Discover how Bitcoin inverse ETFs work, their risks, and how they compare to regular ETFs. Learn strategies to profit from BTC declines.

Bitcoin inverse ETFs let investors profit when Bitcoin’s price drops—without needing to short-sell crypto directly. These complex tools amplify market declines, but come with high risks.

Here’s everything you need to know, explained in plain English.

What Is a Bitcoin Inverse ETF?

A Bitcoin inverse ETF is an exchange-traded fund designed to rise in value when Bitcoin’s price falls. Think of it as a “bet against Bitcoin” that pays off if the crypto’s value drops.

Key features:

- No direct crypto ownership: You don’t buy Bitcoin itself.

- Uses derivatives: Relies on futures contracts (agreements to buy/sell Bitcoin later at set prices).

- Daily reset: Designed for short-term trading (hours/days), not long-term holds.

Example:

If Bitcoin drops 5% in one day, a 1x inverse ETF aims to gain 5%, and a 3x inverse ETF would target a 15% gain.

How Do Bitcoin Inverse ETFs Work?

- Track futures contracts: These ETFs follow Bitcoin futures (not the actual price of Bitcoin).

- Daily rebalancing: Adjust holdings every day to maintain inverse exposure.

- Leverage: Some ETFs amplify returns (e.g., 2x or 3x daily moves).

Why futures?

Bitcoin ETFs can’t hold actual Bitcoin in the U.S. (as of 2025). Instead, they use futures contracts regulated by the CFTC.

Bitcoin Inverse ETFs

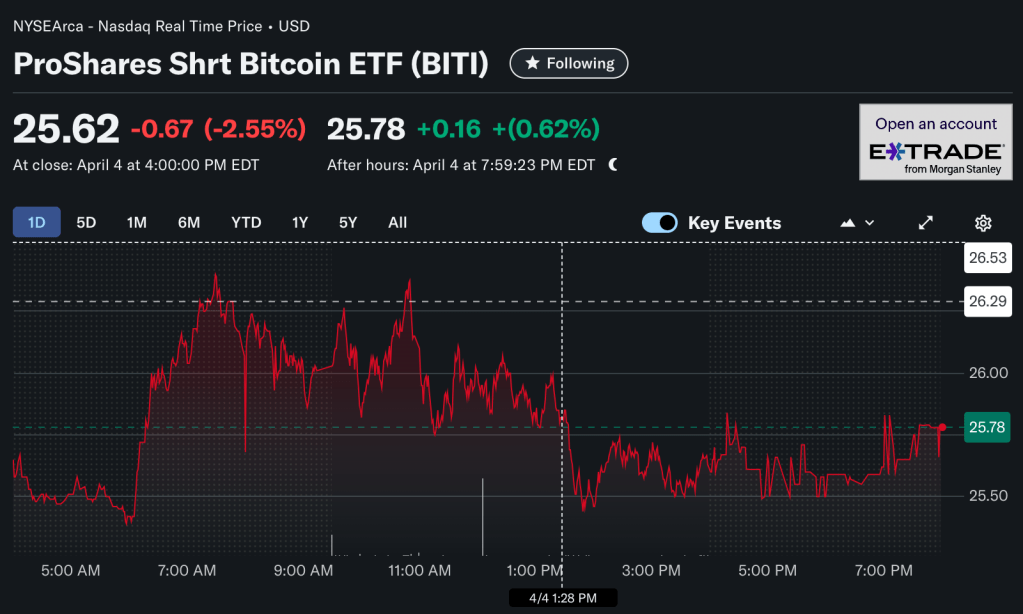

ProShares Short Bitcoin Strategy ETF (BITI)

- Tracks the inverse (-1x) daily performance of Bitcoin futures.

- Designed for short-term trading to profit when Bitcoin prices fall.

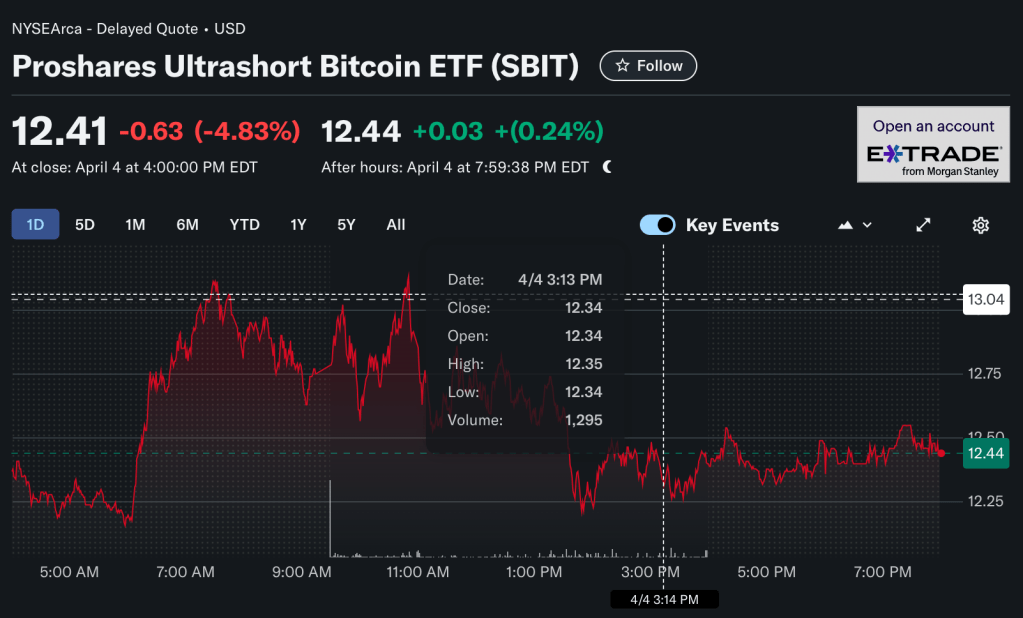

ProShares UltraShort Bitcoin ETF (SBIT)

- Provides leveraged (-2x) daily inverse exposure to Bitcoin futures.

