If you’ve been following the crypto market, you’re very familiar with Bitcoin and Ethereum ETFs. Now, XRP—the digital asset created by Ripple—is stepping into the spotlight with the launch of the first U.S.-based XRP futures ETF and growing momentum for a spot XRP ETF.

In this article, we explain how the new XRP ETF works, what it means for investors, and why Wall Street and regulators are keeping a close eye on Ripple’s digital asset.

Table of Contents:

- What Is an XRP ETF?

- Types of XRP ETFs: Futures vs. Spot

- How Does an XRP ETF Work?

- Why Are XRP ETFs Gaining Attention in 2025?

- What Are the Benefits of an XRP ETF?

- What Are the Risks of an XRP ETF?

- How Does an XRP ETF Compare to Buying XRP Directly?

- Frequently Asked Questions About XRP ETFs

- What’s Next for XRP ETFs? Regulatory Outlook for 2025

- Long-Tail and Trending Keywords for XRP ETF

- Key Takeaways

- Conclusion:

“Investing in an XRP ETF empowers both retail and institutional investors to navigate cryptocurrency, providing exposure to XRP’s price dynamics without the complexities of managing digital assets directly.”

What Is an XRP ETF?

An XRP ETF (Exchange-Traded Fund) is a financial product designed to track the price of XRP, the native token of the XRP Ledger. Instead of buying and storing XRP directly, investors can buy shares of the ETF through traditional brokerage accounts. This makes it easier for both retail and institutional investors to gain exposure to XRP’s price movements without dealing with crypto wallets, private keys, or crypto exchanges.

Key Features of XRP ETF:

- Price Tracking: The ETF aims to mirror XRP’s price as closely as possible, using either direct holdings of XRP or derivatives like futures contracts.

- Exchange-Traded: Shares are bought and sold on stock exchanges during normal trading hours.

- Regulatory Oversight: ETFs are regulated by financial authorities, providing additional investor protections.

- No Need for Crypto Custody: Investors avoid the technical hurdles of managing digital assets themselves.

Types of XRP ETFs: Futures vs. Spot

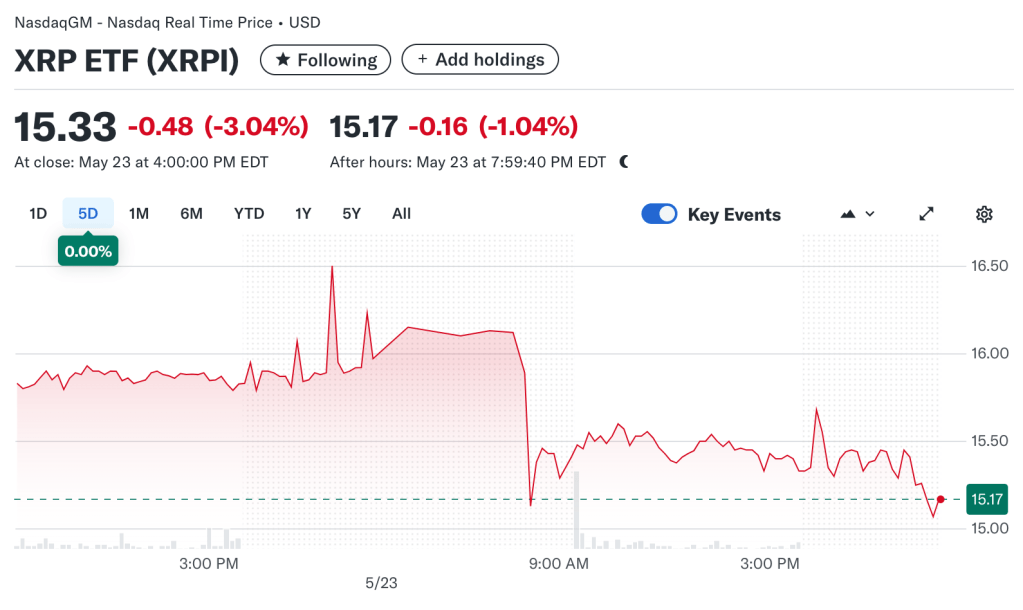

Volatility Shares XRP ETF (ticker: XRPI)

The Volatility Shares XRP ETF (ticker: XRPI) began trading on Nasdaq in May 2025. It invests at least 80% of its assets in XRP futures and similar XRP-linked products, offering 1:1 exposure to XRP price movements. It invests in XRP futures contracts—agreements to buy or sell XRP at a set price in the future—rather than holding XRP directly.

