In this guide, we’ll explore 10 leveraged inverse ETFs that rise when the Russell 2000 falls, including 1x, 2x, and 3x options. We’ll also break down their pros, cons, and strategic uses in volatile bear markets.

The Russell 2000 Index, which tracks small-cap U.S. stocks, is often seen as a barometer of domestic economic health. When this index declines, Russell 2000 leveraged ETFs offer investors a way to profit from or hedge against market downturns. These inverse ETFs use derivatives like swaps and futures to deliver amplified returns opposite to the index’s daily performance.

What Are Russell 2000 Leveraged ETFs?

Leveraged inverse ETFs are designed to deliver returns that move opposite to their benchmark index, multiplied by a leverage factor (1x, 2x, or 3x). For example:

- A 1x inverse ETF rises 1% when the Russell 2000 falls 1%.

- A 3x inverse ETF aims to gain 3% for every 1% decline in the index.

These ETFs reset daily, making them ideal for short-term trading (1 to 3 days) but risky for long-term holds because of compounding effects.

Inverse Russell 2000 ETFs for Bear Markets

Below is a curated list of ETFs that increase in value when the Russell 2000 declines. Each ETF is linked to its provider’s website for more information.

1x Inverse ETFs

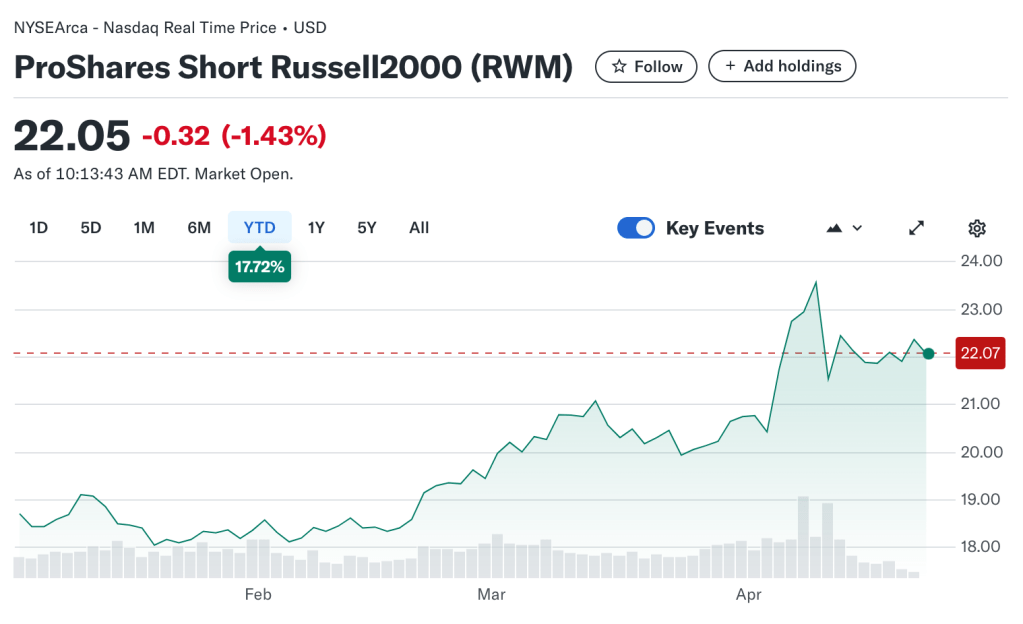

ProShares Short Russell 2000 (RWM)

- Leverage: 1x inverse

- Expense Ratio: 0.95%

- Strategy: Tracks the daily inverse performance of the Russell 2000 Index.

- Best For: Conservative hedging against small-cap volatility.

- Learn More

2x Inverse ETFs

ProShares UltraShort Russell 2000 (TWM)

- Leverage: 2x inverse

- Expense Ratio: 0.95%

- Strategy: Seeks 2x the inverse daily return of the Russell 2000.

- Best For: Moderate risk tolerance during market corrections.

