Defiance ETFs offers a variety of investment products, including leveraged single-stock ETFs, income-generating options strategies, and thematic funds focused on emerging technologies. Their products range from quantum computing exposure to high-yield income funds using zero-day options strategies.

With 29 ETFs managing over $4.5 billion in assets, Defiance ranks as the 55th largest ETF provider in the United States. This article explains what you need to know about this diverse catalog of Defiance ETF.

- What Makes Defiance ETFs Different?

- Popular Defiance ETFs

- Leveraged Single-Stock ETFs

- Income-Generating ETFs

- Specialized Sector ETFs

- How Defiance ETFs Work

- Risk Considerations

- Who Should Consider Defiance ETFs

- Portfolio Integration

- Performance Analysis

- Future Outlook

- Getting Started with Defiance ETFs

What Makes Defiance ETFs Different?

Defiance ETFs has carved out a unique position in the exchange-traded fund market since its founding in 2018. This ETF provider specializes in three main areas: thematic investing, income generation, and leveraged exposure to individual stocks.

Innovative Product Design

Defiance stands out by creating ETFs that traditional fund companies often avoid. Their first-mover advantage in leveraged single-stock ETFs allows investors to gain amplified exposure to high-growth companies without opening margin accounts. This approach delivers sophisticated trading strategies to retail investors.

Technology Focus

Many Defiance ETFs target cutting-edge sectors like quantum computing, 5G connectivity, and artificial intelligence. These thematic funds provide exposure to companies developing tomorrow’s breakthrough technologies, though they come with more risk and volatility.

Income Innovation

Defiance pioneered the use of zero-day-to-expiration (0DTE) options in ETFs. These strategies generate daily income by selling options that expire the same day, capturing rapid time decay while reducing overnight risk exposure.

Popular Defiance ETFs

QTUM – Defiance Quantum ETF

The largest Defiance fund with $1.29 billion in assets, QTUM provides exposure to companies developing quantum computing technologies. This ETF holds 67 stocks including D-Wave Quantum (6.95% weight) and Rigetti Computing (2.25%). The fund charges a 0.40% expense ratio and has delivered strong performance with a 36.04% one-year return.

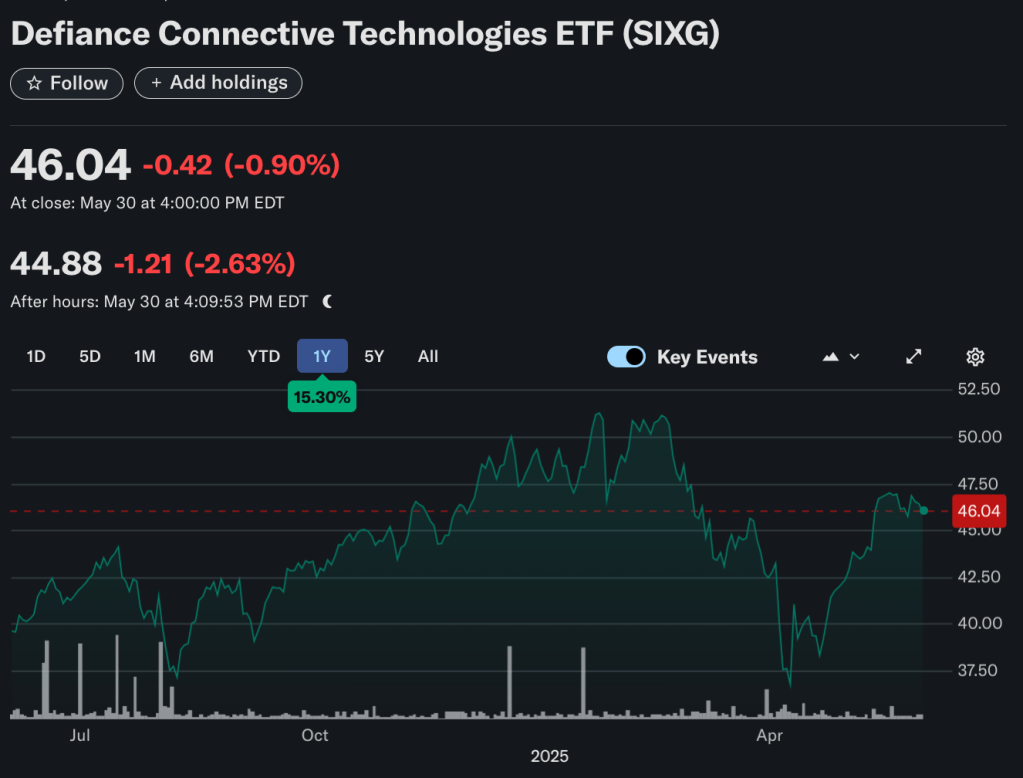

SIXG – Defiance Connective Technologies ETF

With $560.30 million in assets, SIXG focuses on companies enabling 5G and next-generation connectivity. This ETF targets the infrastructure and technology companies building tomorrow’s communication networks. The fund maintains a low 0.30% expense ratio and has generated a 15.19% one-year return.

