European defense ETFs have surged in popularity and performance in 2025, driven by increased defense spending, geopolitical tensions, and investor demand for exposure to the continent’s military and security industries.

What Is a European Defense ETF?

A European defense ETF is an exchange-traded fund that invests primarily in companies within Europe’s defense, aerospace, and security sectors24.

These defense ETF usually track indexes composed of firms involved in military equipment manufacturing, cybersecurity, aerospace technology, and homeland security.

Investors use these ETFs to gain diversified exposure to the defense industry, which has become more relevant because of rising geopolitical tensions and government spending.

Why Are European Defense ETFs Gaining Attention?

1. Rising Defense Budgets

European countries have significantly increased their defense budgets in response to ongoing conflicts and security threats, most notably the Russia-Ukraine war. Germany, Poland, and Nordic countries have all pledged to raise military spending, fueling demand for defense-related stocks and ETFs.

2. Geopolitical Uncertainty

Tensions in Eastern Europe and broader concerns about NATO’s future have prompted governments to prioritize national security, leading to a surge in defense contracts and investments.

3. Strong ETF Performance

Several European defense ETFs have delivered impressive returns in 2025, outpacing broader market indexes and attracting billions in new inflows. This performance has drawn both institutional and retail investors seeking growth and diversification.

Top Performing European Defense ETFs in 2025

Below is a list of the top-performing European defense ETFs, based on year-to-date returns, assets under management (AUM), and investor inflows as of June 2025.

ETF Comparison Table

| ETF Name & Ticker | 2025 YTD Return | AUM (EUR/USD) | TER | Focus/Region | Key Holdings |

|---|---|---|---|---|---|

| Select STOXX Europe Aerospace & Defense ETF (EUAD) | 59% | $59M | ~0.35% | Europe | Airbus, Safran, BAE Systems |

| Global X Defense Tech ETF (SHLD) | 52.5% | $2B | ~0.50% | Europe/Global Tech | Palantir, Rheinmetall |

| WisdomTree Europe Defence UCITS ETF (WDEF) | N/A (launched 2025) | €2.6B | 0.40% | Europe | European defense companies |

| VanEck Defense UCITS ETF (DFEN) | 36.3% | €5B | 0.55% | Europe/Global | Defense manufacturers |

| HANetf Future of Defence UCITS ETF | 32.1% | €2.2B | 0.49% | Europe/Global | Aerospace & defense |

| iShares Global Aerospace & Defence UCITS ETF | 21.9% | €502M | 0.35% | Global | Aerospace & defense |

*YTD = Year-to-date; TER = Total Expense Ratio; AUM = Assets Under Management.

How Do European Defense ETF Work?

European defense ETFs track indexes that include companies generating revenue from defense, aerospace, or security activities within Europe.

Most use a market-cap-weighted or “pure play” approach, which ensures that only companies with substantial defense exposure are included.

Investors buy shares of these ETFs on stock exchanges, gaining instant diversification across many defense firms.

2025 European Defense ETF Performance Overview

| ETF Name & Ticker | 2025 YTD Return | 1-Year Return | Notable Highlights |

|---|---|---|---|

| Select STOXX Europe Aerospace & Defense ETF (EUAD) | +59% to +62% | N/A | Best-performing non-leveraged ETF in 2025, strong European focus12 |

| Global X Defense Tech ETF (SHLD) | +47% to +52.5% | +68.2% | Tech-driven defense, strong inflows, outperformed broad market142 |

