Learn what 3x inverse ETFs are, how they work, and the risks involved. Discover top 3x inverse ETFs to consider and strategies for using them wisely in volatile markets.

When Markets Fall, 3x Inverse ETFs Can Rise-But Proceed With Caution

Imagine a financial tool that triples your gains when the stock market crashes. That’s the promise of 3x inverse ETFs-specialized funds designed to soar when markets sink. But like a chainsaw in untrained hands, these instruments can cause severe damage if misused.

Here’s what everyday investors need to know.

What Is a 3x Inverse ETF?

A 3x inverse ETF is a fund that aims to deliver three times the daily inverse performance of a market index or sector. If the S&P 500 drops 2% in a day, a 3x inverse S&P 500 ETF should rise roughly 6%. These ETFs use derivatives like futures and swaps to amplify returns, making them powerful tools for short-term bets against markets.

Key Features:

- Daily reset: Designed for single-day performance, not long-term holding.

- High risk: Leverage magnifies losses if markets move against you.

- Sector-specific: Target niches like tech, semiconductors, or volatility indexes.

How Do 3x Inverse ETFs Work?

Let’s break it down with an example:

- Benchmark drops 5% today → ETF gains 15%.

- Benchmark rises 3% tomorrow → ETF loses 9%.

These ETFs “reset” daily, meaning their performance can diverge wildly from the index over weeks or months due to compounding. Holding them long-term is like driving a racecar on a winding mountain road-thrilling but perilous.

