Learn how NVDA inverse ETFs work, their risks, and how to use them to profit from NVIDIA stock declines.

NVDA inverse ETFs let investors profit when NVIDIA’s stock price falls—without needing to short-sell shares directly. These tools amplify daily declines but come with steep risks.

Here’s a plain-English breakdown of how they work, top ETFs to watch, and strategies to avoid costly mistakes.

What is a NVDA Inverse ETF?

An NVDA inverse ETF is an exchange-traded fund designed to rise in value when NVIDIA’s stock price drops. It’s like a “bet against NVIDIA” that pays off if the stock declines.

Key features:

- No direct stock ownership: You don’t own NVIDIA shares.

- Uses derivatives: Relies on futures, swaps, or options to track inverse performance.

- Daily reset: Designed for short-term trades (hours/days), not long-term holds.

Example:

If NVIDIA stock drops 5% today, a 1x inverse ETF aims to gain 5%. A 2x inverse ETF targets a 10% gain.

How Do NVDA Inverse ETFs Work?

The Basics Simplified

- Track derivatives: These ETFs use futures contracts (agreements to buy/sell NVIDIA stock at future prices).

- Daily rebalancing: Adjust holdings daily to maintain inverse exposure.

- Leverage: Some ETFs amplify returns (e.g., 2x or 1.5x daily moves).

Why futures?

Most inverse ETFs can’t short stocks directly. Instead, they use regulated futures contracts to mimic inverse performance.

NVDA Inverse ETF

Here is a list of NVDA inverse ETFs along with links to their Yahoo Finance pages and a brief description of each ETF.

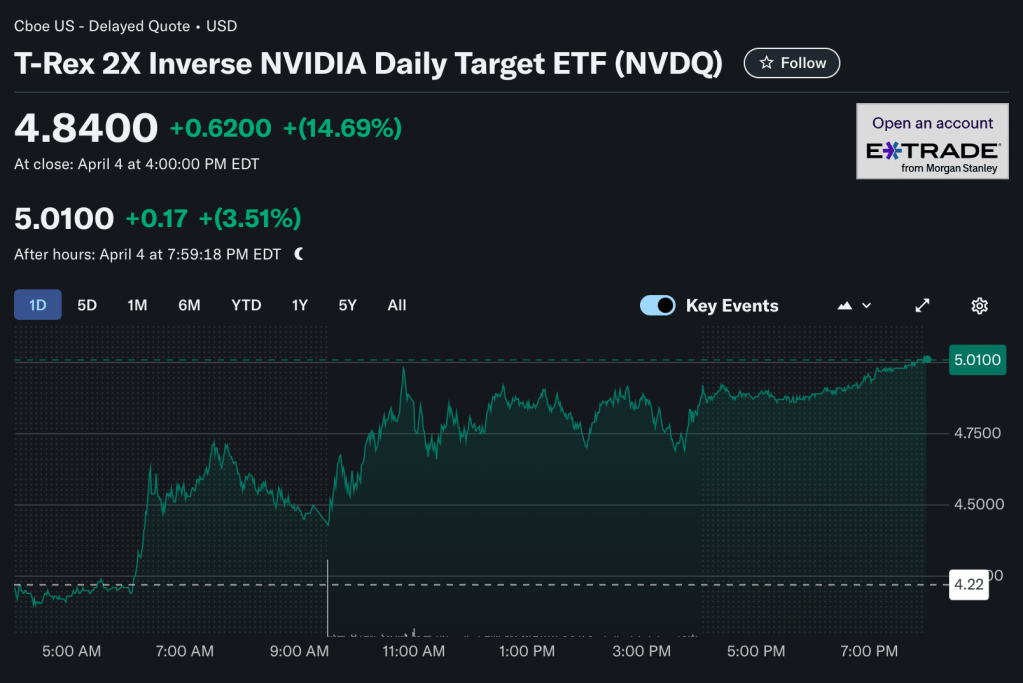

T-Rex 2X Inverse NVIDIA Daily Target ETF (NVDQ)

- Provides -2x daily inverse exposure to NVIDIA’s stock price. Designed for short-term traders who expect NVIDIA to decline significantly in a single day.