- Learn More

3x Inverse ETFs

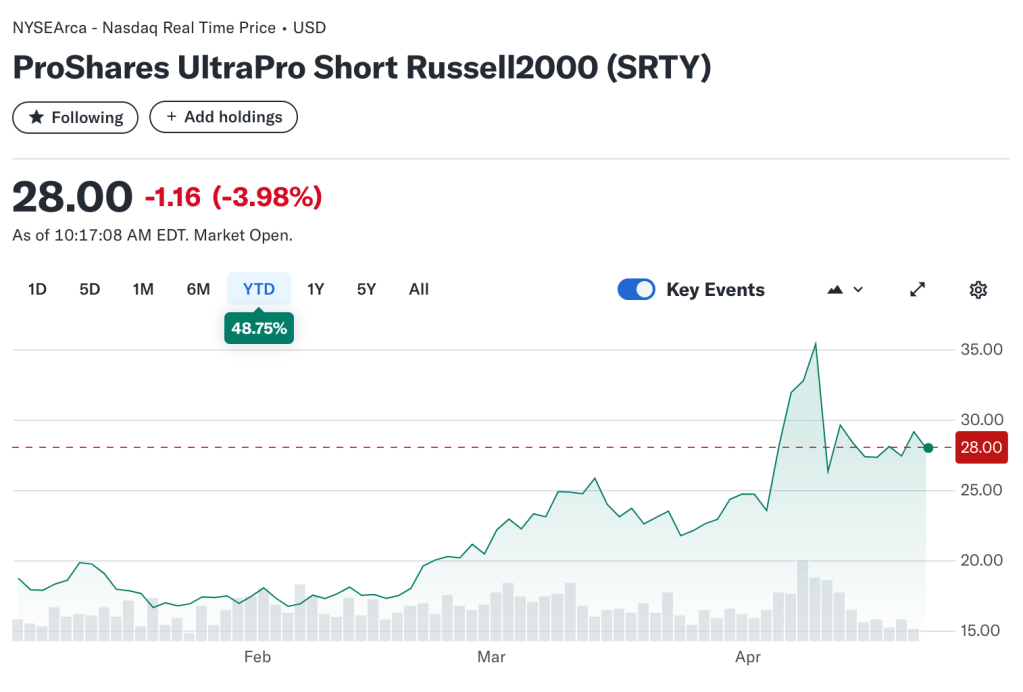

ProShares UltraPro Short Russell 2000 (SRTY)

- Leverage: 3x inverse

- Expense Ratio: 0.95%

- Strategy: Aims for 3x the inverse daily return of the Russell 2000.

- Best For: Aggressive short-term trades during market sell-offs.

- Learn More

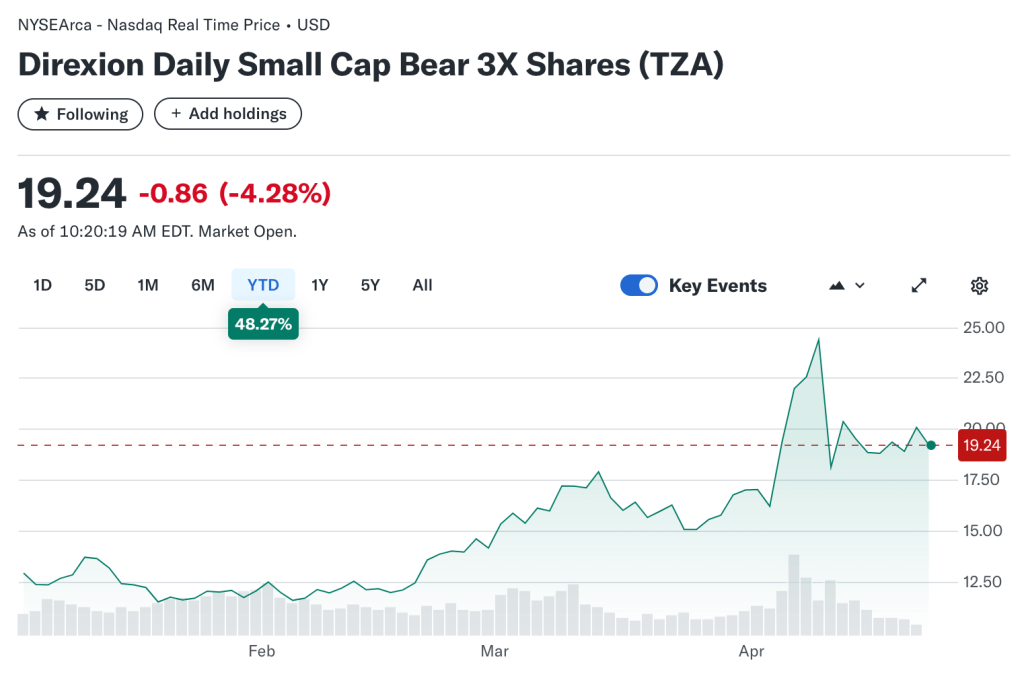

Direxion Daily Small Cap Bear 3X Shares (TZA)

- Leverage: 3x inverse

- Expense Ratio: 1.14%

- Strategy: Targets 3x the inverse daily return of the Russell 2000.

- Best For: High-risk, high-reward bets on small-cap declines.

- Learn More

Sector-Specific Inverse ETFs (Russell 2000 Exposure)

Direxion Daily Russell 2000 Energy Bear 3X Shares (ERY)

- Leverage: 3x inverse

- Expense Ratio: 1.08%

- Strategy: Inverse exposure to energy stocks within the Russell 2000.

- Best For: Hedging oil price volatility.

- Learn More

Direxion Daily Russell 2000 Financials Bear 3X Shares (FAZ)

- Leverage: 3x inverse

- Expense Ratio: 1.08%

- Strategy: Targets 3x the inverse return of financial stocks in the Russell 2000.

- Best For: Profiting from banking sector weakness.

- Learn More

Related Small-Cap Inverse ETFs

ProShares UltraPro Short S&P 600 (SMDD)

- Leverage: 3x inverse

- Expense Ratio: 0.95%

- Strategy: Inverse exposure to the S&P Small Cap 600, which overlaps with Russell 2000 stocks.