Teucrium’s 2x XRP ETF (XXRP)

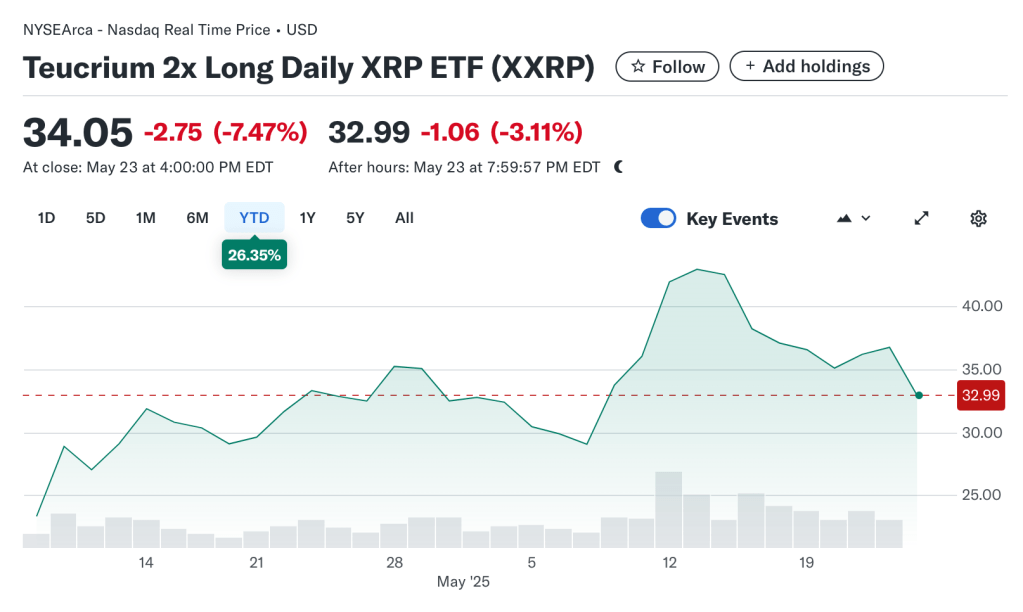

There are also leveraged XRP futures ETFs, like Teucrium’s 2x XRP ETF (XXRP), which offer double the daily price movement of XRP. Futures ETFs track XRP’s price using regulated derivatives markets, such as those on the Chicago Mercantile Exchange (CME), rather than buying the asset itself.

Pros:

- Accessible through any brokerage account

- No need to manage crypto wallets

- Regulated structure

Cons:

- May not perfectly track XRP’s spot price due to futures market dynamics

- Higher management fees (XRPI’s net expense ratio is 0.94%)

- Subject to “roll costs” and potential tracking error

Spot XRP ETF (Pending Approval)

A spot XRP ETF would directly hold XRP tokens in institutional-grade custody, with shares representing a claim on the underlying XRP.

- Current Status: As of May 2025, proposals from major firms like Franklin Templeton and 21Shares are awaiting SEC approval, with a decision expected by June 17, 2025.

- How It Works: The issuer buys XRP and stores it securely. ETF shares are created and redeemed based on investor demand, keeping the ETF’s price in line with the market value of XRP.

- Security Measures: Custodians use cold storage, multi-signature wallets, and insurance to protect the fund’s XRP holdings.

Pros:

- Directly tracks the spot price of XRP

- Lower tracking error compared to futures ETFs

- Likely lower fees (expected to be under 0.20%)

Cons:

- Not yet available in the U.S.

- Regulatory and legal uncertainties remain

How Does an XRP ETF Work?

Whether futures-based or spot, XRP ETFs follow a similar structure to other commodity or crypto ETFs:

- Fund Creation: The ETF issuer acquires XRP or XRP futures contracts.

- Asset Backing: The fund’s value is tied to the XRP or futures contracts it holds.

- Share Trading: Investors buy and sell ETF shares on stock exchanges.

- Net Asset Value (NAV): The NAV is calculated by dividing the total value of the fund’s XRP holdings by the number of outstanding shares.

- Management Fees: The issuer charges a small annual fee for managing the fund.

This structure allows investors to benefit from XRP’s price movements without the complexities of direct crypto ownership.

Why Are XRP ETFs Gaining Attention in 2025?

Mainstream Adoption and Wall Street Interest

- The launch of the first XRP futures ETF (XRPI) on Nasdaq marks a major milestone, signaling Wall Street’s growing acceptance of XRP as a legitimate asset class.

- Institutional investors are increasingly interested in regulated crypto products, especially with the CME now offering XRP futures.

- A spot XRP ETF could further open the doors to banks, hedge funds, and pension funds that have so far been unable or unwilling to hold crypto directly.

Broader Crypto ETF Trend

- Following the success of Bitcoin and Ethereum ETFs, XRP is the next logical step for diversification in crypto portfolios.

- ETFs make it easier for everyday investors to access crypto markets through familiar brokerage platforms, without the need for specialized knowledge or security measures.

What Are the Benefits of an XRP ETF?

- Simplicity: Buy and sell XRP exposure like any stock or ETF.

- No Crypto Wallet Needed: Avoid the risks and hassles of managing private keys and digital wallets.

- Regulated Structure: ETFs are subject to strict regulatory oversight, including daily disclosure of holdings and independent audits.

- Liquidity: Shares can be traded during market hours, and creation/redemption mechanisms help keep prices in line with the value of XRP.

- Tax Reporting: ETFs provide standard tax documents, simplifying reporting compared to direct crypto transactions.

What Are the Risks of an XRP ETF?

- Volatility: XRP’s price can swing dramatically—sometimes over 70% in a single quarter.