Top 3x Inverse ETFs to Know

| Ticker | Name | Target Index/Sector |

|---|---|---|

| SQQQ | Direxion Daily NASDAQ-100 Bear 3X | NASDAQ-100 (tech stocks) |

| SPXS | Direxion Daily S&P 500 Bear 3X | S&P 500 (broad U.S. stocks) |

| SOXS | Direxion Daily Semiconductor Bear 3X | Semiconductor companies |

| FNGD | MicroSectors FANG+ -3X Inverse | Big Tech (Meta, Apple, etc.) |

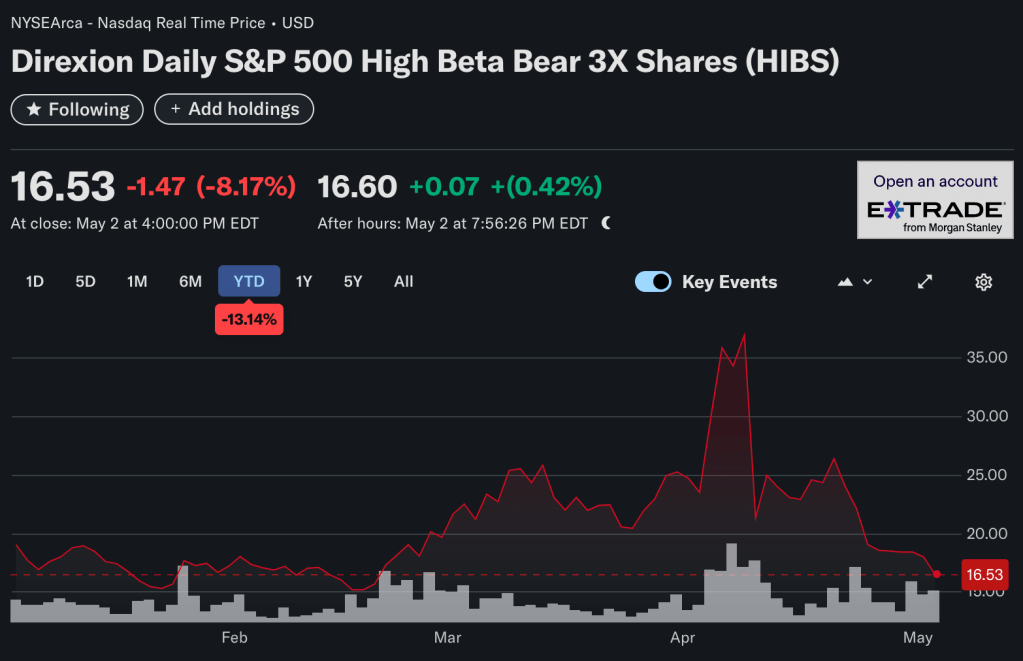

| HIBS | Direxion Daily S&P 500 High Beta Bear | High-volatility U.S. stocks |

| BERZ | MicroSectors FANG & Innovation -3X | Tech innovators and disruptors |

Data sources: ProShares, Direxion, ETF Database

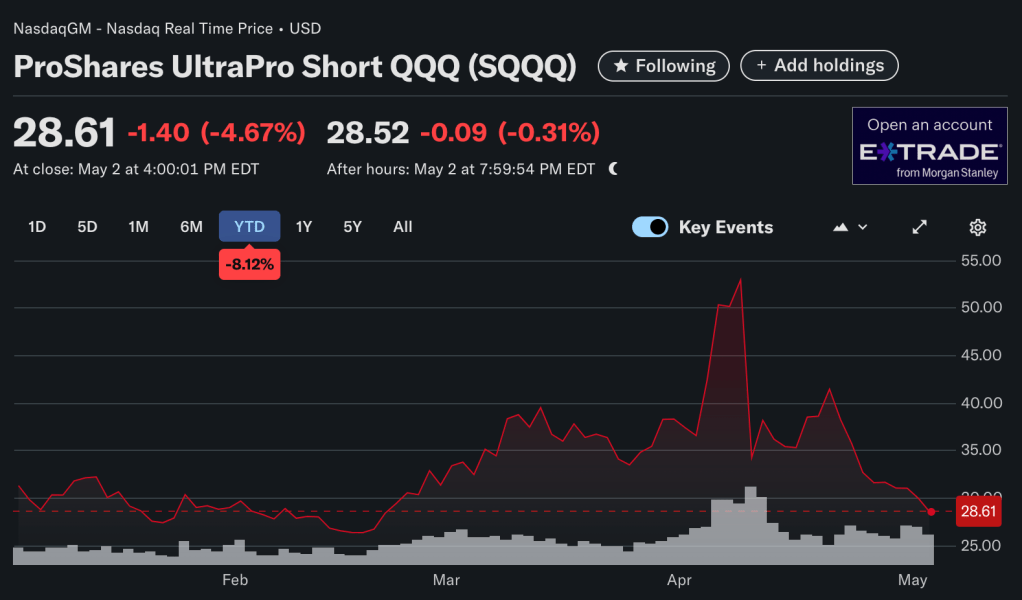

SQQQ

Triple Inverse Exposure: SQQQ seeks to deliver three times the opposite of the daily performance of the Nasdaq-100. For example, if the Nasdaq-100 falls by 1% in a single day, SQQQ is designed to rise by about 3%. If the index rises, SQQQ will fall by roughly three times that amount.