- Expense Ratio: 1.15%

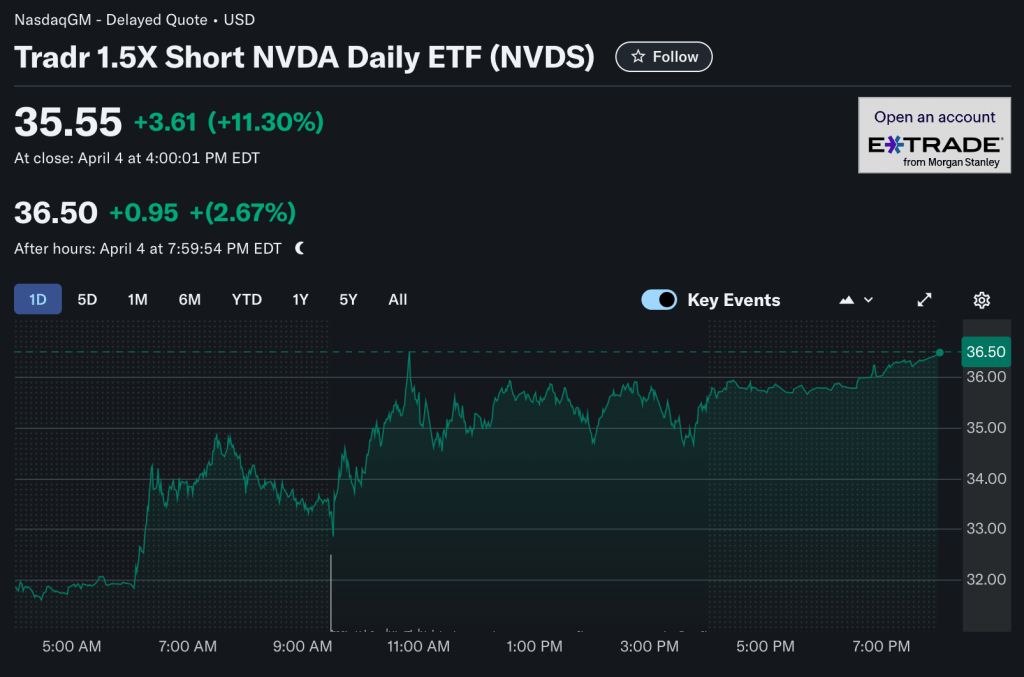

Tradr 1.5X Short NVDA Daily ETF (NVDS)

- Description: Offers -1.5x daily inverse exposure to NVIDIA’s stock price. Aimed at investors seeking moderate leverage against NVIDIA’s daily performance.

- Expense Ratio: 1.15%

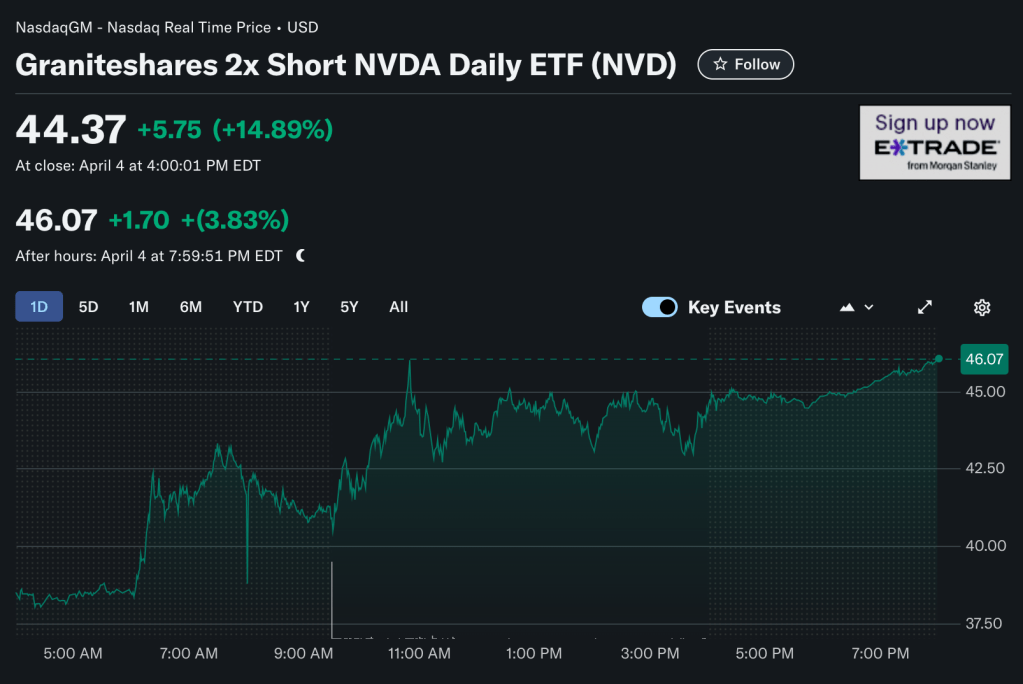

GraniteShares 2X Short NVDA Daily ETF (NVD)

- Description: Tracks -2x the daily performance of NVIDIA’s stock price using swaps and derivatives. Suitable for experienced traders aiming to profit from sharp declines in NVDA.

- Expense Ratio: 0.97%

Direxion Daily NVDA Bear 1X Shares (NVDD)

- Description: Provides -1x daily inverse exposure to NVIDIA’s stock price, making it less risky compared to leveraged options like NVDQ or NVDS.