- Tracking Error: Futures ETFs may not perfectly match XRP’s spot price due to the mechanics of futures contracts and roll costs.

- Regulatory Uncertainty: The SEC has not yet classified XRP as a commodity, and legal or regulatory changes could impact the ETF’s status or operations.

- Custody Risks: Even with institutional-grade security, there’s always a risk of hacks or breaches when holding digital assets.

- Market Liquidity: XRP’s trading volume is lower than Bitcoin or Ethereum, which could lead to wider bid-ask spreads and less efficient price discovery, especially for new ETFs.

How Does an XRP ETF Compare to Buying XRP Directly?

| Feature | XRP ETF | Buying XRP Directly |

|---|---|---|

| Storage | No wallet needed | Requires secure wallet |

| Regulation | SEC oversight (U.S. ETFs) | Varies by exchange |

| Tax Reporting | Standard ETF tax forms | Crypto-specific reporting |

| Trading Hours | Stock market hours | 24/7 on crypto exchanges |

| Fees | Management fee (0.2–1.0%+) | Exchange withdrawal fees |

| Security | Institutional custody | Self-managed security |

| Leverage Options | Available (futures ETFs) | Margin trading varies |

Frequently Asked Questions About XRP ETFs

What is the difference between an XRP futures ETF and a spot XRP ETF?

- Futures ETF: Tracks XRP price using regulated futures contracts. Does not hold XRP directly. May have higher fees and tracking error.

- Spot ETF: Would hold actual XRP tokens in custody. Expected to have lower fees and more accurate price tracking, but not yet approved in the U.S..

How can I buy an XRP ETF?

- XRP futures ETFs like XRPI can be bought through any brokerage account that offers access to Nasdaq-listed ETFs.

- Spot XRP ETFs will be available through similar channels if and when they are approved.

What are the fees for XRP ETFs?

- XRPI charges a net expense ratio of 0.94% after waivers.

- Spot ETFs are expected to have lower fees, likely under 0.20%.

Is there demand for XRP ETFs?

- Yes. The 2x leveraged XRP ETF (XXRP) has already attracted over $120 million in assets and $35 million in daily trading volume. Analysts expect strong demand for both futures and spot XRP ETFs.

Are XRP ETFs safe?

- They are regulated and use institutional custody, but risks remain—including price volatility, regulatory changes, and potential custody breaches.

What’s Next for XRP ETFs? Regulatory Outlook for 2025

- The SEC is reviewing multiple spot XRP ETF proposals, with decisions expected by mid-2025.

- The approval of a spot XRP ETF could further legitimize XRP as an asset class and drive broader adoption among both retail and institutional investors.

- Ongoing legal questions about XRP’s classification as a security or commodity could delay or complicate the process.

Long-Tail and Trending Keywords for XRP ETF

- XRP futures ETF explained

- How to buy XRP ETF in 2025

- XRP spot ETF approval date

- Ripple ETF vs Bitcoin ETF

- Best XRP ETF for US investors

- XRP ETF management fees

- XRP ETF SEC status

- XRP ETF vs holding XRP

- XRP ETF tax implications

- Institutional demand for XRP ETF

Key Takeaways

- XRP ETFs offer a regulated, accessible way to gain exposure to Ripple’s digital asset, without direct crypto ownership.

- The first U.S. XRP futures ETF (XRPI) is now trading on Nasdaq, with spot ETF proposals under SEC review for potential approval in 2025.

- Benefits include simplicity, regulatory oversight, and no need for crypto wallets, but risks include volatility, tracking error, and ongoing regulatory uncertainty.

- Strong investor demand and Wall Street interest suggest XRP ETFs could become a major part of the crypto investment landscape.

Conclusion:

XRP ETFs are ushering Ripple’s digital asset into mainstream finance, offering investors a simple, regulated way to gain exposure through their brokerage accounts. With the launch of the first XRP futures ETF and the possibility of a spot ETF on the horizon, 2025 could be a pivotal year for XRP on Wall Street. As always, weigh the benefits and risks carefully—and stay tuned for regulatory developments that could shape the future of XRP investing.

Citations:

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/collection_ba0d45e7-4185-409f-b191-3462b73eb57a/42cbeeac-1543-419d-9dbd-94d472b6fa55/paste.txt

- https://www.coindesk.com/markets/2025/05/22/first-u-s-xrp-futures-etf-begins-trading-on-nasdaq

- https://crypto.com/en/university/what-are-xrp-etfs

- https://www.volatilityshares.com/xrpi

- https://www.dlnews.com/articles/markets/volatility-shares-to-launch-an-xrp-futures-etf/

- https://www.forbes.com/sites/digital-assets/article/what-is-an-xrp-spot-etf/

- https://bravenewcoin.com/insights/xrp-news-today-xrp-futures-etf-launch-marks-major-milestone-as-xrp-gains-wall-street-spotlight

- https://www.bittime.com/en/blog/Apa-Itu-ETF-XRP

- https://www.kucoin.com/learn/crypto/what-is-an-xrp-etf-and-how-does-it-work

- https://alphapoint.com/blog/xrp-etf/

- https://www.grayscale.com/funds/grayscale-xrp-trust