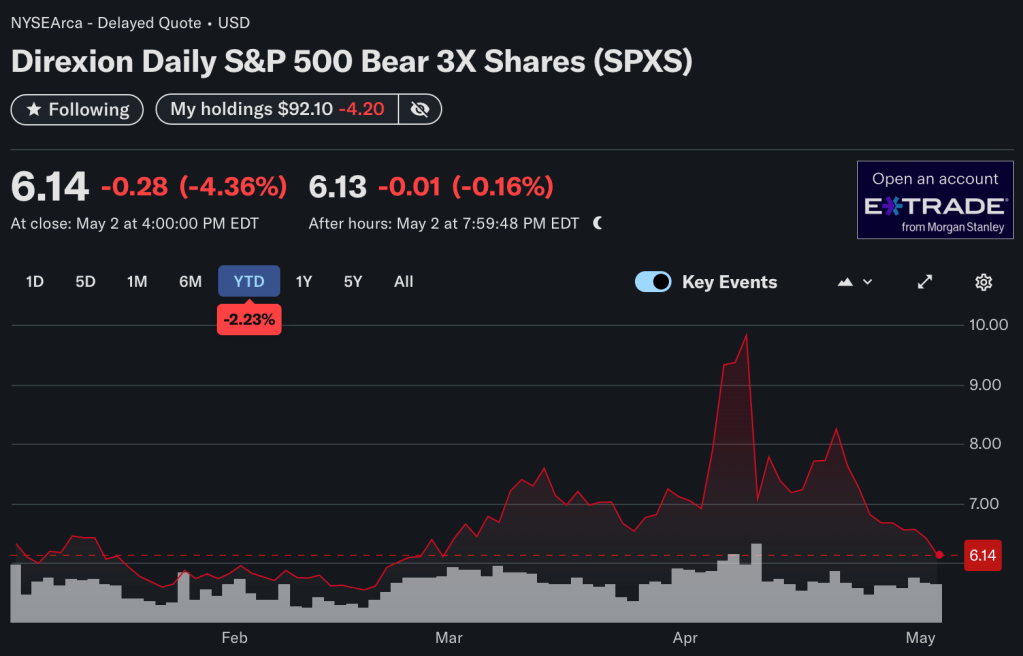

SPXS

The Direxion Daily S&P 500 Bear 3X Shares (SPXS) is a highly specialized exchange-traded fund (ETF) designed for traders who want to profit from short-term declines in the S&P 500 Index. If the S&P 500 falls 1% in a day, SPXS aims to rise about 3%. If the S&P 500 rises 1%, SPXS is designed to fall about 3%.

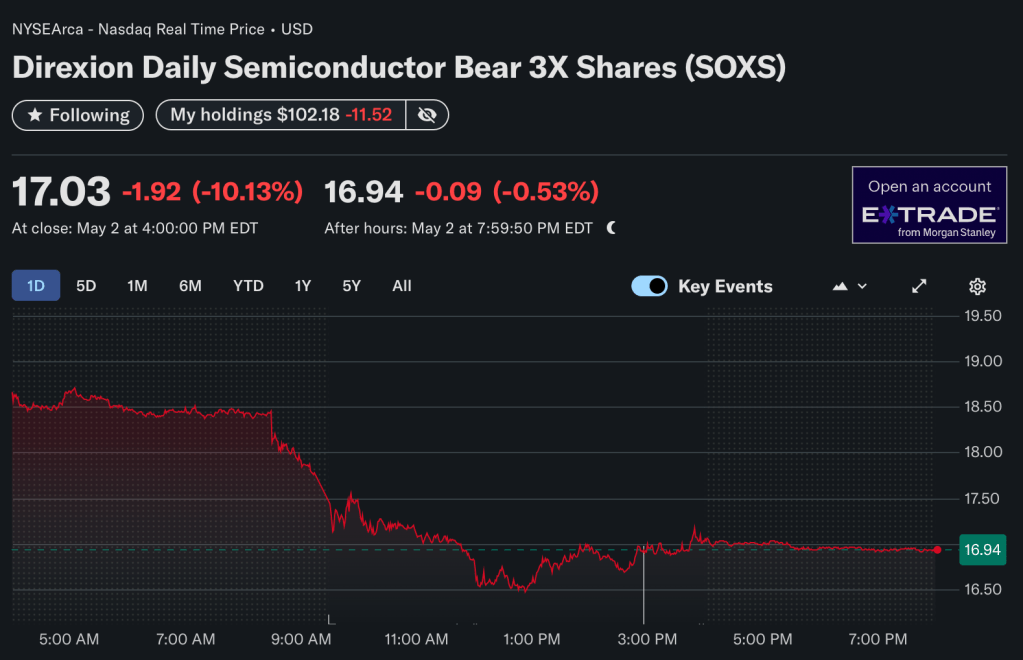

SOXS

The Direxion Daily Semiconductor Bear 3X Shares (SOXS) is a leveraged exchange-traded fund (ETF) designed for traders who want to profit from short-term declines in the semiconductor sector. If the semiconductor index falls 1% in a day, SOXS is designed to rise about 3%. If the index rises 1%, SOXS will drop about 3%.