Leveraged Single-Stock ETFs

MSTX – Defiance Daily Target 2X Long MSTR ETF

This $1.20 billion fund provides 2x daily leveraged exposure to MicroStrategy stock. MicroStrategy’s heavy Bitcoin holdings make this ETF an indirect way to gain amplified cryptocurrency exposure. The fund carries a 1.29% expense ratio and resets daily to maintain its 2x target.

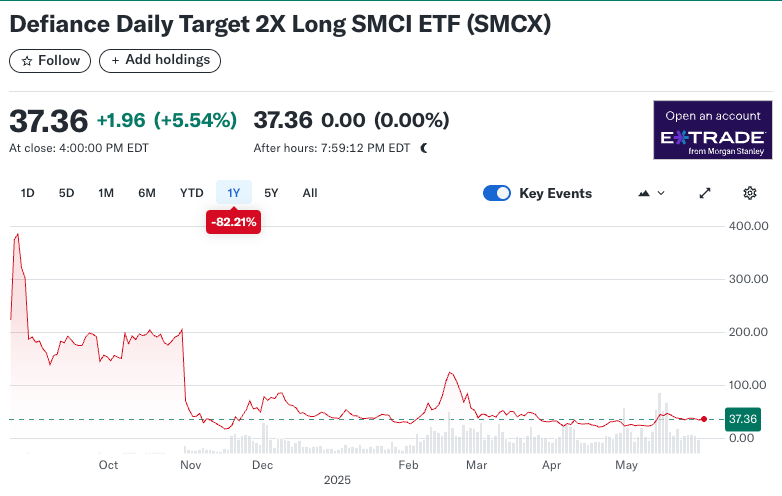

SMCX – Defiance Daily Target 2X Long SMCI ETF

Offering 2x leveraged exposure to Super Micro Computer, this $315.70 million ETF targets the AI server and data center market. Super Micro Computer benefits from artificial intelligence infrastructure demand, making this fund attractive for investors bullish on AI growth.

AVGX – Defiance Daily Target 2X Long AVGO ETF

This $82.63 million fund provides 2x daily exposure to Broadcom, a major semiconductor company. Broadcom’s diversified chip portfolio includes networking, wireless, and data center components essential for modern technology infrastructure.

Income-Generating ETFs

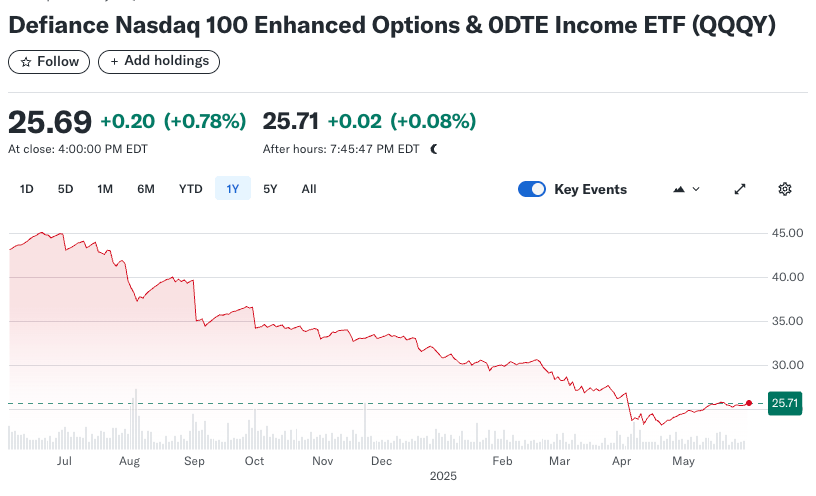

QQQY – Defiance Nasdaq 100 Enhanced Options & 0DTE Income ETF

The world’s first ETF using zero-day options, QQQY generates income by selling daily put options on the Nasdaq-100 Index. With $152.78 million in assets and an impressive 81.28% distribution yield, this fund attracts income-focused investors. However, the high yield comes with significant principal risk, as evidenced by its -44.28% one-year return.

IWMY – Defiance R2000 Enhanced Options & 0DTE Income ETF

Similar to QQQY but targeting the Russell 2000 Index, IWMY uses daily options strategies to generate income3. The fund manages $108.66 million and offers a 98.60% distribution yield6. Like other high-yield options ETFs, it has experienced significant principal decline with a -47.97% one-year return.

