay upgrading devices (e.g., iPhones), revenue growth could slow further.

- High Valuation Risks:

- Apple’s forward P/E of 31.26 (as of March 2025) is much higher than the tech sector average of 13.54.

- Revenue growth has only been 2.3% annually since 2022, while the stock trades at 34 times the expected earnings for FY2025.

- This gap leaves little room for mistakes; even a small earnings miss could lead to a significant drop in valuation.

- Apple’s stock may face pressure if earnings fail to justify its valuation.

Related Posts:

Conclusion

Investing in inverse ETFs for Apple stock can provide opportunities for profit during periods of declining share prices.

Factors such as tariff impacts, stagnant iPhone sales, overreliance on mature product lines, elevated P/E ratios, and regulatory challenges create a bearish outlook for Apple’s stock.

Options like the Direxion Daily AAPL Bear 1X Shares (AAPD) and GraniteShares 3x Short Apple ETP (3SAP) offer varying levels of exposure and risk.

As market conditions continue to evolve, these inverse ETFs may serve as strategic tools for investors looking to hedge against potential downturns in Apple’s performance.