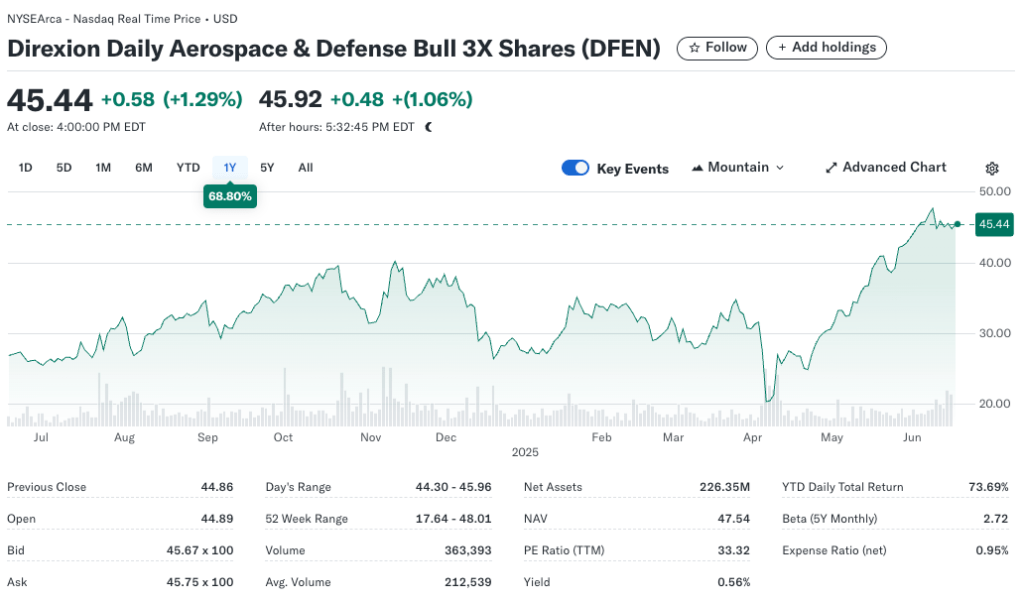

| VanEck Defense UCITS ETF (DFEN) | +36.3% to +58.5% | +73.1% | Leveraged ETF, high volatility, strong 1-year return53 |

Top European Defense ETF

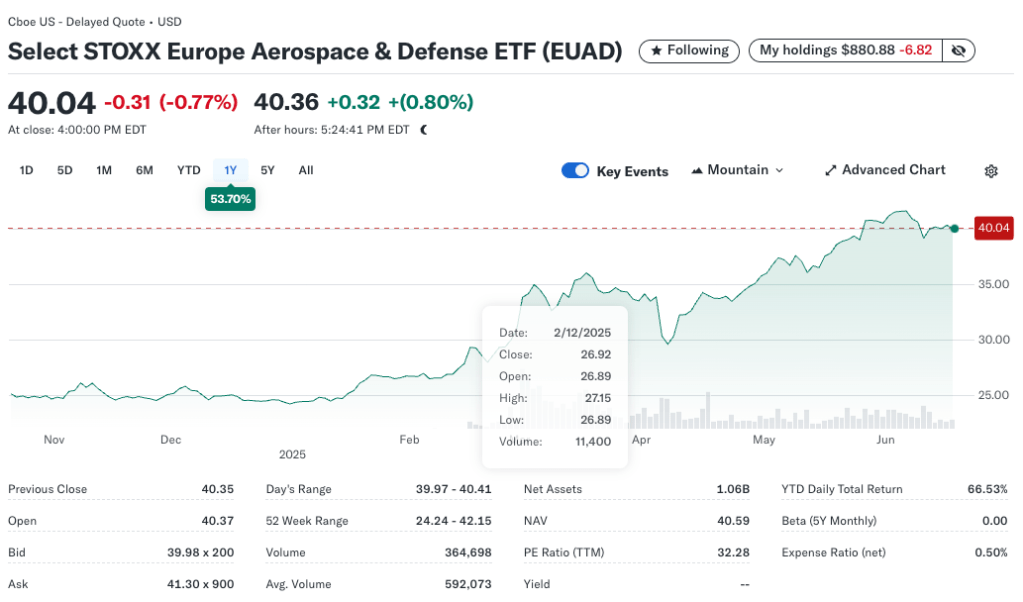

Select STOXX Europe Aerospace & Defense ETF (EUAD)

- 2025 Year-to-Date Return: EUAD is up between 59% and 62% in 2025, making it the best-performing non-leveraged U.S.-listed ETF of the year

- Top Holdings: Airbus, Safran, Rolls-Royce, Rheinmetall, BAE Systems.

- Strategy: Pure European exposure, market-cap weighted, excludes U.S. firms.

- Regional Exposure: UK (26%), France (23%), Germany (22%), Netherlands (18%), Italy (4%), Sweden (3%).

