Discover QQQ inverse ETFs that rise when the Nasdaq-100 declines. Learn how to use 1x, 2x, and 3x leveraged ETFs during volatility, their risks, and strategic applications.

The Invesco QQQ Trust (QQQ), tracking the Nasdaq-100 Index, is a cornerstone of tech investing, offering exposure to giants like Apple, Microsoft, and Nvidia.

When markets turn volatile-driven by earnings shocks, Fed policy shifts, or sector sell-offs-QQQ inverse ETFs provide investors tools to hedge losses or profit from downturns.

These specialized funds move inversely to the Nasdaq-100, with some offering 2x or 3x leveraged returns for amplified exposure.

In this guide, we’ll break down how QQQ inverse ETFs work, list top funds, and explain how to navigate their risks and rewards in volatile markets.

What Are QQQ Inverse ETFs?

QQQ inverse ETFs use derivatives like futures, swaps, and options to deliver returns opposite to the Nasdaq-100 Index. They reset daily, meaning their performance aligns with the index’s single-day moves rather than long-term trends. For example:

- A 1x inverse ETF rises 1% when QQQ falls 1%.

- A 3x inverse ETF aims to gain 3% for every 1% QQQ decline.

These ETFs are tactical tools for short-term trading, hedging, or speculation-not long-term investments.

List of QQQ Inverse ETFs

Here are the top inverse ETFs tied to the Nasdaq-100, categorized by leverage. Each ETF links to its provider’s site for details.

1x Inverse ETFs

ProShares Short QQQ (PSQ)

- Leverage: 1x inverse

- Expense Ratio: 0.95%

- AUM: $150 million

- Strategy: Mirrors the inverse daily performance of the Nasdaq-100.

- Best For: Conservative hedging during mild volatility.

- Learn More

2x Inverse ETFs

ProShares UltraShort QQQ (QID)

- Leverage: 2x inverse

- Expense Ratio: 0.95%

- AUM: $500 million

- Strategy: Targets 2x the inverse daily return of the Nasdaq-100.

- Best For: Amplified hedging during moderate tech sell-offs.

- Learn More

3x Inverse ETFs

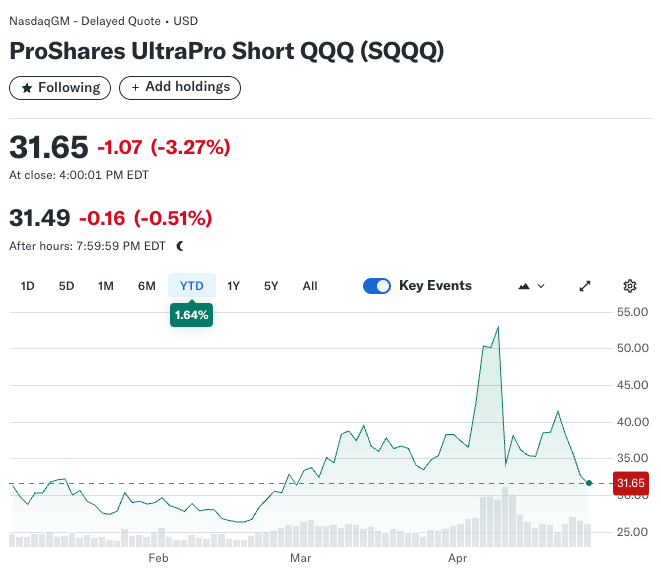

ProShares UltraPro Short QQQ (SQQQ)

- Leverage: 3x inverse

- Expense Ratio: 0.95%

- AUM: $3.8 billion

- Strategy: Seeks 3x the inverse daily return of the Nasdaq-100.

- Best For: Aggressive short-term bets during sharp tech declines.

- Learn More

Direxion Daily NASDAQ-100 Bear 3X Shares (QID)

- Leverage: 3x inverse

- Expense Ratio: 1.08%

- AUM: $400 million

- Strategy: Triples the inverse daily return of the Nasdaq-100.