HIBS

HIBS aims to deliver three times the opposite of the daily performance of an index made up of the 100 most “high beta” stocks in the S&P 500. “High beta” stocks are those that tend to move up or down more than the overall market-think of them as the most sensitive or “jumpy” stocks. If that group of stocks falls by 1% in a day, HIBS is designed to go up by about 3%. If the group rises by 1%, HIBS would drop by about 3%.

Pros and Cons of 3x Inverse ETFs

Pros:

- Profit in bear markets: Hedge portfolios or speculate on declines.

- No short-selling complexity: Easier than betting against individual stocks.

- Accessibility: Trade like regular stocks in brokerage accounts.

Cons:

- Daily decay: Compounding erodes returns over time, even if the index trends down.

- High fees: Expense ratios often exceed 1%.

- Volatility whiplash: Wild swings can trigger margin calls or panic selling.

Who Should Use 3x Inverse ETFs?

- Day traders: Capitalize on short-term market moves.

- Hedgers: Offset losses in a stock portfolio during corrections.

- Risk-tolerant speculators: Bet on sector-specific downturns (e.g., semiconductors).

Avoid if:

- You’re a long-term investor.

- You can’t monitor markets daily.

- You’re uncomfortable with potential 50%+ losses in a week.

3 Rules for Trading 3x Inverse ETFs Safely

- Set strict time limits: Hold for hours or days-never months.

- Use stop-loss orders: Automatically sell if losses hit a threshold (e.g., -15%).

- Diversify bets: Never allocate more than 5% of your portfolio to these ETFs.

The Bottom Line: High Risk, High Reward-For the Right Hands

3x inverse ETFs are niche tools for seasoned traders, not buy-and-hold investors. While they’ve delivered weekly gains as high as 22% during market turmoil (see: SSG, TSLQ in April 20258), they’ve also erased fortunes during rebounds. Use them sparingly, with eyes wide open to the risks.

Final Tip: Paper-trade first. Practice with virtual money to understand how leverage and volatility interact before risking real capital.

Related Posts:

- 3x Inverse ETFs: A Complete Guide for Navigating Market Downturns

- QQQ Inverse ETF: How to Hedge or Profit When Tech Stocks Fall

- SPY Inverse ETFs: How to Hedge or Profit During Market Volatility

- Russell 2000 Leveraged ETFs That Profit When Small-Caps Fall: Bear Market Guide

- 10 Inverse (Leveraged) ETFs That Profit When the Dow Jones Falls: Complete Bear Market Guide

Citations:

- https://www.proshares.com/our-etfs/find-leveraged-and-inverse-etfs

- https://en.wikipedia.org/wiki/Inverse_exchange-traded_fund

- https://etfdb.com/leveraged-inverse-channel/top-performing-leveraged-2025-03-30/

- https://pictureperfectportfolios.com/leveraged-and-inverse-etfs-a-cautionary-guide-for-beginners/

- https://www.etf.com/topics/inverse

- https://followthemoney.com/the-ultimate-inverse-etf-list/

- https://www.direxion.com/uploads/Leveraged-and-Inverse-ETF-List.pdf

- https://etfdb.com/leveraged-inverse-channel/top-performing-leveraged-2025-04-27/

- https://www.direxion.com/leveraged-and-inverse-etfs

- https://www.nerdwallet.com/article/investing/inverse-etfs

- https://etfdb.com/leveraged-inverse-channel/top-performing-leveraged-2025-04-06/

- https://www.etf.com/sections/etf-basics/what-inverse-etf-everything-you-need-know

- https://etftrends.com/leveraged-inverse-channel/top-performing-leveraged-inverse-etfs-03-02-2025/

- https://investor.vanguard.com/investor-resources-education/etfs/leveraged-inverse-etf-etn

- https://www.etftrends.com/leveraged-inverse-channel/top-performing-leveraged-inverse-etfs-04-27-2025/

- https://finimize.com/content/intro-to-leveraged-and-inverse-etfs-with-direxion

- https://www.3xetf.com

- https://www.direxion.com

- https://finance.yahoo.com/news/best-inverse-short-etfs-know-171112769.html

- https://www.youtube.com/watch?v=FueWXyOXjc0