- Expense Ratio: 0.95%

NVDA Inverse ETFs vs. Short Selling

| Feature | NVDA Inverse ETF | Short Selling NVIDIA Stock |

|---|---|---|

| Complexity | Simple (trade like a stock) | Requires margin account |

| Risk | Limited to investment amount | Unlimited risk (stock can rise infinitely) |

| Time Horizon | Days | Days/weeks |

| Costs | Management fees (0.75%-1.5%) | Margin interest + borrowing fees |

Top NVDA Inverse ETFs (2025)

| ETF | Ticker | Leverage | Expense Ratio | Key Details |

|---|---|---|---|---|

| T-REX 2X Inverse NVDA ETF | NVDQ | -2x | 1.15% | First U.S.-listed 2x inverse ETF |

| Tradr 1.5X Short NVDA ETF | NVDS | -1.5x | 1.15% | Mid-level leverage for cautious traders |

| Direxion Daily NVDA Bear 1X | NVDD | -1x | 0.95% | Simple 1x inverse exposure |

| GraniteShares 2X Short NVDA | NVD | -2x | 0.97% | Competes with NVDQ |

Risks of NVDA Inverse ETFs

1. Daily Resets

Inverse ETFs reset leverage daily. Holding them longer can lead to compounding losses, even if NVIDIA’s stock trends down over time.

Example:

If NVIDIA swings between -5% and +5% daily for a week, a 2x inverse ETF could lose 25% due to volatility drag.

2. High Fees

Management fees (1-1.5%) eat into returns, especially for leveraged ETFs.

3. Sector-Specific Risks

NVIDIA operates in the volatile tech sector. Rapid innovation, competition, or supply chain issues can cause unpredictable stock swings.

4. Leverage Decay

Amplified losses can wipe out gains quickly. A 2x ETF might drop 30% in a week if NVIDIA rallies 15%.

Who Should Use NVDA Inverse ETFs?

✅ Best For:

- Day traders with market experience.

- Investors hedging short-term NVIDIA exposure.

- Those comfortable monitoring markets daily.

❌ Avoid If:

- You’re a long-term investor.

- You don’t understand derivatives.

- You can’t afford sudden losses.

Trending Questions About NVDA Inverse ETFs

1. “Can I Hold NVDA Inverse ETFs for Months?”

No. Daily resets make them unsuitable for holding beyond days. Even if NVIDIA trends down, volatility could erase gains.

2. “Are Inverse ETFs Safer Than Buying Put Options?”

Depends. Inverse ETFs don’t expire like options, but fees and leverage risks can still lead to losses.

3. “How Do I Start Trading?”

- Open a brokerage account (e.g., Fidelity, Robinhood).

- Search for tickers like NVDQ or NVDS.

- Buy shares when you expect NVIDIA to fall.

Real-World Example: April 2025 Trump Tariff Impact

When Trump announced tariffs on April 3, 2025:

- NVIDIA stock dropped 8% in a day.

- NVDQ (2x inverse) surged 15%.

Lesson: Inverse ETFs can capitalize on sudden news—but exit quickly before markets stabilize.

Alternatives to NVDA Inverse ETFs

| Strategy | Pros | Cons |

|---|---|---|

| Put Options | Limited risk; set expiration | Complex for beginners |

| Short Selling | Direct exposure to price drops | Requires margin; unlimited risk |

| Diversification | Reduces reliance on one stock | Won’t profit from NVIDIA declines |

Final Thoughts

- NVDA inverse ETFs are high-risk, short-term tools.

- They use derivatives to profit from NVIDIA’s daily declines.

- Daily resets and fees make them unsuitable for most investors.

- Consult a financial advisor before trading.

Related Posts:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

Citations:

[1] https://www.etf.com/sections/features/users-guide-inverse-etfs

[2] https://www.rexshares.com/nvdq/

[3] https://marketerinterview.com/5-ways-to-structure-an-seo-friendly-article-for-competitive-financial-services-topics/

[4] https://tommyshek.com/breaking-down-complex-financial-concepts-for-business-leaders/

[5] https://graniteshares.com/institutional/us/en-us/research/how-to-short-nvidia/

[6] https://www.direxion.com/product/daily-nvda-bull-and-bear-leveraged-single-stock-etfs

[7] https://www.tradretfs.com/nvds-1.5x-short-nvda-daily-etf

[8] https://www.siegemedia.com/creation/seo-friendly-content

[9] https://ahrefs.com/blog/seo-writing/

[10] https://leverageshares.com/en-eu/etps/leverage-shares-3x-short-nvidia-etp/

[11] https://leverageshares.com/en/etps/leverage-shares-1x-nvidia-etp/

[12] https://money.usnews.com/funds/etfs/trading-inverse-equity/graniteshares-2x-short-nvda-daily-etf/nvd

[13] https://www.direxion.com/education/whats-inside-direxions-daily-nvda-bull-2x-and-bear-1x-etfs

[14] https://www.reddit.com/r/wallstreetbets/comments/1gbunt4/nvidia_position_with_inverse_etfs/

[15] https://www.youtube.com/watch?v=ptFmprmjfB0