Given the volatility of US equity markets in Q1 2025, investors might be considering looking at international equities. Japanese ETFs offer worthwhile alternatives at undervalued prices.

Japanese stocks offer low valuations compared to overvalued US equities, potential for higher growth, and better corporate governance.

Plus, Japan’s global trading structure is predictable and reliable—unlike the volatility brought on by the sudden implementation of tariffs in the US.

Why are Japanese Equities Undervalued?

1. Valuation Metrics

Japanese stocks often trade at lower price-to-earnings (P/E) and price-to-book (P/B) ratios compared to their global peers. For example, the TOPIX is valued at around 12x forward earnings, which is historically low.

2. Limited Analyst Coverage

There is a significant lack of analyst coverage for smaller Japanese companies, leading to a lack of visibility and understanding among investors. This limited coverage contributes to undervaluation, as many of these companies are not well-represented in market analyses.

3. Historical Underperformance and Perception

Following the Japanese asset bubble’s collapse in the late 1980s, the market experienced a prolonged period of underperformance. This historical context has led to a lingering perception that Japanese equities are less attractive, resulting in lower valuations compared to other developed markets.

4. Market Inefficiencies

The Japanese stock market exhibits inefficiencies similar to those found in emerging markets, despite being the second-largest developed market globally. This inefficiency creates opportunities for active managers to outperform benchmarks by identifying undervalued companies.

Health of Japanese Small, Mid, and Large-Cap Companies

Japanese equities, particularly small and mid-cap companies, have been gaining attention because of their undervaluation relative to large-cap stocks and historical averages.

Despite historical challenges like yen depreciation, which increased input costs, Japanese companies are poised for growth due to rising wages and stabilizing inflation around 2%[1].

This economic environment allows small caps with pricing power to pass on costs and improve their profitability.

Small-Cap Companies:

Japanese small-cap stocks are undervalued compared to large-cap stocks, which makes them appealing for investors looking for growth. The economic recovery in Japan and improvements in corporate governance are helping small-cap stocks grow.

Mid-Cap Companies:

Mid-cap companies combine the agility of small caps with the reliability of large caps. They usually have more developed operations and a better market presence than small caps, while still providing opportunities for growth. Japanese mid-caps are gaining from improvements in corporate governance and the recovering economy.

Japanese Large-Cap Companies:

Japanese large-cap companies have historically been leaders in sectors like technology and automotive. They have strong balance sheets and are well-positioned to handle to global market changes. Large caps have been at the forefront of implementing shareholder-friendly actions like share buybacks and dividend increases.

Japan’s Manufacturing Presence in the US and Tariff Implications

Japan has a significant manufacturing presence in the US, particularly in the automotive sector.

Japanese companies like Toyota and Honda have substantial operations in the US, which can mitigate the impact of tariffs on their exports.

However, recent US tariffs on imported vehicles have posed challenges for Japanese automakers, despite Japan’s zero-tariff policy on passenger vehicles[2][3].

Impact of Tariffs:

- US Tariffs on Vehicles: The recent 25% tariff on imported vehicles entering the US has significant implications for Japanese automakers, despite Japan’s zero-tariff policy[2].

- Japan’s Zero-Tariff Policy: Japan maintains a 0% tariff rate on imported passenger vehicles, but non-tariff barriers and consumer preferences limit US car exports[2].

- Manufacturing in the US: Japanese companies with manufacturing operations in the US can reduce their exposure to tariffs, providing a strategic advantage[3].

Impact of Japanese Governance on Company Valuation

Corporate governance reforms in Japan have been instrumental in enhancing shareholder value.

The Tokyo Stock Exchange’s initiatives have led to increased transparency and accountability, encouraging companies to focus on capital efficiency and shareholder returns[4][5].

These reforms have resulted in companies selling non-core assets, increasing dividends and buybacks, and investing in profitable segments[4].

Key Governance Reforms:

- Enhanced Transparency: Companies are now more transparent about their governance practices, which helps investors assess their potential for growth.

- Shareholder-Friendly Actions: Japanese companies are increasingly adopting shareholder-friendly strategies, such as share buybacks and dividend payments.

- Capital Efficiency: There is a growing focus on improving capital efficiency, which can lead to higher valuations for companies embracing these reforms.

Top-Performing Japanese ETFs

WisdomTree Japan Hedged Equity ETF (NYSE: DXJ)

Key Features:

- Currency Hedging: DXJ hedges against yen fluctuations, which can be beneficial for investors concerned about currency risks. This feature allows investors to focus on stock performance without direct exposure to currency volatility14.

- Dividend Focus: The fund focuses on dividend-paying companies, which can provide a steady income stream. The distribution yield is approximately 1.94%, and the SEC 30-day yield is about 2.20%1.

- Expense Ratio: The net expense ratio is 0.48%, which is competitive and offers a cost advantage over many peers35.

- Market Capitalization Breakdown: The fund primarily invests in large-cap stocks (76.64%), with smaller allocations to mid-cap (16.26%) and small-cap (7.10%) companies1.