- Best For: Tactical trading during high volatility.

- Learn More

Sector-Specific Inverse ETFs (Tech Exposure)

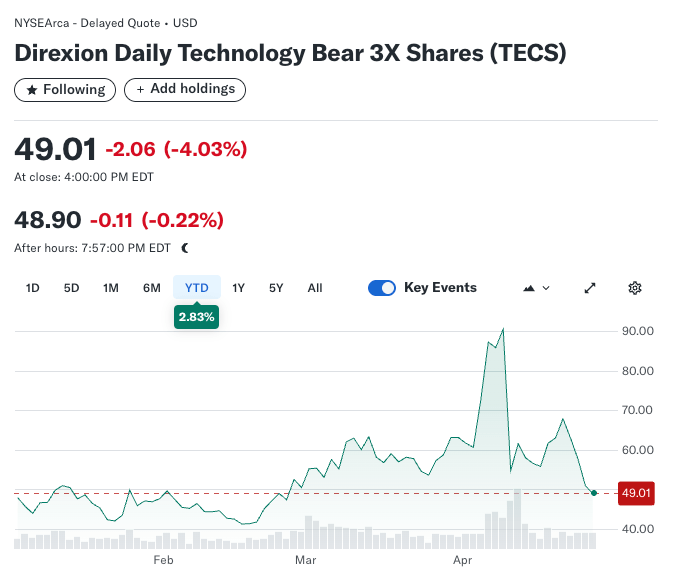

Direxion Daily Technology Bear 3X Shares (TECS)

- Leverage: 3x inverse

- Expense Ratio: 1.17%

- AUM: $450 million

- Strategy: Targets tech stocks within the Nasdaq-100.

- Best For: Hedging AI or semiconductor volatility.

- Learn More

T-Rex 2X Inverse NVIDIA Daily Target ETF (NVDQ)

- Leverage: 2x inverse

- Expense Ratio: 1.15%

- AUM: $150 million

- Strategy: 2x the inverse daily return of Nvidia (a top Nasdaq-100 component).

- Best For: Betting against AI chipmaker volatility.

- Learn More

How to Use QQQ Inverse ETFs During High Volatility

1. Hedging Tech-Heavy Portfolios

Strategy: Allocate 5–10% of your portfolio to 1x or 2x inverse ETFs like PSQ or QID ahead of high-risk events (e.g., Fed meetings, earnings reports).

Example: A $100,000 portfolio with 10% in QID ($10,000) offsets a 10% Nasdaq-100 drop with a ~20% gain in QID.

2. Tactical Short-Term Trading

Strategy: Use 3x ETFs like SQQQ to capitalize on anticipated short-term drops.

Case Study: In April 2025, QQQ fell 12% in three days due to tariff fears. SQQQ surged ~36% during this period.

3. Pair Trading

Strategy: Balance long positions in defensive sectors (utilities, healthcare) with inverse ETFs during tech sell-offs. For example, pair Amazon (AMZN) shares with TECS.

4. Leveraging Sector Volatility

Strategy: Trade around sector-specific news:

- Earnings Reports: Use NVDQ ahead of Nvidia earnings if expecting weak guidance.

- Regulatory Announcements: Bet against Big Tech with SQQQ during antitrust rulings.

Risks of QQQ Inverse ETFs

1. Daily Compounding Risk

Inverse ETFs reset daily, causing returns to diverge from expectations over time. For example:

- Day 1: QQQ drops 5% → 3x ETF gains 15%.

- Day 2: QQQ rises 5% → 3x ETF loses 15%.

Result: QQQ ends at -0.25%, but the 3x ETF loses ~2.25% due to compounding.

2. Volatility Decay

Frequent market swings erode leveraged ETF value. A 3x ETF held during sideways volatility often underperforms due to “volatility drag.”

3. High Expense Ratios

Fees for leveraged inverse ETFs (0.95–1.17%) are higher than traditional ETFs, eating into returns.

4. Liquidity Gaps

During extreme volatility, bid-ask spreads for ETFs like SQQQ may widen, increasing trading costs.