WDTE – Defiance S&P 500 Enhanced Options & 0DTE Income ETF

This $66.97 million fund applies the same 0DTE options strategy to the S&P 500 Index. With a 53.31% distribution yield, WDTE offers income generation from the broad market while maintaining exposure to large-cap stocks.

SPYT – Defiance S&P 500 Target Income ETF

Managing $110.17 million, SPYT uses traditional options strategies to generate income from S&P 500 exposure. The fund offers a more conservative 21.97% distribution yield compared to the 0DTE funds, with a smaller -11.20% one-year decline.

Specialized Sector ETFs

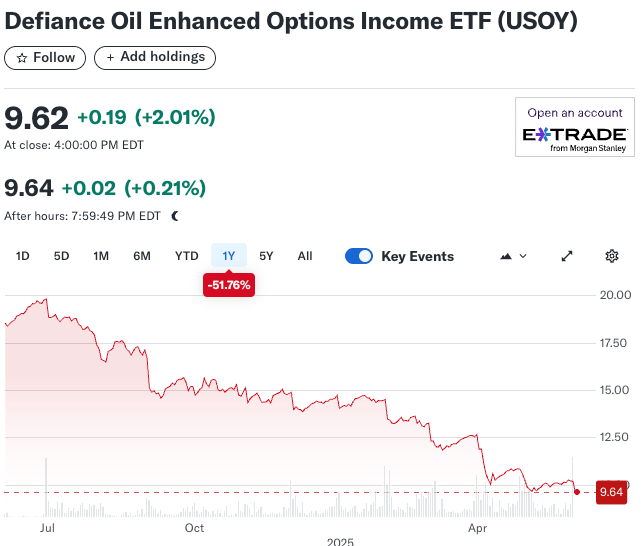

USOY – Defiance Oil Enhanced Options Income ETF

This unique $35.07 million fund combines oil exposure through the United States Oil Fund (USO) with income generation from options strategies. USOY sells put options on USO to generate current income while maintaining indirect oil price exposure. The fund offers a 96.95% distribution yield but has declined -49.69% over the past year due to oil market volatility.

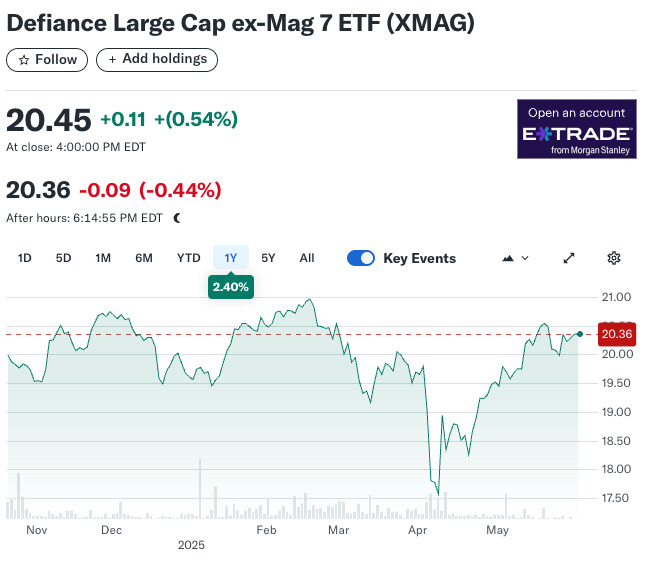

XMAG – Defiance Large Cap ex-Mag 7 ETF

With $35.47 million in assets, XMAG provides exposure to large-cap stocks while excluding the “Magnificent 7” technology giants. This fund appeals to investors seeking diversified large-cap exposure without concentration in mega-cap tech stocks.

How Defiance ETFs Work

Leveraged Single-Stock Strategy

Defiance’s leveraged ETFs use derivatives to provide 2x daily exposure to individual stocks. These funds reset daily, meaning they target 2x the daily return of the underlying stock, not long-term performance. Daily rebalancing can cause performance to diverge significantly from 2x the stock’s long-term return, especially during volatile periods.

0DTE Options Strategy

The zero-day-to-expiration options strategy involves selling put options that expire the same trading day. This approach captures rapid time decay as options lose value quickly approaching expiration. While this generates consistent income, it exposes the fund to significant downside risk if the underlying index declines sharply.

Thematic Investing Approach

Defiance’s thematic ETFs identify emerging technology trends and invest in companies positioned to benefit from these developments. The quantum computing ETF, for example, holds companies developing quantum hardware, software, and applications across various industries.