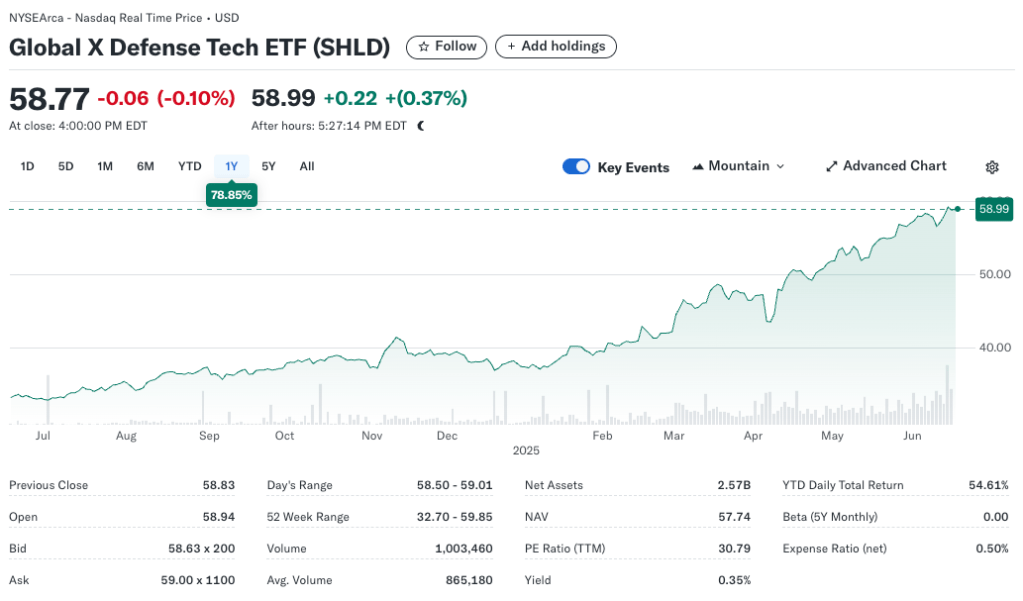

Global X Defense Tech ETF (SHLD)

- 2025 Year-to-Date Return: SHLD is up YTD between 47% to 52.5%.

- Top Holdings: Palantir Technologies, Rheinmetall, other tech-driven defense firms

- Strategy: Focuses on defense technology, cybersecurity, AI, and advanced military hardware

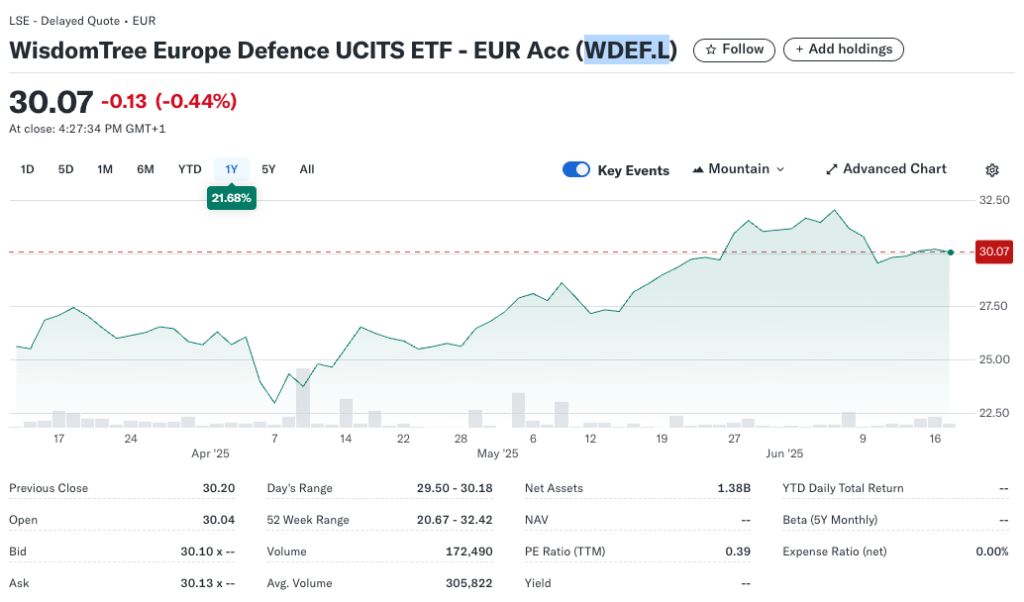

WisdomTree Europe Defence UCITS ETF (WDEF.L)

- Top Holdings: Rheinmetall AG (13.86%), BAE Systems plc (12.81%), Leonardo S.p.a. (12.39%), Thales S.A. (12.32%), and Saab AB (8.27%), among others.

- Strategy: Tracks the WisdomTree Europe Defence UCITS Index, launched March 2025

VanEck Defense UCITS ETF (DFEN)

- 2025 Year-to-Date Return: DFEN had a 36.3% YTD return in 2025.

- Top Holdings: GE Aerospace (14.08%), RTX Corporation (9.65%), The Boeing Company (6.71%), The Boeing Company (6.71%), and Howmet Aerospace Inc. (3.39%), among others.