5. Sector Concentration

Tech dominates the Nasdaq-100. A rally in mega-caps like Apple or Microsoft can trigger outsized losses.

Strategic Tips for Managing Risks

- Set Stop-Loss Orders: Automate exits to limit losses (e.g., sell SQQQ if it drops 10%).

- Avoid Long-Term Holds: Hold inverse ETFs for hours or days, not weeks.

- Monitor the VIX: Rising volatility often signals larger Nasdaq swings-adjust positions accordingly.

- Diversify Strategies: Combine inverse ETFs with put options or defensive stocks.

When to Avoid QQQ Inverse ETFs

- Tech Bull Markets: QQQ inverse ETFs lose value during rallies (e.g., AI-driven surges).

- Low-Volatility Periods: Sideways markets amplify decay.

- Retirement Accounts: Many brokers restrict leveraged ETFs in IRAs due to risk.

Real-World Example: SQQQ During the 2025 Tech Sell-Off

In April 2025, the Nasdaq-100 dropped 15% in two weeks amid tariff tensions and weak semiconductor demand. Investors using SQQQ saw gains of ~45% during this period. However, when the Fed paused rate hikes the following week, QQQ rebounded 8%, erasing 24% of SQQQ’s value. This highlights the importance of timing and risk management.

Conclusion

QQQ inverse ETFs like PSQ, QID, and SQQQ are powerful tools for hedging or profiting from tech sector declines, but they demand careful handling. Their daily resets and volatility sensitivity make them unsuitable for passive investors.

Key Takeaways:

- Use 1x ETFs for hedging and 3x ETFs for tactical trades.

- Monitor positions daily and avoid holding through earnings announcements.

- Pair with stop-loss orders to manage downside risk.

By mastering these ETFs, you can turn tech volatility into strategic opportunities-without falling victim to their pitfalls.

Related Articles:

- 3x Inverse ETFs: A Complete Guide for Navigating Market Downturns

- QQQ Inverse ETF: How to Hedge or Profit When Tech Stocks Fall

- SPY Inverse ETFs: How to Hedge or Profit During Market Volatility

- Russell 2000 Leveraged ETFs That Profit When Small-Caps Fall: Bear Market Guide

- 10 Inverse (Leveraged) ETFs That Profit When the Dow Jones Falls: Complete Bear Market Guide

- 10 Inverse Nasdaq ETFs That Profit When Tech Markets Fall: Complete Bear Market Guide

- NVDA Inverse ETFs: How to Profit When NVIDIA Stock Drops

- Inverse ETFs for Tesla Stock: A Beginner’s Guide to Betting Against TSLA

- Inverse ETFs for Apple Stock: A Beginner’s Guide to Betting Against AAPL

- Navigate Market Risks with These Inverse ETFs

Citations:

- https://www.proshares.com/our-etfs/find-leveraged-and-inverse-etfs

- https://www.stockbrokers.com/education/inverse-short-etfs-bearish-etf-funds

- https://www.bankrate.com/investing/best-leveraged-etfs/

- https://www.investopedia.com/leveraged-volatility-etf-11714205

- https://www.etf.com/sections/news/market-volatility-inverse-etfs-sh-sqqq

- https://www.investopedia.com/articles/mutualfund/07/inverse-etfs.asp

- https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-alerts/sec

- https://etfdb.com/themes/leveraged-inverse-etfs/

- https://www.investopedia.com/articles/investing/122215/sqqq-proshares-ultrapro-short-qqq-etf.asp

- https://luckboxmagazine.com/techniques/using-inverse-leveraged-etfs-volatility-markets/

- https://etfdb.com/leveraged-inverse-channel/leveraged-etfs-embrace-market-volatility/

- https://pictureperfectportfolios.com/leveraged-and-inverse-etfs-a-cautionary-guide-for-beginners/

- https://study.com/academy/lesson/what-is-an-inverse-etf-definition-characteristics-risks.html