Risk Considerations

High Volatility

Defiance ETFs typically exhibit higher volatility than broad market funds. Leveraged products amplify both gains and losses, while thematic funds concentrate risk in specific sectors or technologies that may face rapid changes.

Principal Risk in Income ETFs

The high-yield income ETFs often distribute more than they earn, leading to return of capital that reduces the fund’s net asset value. Investors may receive attractive income payments while losing principal value over time.

Concentration Risk

Many Defiance ETFs focus on specific themes, sectors, or individual stocks, creating concentration risk. Poor performance in the targeted area can significantly impact fund returns.

Complexity

These ETFs use sophisticated strategies that may not be suitable for all investors. Understanding how leveraged products, options strategies, and thematic investing work is crucial before investing.

Who Should Consider Defiance ETFs

Active Traders

Leveraged single-stock ETFs appeal to traders seeking amplified exposure to specific companies without using margin accounts. These products work best for short-term tactical positions rather than long-term holdings.

Income Seekers

The high-yield options ETFs attract investors prioritizing current income over capital preservation. However, these funds require careful monitoring due to principal erosion risk.

Technology Enthusiasts

Thematic ETFs like QTUM and SIXG suit investors wanting exposure to emerging technologies. These funds provide diversified access to sectors that might be difficult to research and select individually.

Portfolio Integration

Tactical Allocation

Most financial advisors recommend limiting Defiance ETFs to small tactical allocations within diversified portfolios. The specialized nature and higher risk profiles make these funds unsuitable as core holdings for most investors.

Risk Management

Investors should carefully monitor leveraged and high-yield income positions, as these products can experience rapid value changes. Setting stop-losses or position size limits helps manage downside risk.

Performance Analysis

Recent Performance Trends

Defiance ETFs have shown mixed performance reflecting their specialized focus areas. Technology-themed funds like QTUM have benefited from AI and quantum computing enthusiasm, while income-focused ETFs have struggled with principal preservation during market volatility.

Expense Ratios

Defiance ETFs carry higher expense ratios than broad market funds, averaging 1.04% across all products. Leveraged and options-based ETFs typically charge 1.00-1.31%, while thematic funds range from 0.30-0.40%. These higher fees reflect the complexity and active management required for specialized strategies.

Future Outlook

Product Innovation

Defiance continues expanding its product lineup with new leveraged single-stock ETFs and income strategies. The company’s first-mover advantage in certain areas positions it well for continued growth as investor interest in alternative ETF strategies increases.

Market Adoption

Growing retail investor sophistication and demand for targeted exposure strategies support continued adoption of Defiance’s innovative products. However, regulatory scrutiny of complex ETF products may impact future development.

Technology Trends

The quantum computing and 5G themes underlying several Defiance ETFs remain in early development stages. Long-term success depends on these technologies achieving commercial viability and widespread adoption.

Getting Started with Defiance ETFs

Research Process

Before investing, thoroughly research the specific strategy, underlying holdings, and risk factors for each fund. Defiance provides detailed information on their website, including full holdings lists and strategy explanations.

Broker Compatibility

Most major brokerages offer Defiance ETFs for trading. However, some platforms may require additional approvals for leveraged products or provide warnings about complex strategies.

Monitoring Requirements

These specialized ETFs require more active monitoring than traditional index funds. Set up alerts for significant price movements and regularly review performance relative to expectations and risk tolerance.

Defiance ETFs offers innovative investment solutions for sophisticated investors seeking targeted exposure to emerging technologies, amplified stock positions, or enhanced income generation.

While these products provide unique opportunities, they also carry higher risks and complexity than traditional ETFs. Careful research, appropriate position sizing, and ongoing monitoring are essential for successful investing in Defiance’s specialized fund lineup.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

Citations:

- https://ppl-ai-file-upload.s3.amazonaws.com/web/direct-files/collection_ba0d45e7-4185-409f-b191-3462b73eb57a/42cbeeac-1543-419d-9dbd-94d472b6fa55/paste.txt

- https://www.morningstar.com/asset-management-companies/defiance-BN00000AXE/etfs

- https://www.youtube.com/watch?v=KH7CPJamw3g

- https://www.defianceetfs.com/usoy/

- https://www.defianceetfs.com

- https://stockanalysis.com/etf/provider/defiance/

- https://www.defianceetfs.com/qtum-full-holdings/

- https://www.defianceetfs.com/explore-our-etfs/

- https://etfdb.com/etfs/issuers/defiance-etfs/

- https://www.defianceetfs.com/qqqy/

- https://weaponfreefunds.org/fund-manager/Defiance%20ETFs