- Performance: DXJ has delivered strong returns, with a five-year annualized return of approximately 20.90% and a ten-year return of 12.36%1. However, performance can vary depending on market conditions and the yen’s strength relative to the U.S. dollar.

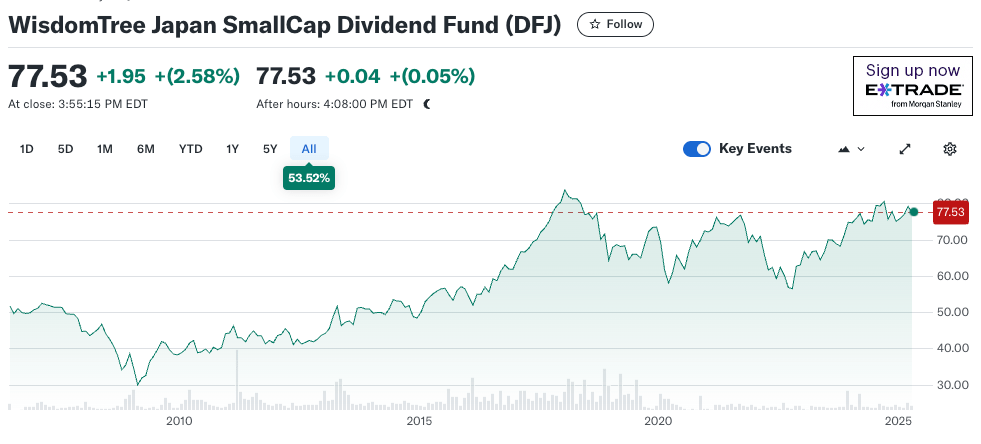

WisdomTree Japan SmallCap Dividend Fund (NYSE: DFJ)

Key Features:

- Dividend Yield: DFJ tracks the performance of dividend-paying small-cap companies in Japan, providing exposure to local economic growth. Offers a distribution yield of 1.24% and an SEC 30-day yield of 2.21%, which can be attractive for income-seeking investors.

- Expense Ratio: The expense ratio is 0.58%, which is slightly higher than some other small-cap ETFs.

- Performance: Since inception, DFJ has delivered a cumulative return of 124.05% (NAV returns), with an average annual return of 4.55% over the same period1.

- Valuation Metrics: The fund has a price-to-earnings ratio of 11.73 and a price-to-book ratio of 0.97, indicating relatively undervalued stocks1.

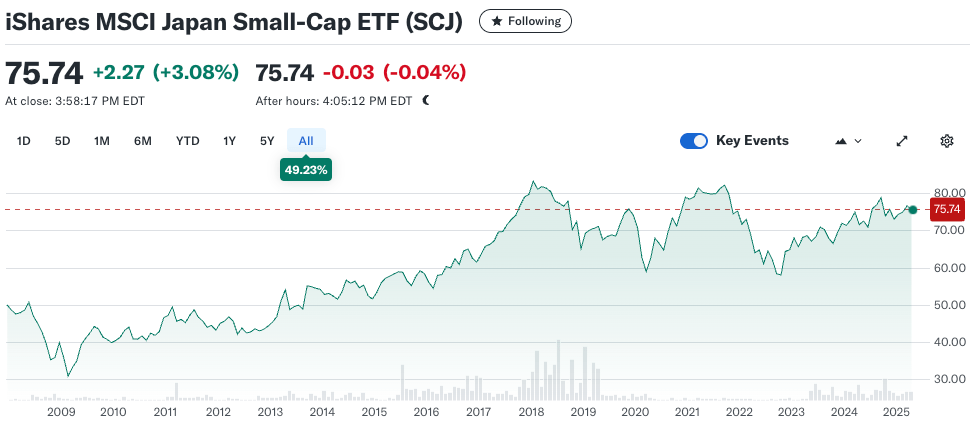

iShares MSCI Japan Small-Cap ETF (SCJ)

Key Features:

- Objective: SCJ tracks the MSCI Japan Small Cap Index, offering broad exposure to Japanese small-cap stocks.

- Diversification: Holds over 800 stocks, providing extensive diversification within the small-cap segment.

- Expense Ratio: Not explicitly mentioned in the search results, but typically lower than DFJ.

- Performance: SCJ has delivered a five-year return of 6.83%, with a one-year return of 4.08%3.

- Holdings: Includes a wide range of sectors and companies, such as IHI Corporation and Ryohin Keikaku Co., Ltd.4.

WisdomTree Japan Hedged SmallCap Equity Fund (NASDAQ: DXJS)

Key Features:

- Currency Hedging: Mitigates the impact of yen fluctuations on returns, which can be beneficial in a volatile currency environment.

- Expense Ratio: Typically higher than unhedged options due to the hedging strategy.

- Performance: The hedged approach can lead to better returns in environments where the yen is weak.

Notes:

- Trailing Returns: Returns are based on recent data available and may not reflect the full year’s performance.

- Net Assets: Figures are in millions of EUR unless specified otherwise.

- Beta (5Y Monthly): Specific beta values for these ETFs are not provided in the search results.

- PE Ratio (TTM): The price-to-earnings ratio is not specified for these ETFs in the search results.