- Best For: Indirect hedging of small-cap declines.

- Learn More

Direxion Daily Small Cap Bear 1X Shares (SCAP)

- Leverage: 1x inverse

- Expense Ratio: 0.45%

- Strategy: Tracks the inverse daily return of small-cap indices correlated with the Russell 2000.

- Best For: Low-cost hedging.

- Learn More

Pros of Russell 2000 Leveraged ETFs

- Hedging: Protect portfolios heavy in small-cap stocks during downturns (e.g., using RWM).

- Amplified Gains: 3x ETFs like SRTY or TZA can deliver significant returns during sharp declines.

- No Short-Selling Complexity: Avoid margin requirements or borrowing shares.

- Liquidity: Major funds like TZA trade over 20 million shares daily.

- Sector-Specific Exposure: Target declines in sectors like energy (ERY) or financials (FAZ).

Cons of Russell 2000 Leveraged ETFs

- Daily Compounding: Returns diverge from expectations over time, especially in volatile markets.

- High Fees: Expense ratios up to 1.14% erode returns.

- Sector Risk: Funds like ERY or FAZ face concentrated exposure.

- Tracking Error: Derivatives may not perfectly mirror index performance.

- Volatility Decay: Frequent market swings can erode value in leveraged ETFs.

Strategic Uses

- Short-Term Trading: Use 3x ETFs like SRTY to capitalize on earnings season volatility.

- Portfolio Insurance: Allocate 5-10% to 1x ETFs (e.g., RWM) during uncertain periods.

- Sector Rotation: Pair long positions in tech with inverse ETFs like FAZ during rate hikes.

Key Considerations

- Monitor Daily: These ETFs require active management—avoid holding for weeks or months.

- Use Stop-Loss Orders: Limit losses during unexpected market rebounds.

- Understand Compounding: A 3x ETF’s returns won’t match 3x the index’s multi-day decline.

Final Thoughts

Russell 2000 leveraged ETFs like SRTY, TZA, and RWM are powerful tools for navigating bear markets, but they demand caution. While they offer amplified returns and hedging opportunities, their risks—such as daily resets and fees—make them unsuitable for passive investors. Use them as tactical instruments in a broader strategy, and always align their use with your risk tolerance and market outlook.

Related Articles:

- Defiance ETF

- 10X Leveraged ETF S&P 500: Myths, Realities, and Top 3X Alternatives

- 3x Inverse ETFs: A Complete Guide for Navigating Market Downturns

- QQQ Inverse ETF: How to Hedge or Profit When Tech Stocks Fall

- SPY Inverse ETFs: How to Hedge or Profit During Market Volatility

- Russell 2000 Leveraged ETFs That Profit When Small-Caps Fall: Bear Market Guide

- 10 Inverse (Leveraged) ETFs That Profit When the Dow Jones Falls: Complete Bear Market Guide

- Nasdaq Leveraged ETFs: How to Profit from Rising Tech Markets

- March 12, 2025: Analysis of Leveraged Inverse ETFs in Economic Downturn Scenarios

- The Dramatic Decline of Leveraged Bear ETFs – Understanding the Multi-Factor Phenomenon

Citations:

- https://etfdb.com/themes/leveraged-3x-inverse-short-etfs/

- https://www.stockbrokers.com/education/inverse-short-etfs-bearish-etf-funds

- https://www.proshares.com/our-etfs/find-leveraged-and-inverse-etfs

- https://etfdb.com/leveraged-inverse-channel/8-leveraged-russell-2000-etf-plays/

- https://www.etftrends.com/leveraged-inverse-channel/7-leveraged-russell-2000-etf-plays/

- https://etfdb.com/etfs/inverse/equity/

- https://www.direxion.com/leveraged-and-inverse-etfs

- https://etfvest.com/list/russell-2000-etfs-2

- https://www.composer.trade/etf/TZA

- https://www.forbes.com/advisor/investing/best-leveraged-etfs/

- https://www.proshares.com/our-etfs/leveraged-and-inverse/rwm

- https://finance.yahoo.com/news/8-leveraged-russell-2000-etf-172705348.html

- https://www.direxion.com/product/daily-small-cap-bull-bear-3x-etfs

- https://www.financialplanningassociation.org/sites/default/files/2021-08/MAY08%20Leveraged%20ETFs%20A%20Risky%20Double%20That%20Doesnt%20Multiply%20by%20Two.pdf

- https://www.guggenheiminvestments.com/mutual-funds/fund/ryiux-inverse-russell-2000-2x-strategy

- https://www.nasdaq.com/articles/a-guide-to-the-10-most-popular-leveraged-etfs-1

- https://etftrends.com/leveraged-inverse-channel/top-performing-leveraged-inverse-etfs-03-02-2025/

- https://followthemoney.com/the-ultimate-inverse-etf-list/

- https://www.bankrate.com/investing/best-leveraged-etfs/

- https://wtop.com/news/2024/10/7-best-russell-2000-etfs-to-buy-now/