- https://finance.yahoo.com/news/market-volatility-underscores-role-inverse-120000505.html

- https://swingtradebot.com/inverse-etfs

- https://etfdb.com/themes/leveraged-3x-inverse-short-etfs/

- https://www.moomoo.com/community/feed/109545735389189

- https://www.britannica.com/money/inverse-leveraged-etf-definition

- https://followthemoney.com/the-ultimate-inverse-etf-list/

- https://www.investopedia.com/articles/investing/092815/risks-investing-inverse-etfs.asp

- https://www.investopedia.com/articles/etfs/062716/hedging-etf-indexes-relevant-strategy-qqq-psq.asp

- https://etfdb.com/etfs/inverse/equity/

- https://www.etf.com/topics/inverse

- https://www.nasdaq.com/articles/5-leveraged-inverse-etfs-gained-double-digits-march

- https://www.direxion.com/leveraged-and-inverse-etfs

- https://leverageshares.com/en/etps/leverage-shares-5x-short-nasdaq-100-etp/

- https://www.direxion.com

- https://www.proshares.com/our-etfs/leveraged-and-inverse/sqqq

- https://finance.yahoo.com/news/best-inverse-short-etfs-know-171112769.html

- https://www.proshares.com/our-etfs/leveraged-and-inverse/tqqq

- https://www.direxion.com/product/daily-magnificent-7-bull-2x-bear-1x-etfs

- https://etftrends.com/leveraged-inverse-channel/top-performing-leveraged-inverse-etfs-03-02-2025/

- https://leverageshares.com/en-eu/short-and-leveraged-etps/

- https://aptuscapitaladvisors.com/leveraged-etfs-the-hidden-costs-of-volatility-drag/

- https://www.reddit.com/r/LETFs/comments/1f5xsos/leveraged_etfs_if_traded_the_right_way_can/

- https://finance.yahoo.com/news/best-leveraged-etfs-high-risk-222357221.html

- https://www.quantifiedstrategies.com/leveraged-etf-trading-strategy/

- https://www.investopedia.com/terms/l/leveraged-etf.asp

- https://www.reddit.com/r/quant/comments/16gz2em/help_me_understand_the_volatility_decay_of/

- https://www.morningstar.com/funds/can-leveraged-etfs-benefit-your-portfolio

- https://app.tradingsim.com/blog/4-tips-for-how-to-trade-leveraged-etfs/

- https://www.crystalfunds.com/insights/leveraged-etfs-decay-understanding-mechanics-and-risks

- https://www.financialplanningassociation.org/sites/default/files/2021-08/MAY08%20Leveraged%20ETFs%20A%20Risky%20Double%20That%20Doesnt%20Multiply%20by%20Two.pdf

- https://www.etftrends.com/embracing-market-volatility-leveraged-etfs/

- https://www.reddit.com/r/stocks/comments/1j5aprv/has_anyone_looked_into_inverse_etfs_to_prepare/

- https://www.etf.com/sections/features/users-guide-inverse-etfs

- https://www.invesco.com/qqq-etf/en/market-outlook/five-risks-to-know-when-investing-in-etfs.html

- https://www.reddit.com/r/dividends/comments/1k10ow7/whats_the_risk_with_qqqi_and_spyi_for_these/

- https://www.schwab.com/learn/story/leveraged-inverse-etfs-going-going-gone

- https://www.proshares.com/our-etfs/leveraged-and-inverse/psq

- https://www.youtube.com/watch?v=qyb9D9bFs7s

- https://www.bairdwealth.com/globalassets/pdfs/help/leveraged-inverse-funds.pdf

- https://etfdb.com/leveraged-inverse-channel/leveraged-etfs-embrace-market-volatility/

- https://www.proshares.com/strategies/leveraged-and-inverse

- https://www.chase.com/personal/investments/learning-and-insights/article/what-is-an-inverse-etf

- https://www.proshares.com/browse-all-insights/insights/part-iii-the-efficacy-of-hedging-with-inverse-etfs