- Expense Ratio (net): The expense ratios listed are accurate as of the latest available data.

Pros and Cons of Investing in Japanese Equity ETFs

Pros:

- Diversification: Investing in Japanese equities can provide a diversification benefit when combined with US equities, potentially reducing portfolio risk.

- Undervaluation: Japanese small-cap stocks are often undervalued, offering growth potential.

- Corporate Governance Reforms: Improved governance practices enhance shareholder value and transparency.

- Economic Recovery: Japan’s economic recovery supports the growth of domestic demand-focused companies.

- Manufacturing Presence: Japanese companies with US operations can mitigate tariff risks.

Cons:

- Yen Volatility: Fluctuations in the yen can impact the profitability of Japanese companies and the value of investments.

- Tariff Risks: Despite Japan’s zero-tariff policy, US tariffs on vehicles affect Japanese automakers.

- Cultural Barriers: Non-tariff barriers and consumer preferences limit the market share of foreign products in Japan.

- Dependence on Exports: Japan’s economy is heavily reliant on exports, making it vulnerable to global trade fluctuations.

Frequently Asked Questions

What are the benefits of investing in Japanese small-cap stocks?

Japanese small-cap stocks are undervalued compared to large caps, offering growth potential. They benefit from Japan’s economic recovery and corporate governance reforms, which enhance profitability and transparency.

How do US tariffs affect Japanese automakers?

Despite Japan’s zero-tariff policy, US tariffs on imported vehicles pose significant challenges for Japanese automakers. However, those with manufacturing operations in the US can mitigate some of these risks.

What impact do corporate governance reforms have on Japanese companies?

Corporate governance reforms in Japan have led to increased transparency, shareholder-friendly actions, and a focus on capital efficiency. These changes enhance shareholder value and make Japanese stocks more attractive to investors.

Are Japanese equity ETFs a good alternative to US equity ETFs?

Yes, Japanese equity ETFs can provide diversification benefits and growth opportunities, especially in the small-cap sector. However, investors should consider factors like yen volatility and tariff risks.

How does Japan’s zero-tariff policy on passenger vehicles affect US car exports?

Japan’s zero-tariff policy does not significantly boost US car exports due to non-tariff barriers and strong domestic brand loyalty. US vehicles often struggle to meet Japan’s specific regulatory and consumer preferences.

Conclusion

In conclusion, Japanese equity ETFs offer a compelling alternative to US equity ETFs, particularly for investors seeking diversification and growth potential. While there are challenges such as yen volatility and tariff risks, the benefits of improved corporate governance, economic recovery, and undervalued small-cap stocks make Japanese equities an attractive option for those looking to expand their investment portfolios.

Related Posts:

- March 4 2025: 10 Undervalued ETFs

- Navigate Market Risks with These Inverse ETFs

- The Dramatic Decline of Leveraged Bear ETFs – Understanding the Multi-Factor Phenomenon

- March 12, 2025: Analysis of Leveraged Inverse ETFs in Economic Downturn Scenarios

Citations:

[1] https://www.hennessyfunds.com/insights/commentary-japan-small-cap-nov-2024

[2] https://www.wcshipping.com/blog/japanese-auto-tariffs-us-car-exports-2025

[3] https://www.oxfordeconomics.com/resource/trump-tariffs-to-shake-up-asian-manufacturing-in-2025/

[4] https://institutional.fidelity.com/app/item/RD_9919043/improved-corporate-governance-makes-japan-a-more-intriguing-market.html

[5] https://am.jpmorgan.com/fi/en/asset-management/adv/insights/etf-perspectives/japan-corporate-governance-shareholder-value/

[6] https://enrichest.com/en/blog/closer-look-at-exchange-traded-funds-in-japan-pros-and-cons

[7] https://www.investopedia.com/terms/j/japan_etf.asp

[8] https://www.etftrends.com/model-portfolio-channel/japan-etfs-2025-winners/

[9] https://www.justetf.com/en/how-to/invest-in-japan.html

[10] https://www.investopedia.com/best-japan-etfs-5076938

[11] https://www.hennessyfunds.com/insights/japan-small-cap-fund-january-2025

[12] https://www.tradingview.com/news/zacks:67b0576da094b:0-buffett-bets-big-on-japan-etfs-to-play/

[13] https://www.franklintempleton.lu/articles/2025/equity/global-equity-pulse-march-2025

[14] https://www.cambridgeassociates.com/insight/2025-outlook-public-equities/

[15] https://www.nb.com/en/us/insights/japanese-equities-in-2025-goldilocks-would-approve

[16] https://www.financecharts.com/screener/most-profitable-country-jp-mid-cap

[17] https://www.gmo.com/americas/research-library/three-reasons-were-overweight-japanese-equities_insights/

[18] https://www.janushenderson.com/corporate/article/following-a-transformative-year-for-japanese-equities-what-lies-ahead-for-2025/

[19] https://sg.news.yahoo.com/could-drive-japanese-small-mid-214728510.html

[20] https://americas.nikkoam.com/articles/2024/japan-equity-outlook-2025