Performance Drivers: Geopolitics and Policy

1. Geopolitical Tensions

The Russia-Ukraine conflict has been the single biggest catalyst for the surge in European defense stocks and ETFs. As the war drags on, European nations have accelerated military procurement and investment, directly benefiting ETF constituents.

2. NATO and Policy Shifts

Uncertainty about NATO’s future, especially following U.S. political developments, has caused European governments to take more responsibility for their own defense. This policy shift has translated into real increases in defense contracts and stock prices for European defense firms.

3. Investor Inflows

Defense ETFs have seen record inflows in 2025, reflecting both performance-chasing and a strategic shift by investors seeking exposure to sectors less correlated with the broader market. Funds like EUAD and SHLD have attracted hundreds of millions in new assets.

Risks and Considerations

1. Political and Regulatory Risk

Defense spending is highly dependent on government budgets and political priorities. Changes in policy, peace agreements, or shifts in public opinion could quickly reverse the sector’s fortunes.

2. Ethical and ESG Concerns

Some investors avoid defense stocks due to ethical or ESG (Environmental, Social, Governance) concerns. Many European defense ETFs do not qualify as sustainable investments, so investors should consider their values before investing.

3. Volatility

Defense stocks can be volatile, especially during periods of geopolitical uncertainty or market corrections. While recent performance has been strong, past results do not guarantee future returns.

Frequently Asked Questions (PAA)

What is the best European defense ETF in 2025?

The Select STOXX Europe Aerospace & Defense ETF (EUAD) has been the top performer in 2025, with a 59% year-to-date return. It offers pure European exposure and includes leading firms like Airbus and BAE Systems.

Are European defense ETFs risky?

Yes, they carry risks related to geopolitics, government budgets, and market volatility. Investors should also consider ethical implications before investing.

How do I buy a European defense ETF?

You can purchase these ETFs through most online brokers, just like any other stock or ETF. Popular tickers include EUAD, SHLD, WDEF, and DFEN.

What are the main holdings in these ETFs?

Typical holdings include large European defense contractors such as Airbus, Safran, Rheinmetall, Rolls-Royce, and BAE Systems.

Why are defense ETFs outperforming the market?

Surging defense budgets, geopolitical tensions, and investor demand for “safe haven” sectors have driven up both the share prices of defense companies and the value of defense ETFs.

Conclusion: Should You Invest in European Defense ETFs?

European defense ETFs have delivered exceptional returns in 2025, fueled by rising military spending and global uncertainty.

The sector’s outlook remains strong as governments prioritize security and rearmament. However, investors must weigh the risks of political change, ethical considerations, and sector volatility.

For those seeking targeted exposure to a sector benefiting from long-term policy shifts and current events, European defense ETFs offer a compelling, though sometimes controversial, opportunity.

As always, diversification and a clear understanding of your investment goals are key.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

Note: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making investment decisions.

- https://www.spglobal.com/marketintelligence/en/mi/research-analysis/defending-opportunities-the-rise-of-european-defense-etfs-.html

- https://www.justetf.com/en/how-to/invest-in-defense.html

- https://www.etf.com/sections/news/nato-european-defense-etfs-2025-market-leaders

- https://www.vaneck.com/ch/en/defense-etf/

- https://www.etf.com/sections/data-dive/euad-europe-best-stock-etf-defense

- https://www.etf.com/sections/features/defense-etfs-are-soaring-and-shld-leading-charge

- https://fintel.io/i/spinnaker-etf-series-select-stoxx-europe-aerospace-defense-etf-2364

- https://www.schwab.wallst.com/Prospect/Research/etfs/performance.asp?symbol=shld

- https://www.tradingview.com/symbols/MIL-WDEF/

- https://www.justetf.com/en/etf-profile.html?isin=IE0002Y8CX98

- https://www.schwab.wallst.com/Prospect/Research/etfs/portfolio.asp?symbol=euad

- https://www.trackinsight.com/fr/etf-news/etfs-profit-europes-defense-spending-surge

- https://etfdb.com/etfs/industry/aerospace–defense/

- https://etfdb.com/etf/EUAD/

- https://www.etf.com/EUAD

- https://weaponfreefunds.org/fund/select-stoxx-europe-aerospace–defense-etf/EUAD/weapon-investments/FS0000IXPK/F00001LY3E

- https://etftrends.com/2025-puts-european-global-defense-etfs-map/

- https://www.morningstar.co.uk/uk/news/265856/whats-next-in-the-european-defense-stock-rally.aspx

- https://finance.yahoo.com/quote/EUAD/holdings/

- https://finance.yahoo.com/quote/EUAD/