- Suitable for experienced traders seeking amplified returns during Bitcoin declines.

T-Rex 2X Inverse Bitcoin Daily Target ETF (BTCZ)

- Offers -2x daily exposure to spot Bitcoin performance.

- Utilizes derivatives like futures and swaps rather than directly shorting Bitcoin.

Bitcoin Inverse ETF vs. Regular Bitcoin ETF

| Feature | Inverse Bitcoin ETF | Regular Bitcoin ETF |

|---|---|---|

| Goal | Profit from BTC price declines | Mirror BTC’s price increases |

| Tools Used | Futures, swaps, options | Futures or actual BTC (if allowed) |

| Best For | Short-term traders | Long-term investors |

| Risk Level | High (leveraged losses) | Moderate |

Top Risks of Bitcoin Inverse ETFs

1. Volatility Drag

Bitcoin’s wild price swings can cause inverse ETFs to lose value faster than expected.

Example:

If Bitcoin swings between +10% and -10% daily, a 2x inverse ETF might drop 44% in a week due to compounding losses.

2. Contango Costs

Futures contracts for Bitcoin often trade at higher prices than the current rate. Rolling these contracts erodes returns over time.

3. Leverage Decay

Daily resets mean losses compound quickly in volatile markets. A 3x ETF can wipe out 50% of its value in days.

4. High Fees

Management fees for inverse ETFs average 1-2% annually—much higher than regular ETFs.

Who Should Use Bitcoin Inverse ETFs?

✅ Best For:

- Day traders with market experience.

- Investors hedging against short-term BTC drops.

- Those comfortable with high-risk, high-reward tools.

❌ Avoid If:

- You’re a long-term investor.

- You don’t understand futures/derivatives.

- You can’t monitor markets daily.

FAQs About Bitcoin Inverse ETFs

1. “Can I Hold an Inverse Bitcoin ETF Long-Term?”

No. These ETFs reset daily, making them unsuitable for holding beyond a few days. Long-term holds often lead to massive losses.

2. “Are Inverse ETFs Safer Than Shorting Bitcoin?”

Not necessarily. While you avoid margin calls (unlike shorting), leverage and fees can still wipe out gains.

3. “How Do I Start Trading Inverse Bitcoin ETFs?”

- Open a brokerage account (e.g., Vanguard, Fidelity).

- Search for tickers like BITI (1x inverse) or SBIT (2x inverse).

- Trade like a stock—buy shares when you expect BTC to fall.

Real-World Example: The April 2025 Trump Tariff Spike

When Trump announced new tariffs on April 3, 2025:

- Bitcoin dropped 12% in 24 hours.

- The ProShares UltraShort Bitcoin ETF (SBIT) surged 22%.

Lesson: Inverse ETFs can capitalize on sudden market shocks—but timing is critical.

Alternatives to Bitcoin Inverse ETFs

| Strategy | Pros | Cons |

|---|---|---|

| Short Selling BTC | Direct exposure to price drops | Requires margin account; unlimited risk |

| Put Options | Limited risk; set expiration | Complex for beginners |

| Diversification | Reduces portfolio volatility | Won’t profit from BTC crashes |

Key Takeaways

- Bitcoin inverse ETFs are high-risk, short-term tools.

- They use futures contracts to bet against BTC’s price.

- Daily resets and fees make them unsuitable for most investors.

- Always consult a financial advisor before trading.

Final Tip: If you’re new to crypto, stick to regular ETFs or dollar-cost averaging. Inverse ETFs are for seasoned traders only.

Related Posts:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

Citations:

[1] https://www.theblock.co/learn/289717/what-is-an-inverse-bitcoin-etf

[2] https://b2binpay.com/en/news/what-is-inverse-bitcoin-etf-is-it-better-than-btc-spot-etfs

[3] https://m.pocketoption.com/blog/en/post/bitcoin-inverse-etf-3x

[4] https://academy.wirexapp.com/post/inverse-bitcoin-etfs-explained

[5] https://gov.capital/ico-seo/

[6] https://www.squarespace.com/blog/how-to-write-meta-descriptions-and-titles

[7] https://productiveshop.com/how-to-write-seo-friendly-meta-titles-and-descriptions/

[8] https://www.etf.com/sections/features/users-guide-inverse-etfs

[9] https://revenuezen.com/seo-titles-meta-descriptions/

[10] https://bitcompare.net/post/what-is-an-inverse-bitcoin-etf

[11] https://www.fidelity.com/learning-center/investment-products/etf/types-of-etfs-inverse-etfs

[12] https://www.proshares.com/our-etfs/leveraged-and-inverse/sbit

[13] https://www.investopedia.com/terms/i/inverse-etf.asp

[14] https://www.proshares.com/our-etfs/leveraged-and-inverse/biti

[15] https://cointelegraph.com/learn/articles/types-of-bitcoin-etfs