Cocoa ETFs have become a focal point for investors in 2025, following wild price swings and historic supply shortages. This article breaks down how cocoa ETFs work, lists the top-performing funds, and provides their 2025 year-to-date (YTD) returns.

What Is a Cocoa ETF?

A cocoa ETF is an exchange-traded fund or exchange-traded commodity (ETC) designed to track the price of cocoa, usually through futures contracts.

These funds let investors gain exposure to the cocoa market—used for chocolate and food additives—without needing to physically buy or store cocoa beans.

Most cocoa ETFs are structured as ETCs in Europe and as ETNs (exchange-traded notes) in the US, tracking indices like the Bloomberg Cocoa Subindex.

Why Are Cocoa ETFs Popular in 2025?

1. Historic Cocoa Price Surge

In 2025, cocoa prices soared to record highs, at times exceeding $6,000 per tonne, driven by severe supply shortages in West Africa (the world’s main cocoa-producing region) and rising global demand.

2. Volatility and Trading Opportunities

Cocoa’s price swings have attracted both long-term investors and short-term traders, making cocoa ETFs a popular vehicle for speculation and portfolio diversification.

3. Inflation Hedge

As a soft commodity, cocoa can act as a hedge against inflation and currency devaluation, especially during periods of market uncertainty.

Key Takeaways

- 2024 was a record year for cocoa ETFs, with returns as high as +338.89% for WisdomTree Cocoa (COCO).

- 2025 has seen a sharp reversal, with COCO down -21.52% YTD and the leveraged COCO2 down -44.90% YTD.

- US investors have limited options after the delisting of NIB; European ETCs dominate the market.

- Cocoa ETFs remain highly volatile and are best suited for investors with a high risk tolerance.

Top Performing Cocoa ETFs in 2025

Below is a list of the most notable cocoa ETFs and ETCs, including their 2025 YTD performance:

ETF Comparison Table

| ETF Name & Ticker | 2025 YTD Return | 2024 Return | Expense Ratio | Structure | Exchange/ ISIN |

|---|---|---|---|---|---|

| WisdomTree Cocoa | -21.52% | +338.89% | 0.49% | ETC | LSE/JE00B2QXZK10 |

| WisdomTree Cocoa 2x Daily Leveraged | -44.90% | +1,062.92% | 0.99% | ETC | LSE/JE00B2NFV803 |

How Do Cocoa ETFs Work?

Cocoa ETFs and ETCs typically track the performance of cocoa futures contracts.

Here’s how they operate:

- Futures-Based Exposure: Most cocoa ETFs gain exposure by rolling front-month cocoa futures contracts, meaning they buy the nearest contract and roll it forward as expiration approaches.

- Synthetic Replication: Some funds, like WisdomTree Cocoa, use swaps to synthetically replicate cocoa price movements.

- Leverage: Leveraged cocoa ETFs, such as WisdomTree Cocoa 2x Daily Leveraged, aim to deliver twice the daily return of the cocoa futures index.

- No Physical Delivery: Investors do not receive physical cocoa. Returns are based solely on price changes in the underlying futures contracts.

Quick Reference: Top Cocoa ETFs 2025

Performance Drivers: Cocoa Prices and Supply Shocks

1. Weather and Crop Disease

Cocoa production is highly sensitive to weather conditions and crop diseases, especially in Ivory Coast and Ghana. In 2025, El Niño events and fungal outbreaks led to the worst harvests in decades, slashing global supply and sending prices sky-high.

2. Geopolitical and Economic Factors

Political instability in producing countries, trade restrictions, and currency fluctuations have all contributed to cocoa price volatility.

3. Demand Trends

Global demand for chocolate and cocoa-based products has remained robust, even as prices soared. This demand, combined with supply disruptions, created a perfect storm for price spikes.

Detailed Performance Review: Top Cocoa ETFs 2025

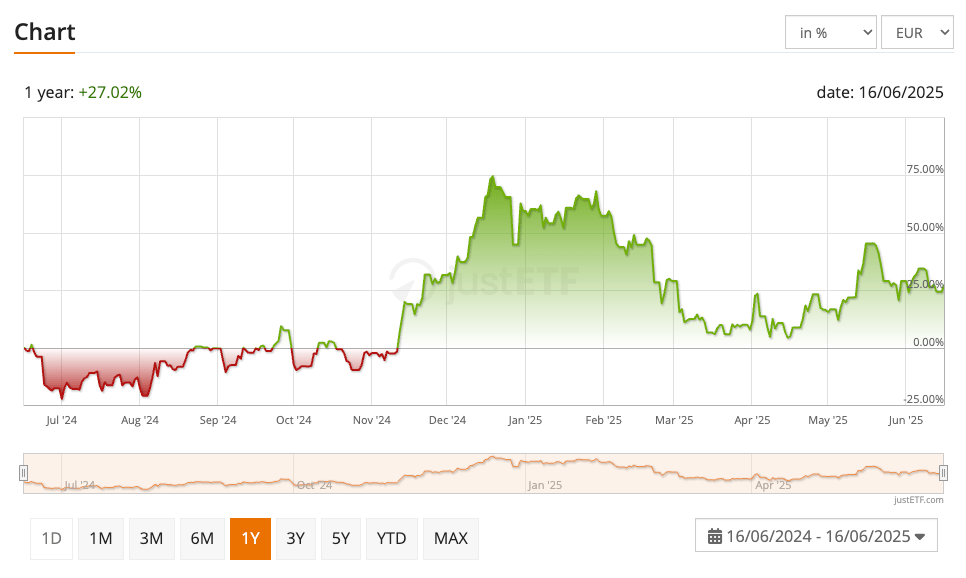

WisdomTree Cocoa

- 2025 YTD Return: -21.52%

- 2024 Return: +338.89%

- 1-Year Return: +26.90%

- Expense Ratio: 0.49%

- Assets Under Management: €24 million

- Strategy: Tracks the Bloomberg Cocoa Index via synthetic replication (swaps)

- Exchange: London Stock Exchange, Borsa Italiana, Stuttgart

- Key Features:

- High volatility (58.28% 1-year)

- Accumulating structure (no distributions)

- Currency unhedged; subject to USD/EUR moves

- Performance Summary:

After a historic rally in 2024, the ETF saw a sharp correction in 2025 as cocoa prices pulled back from record highs.

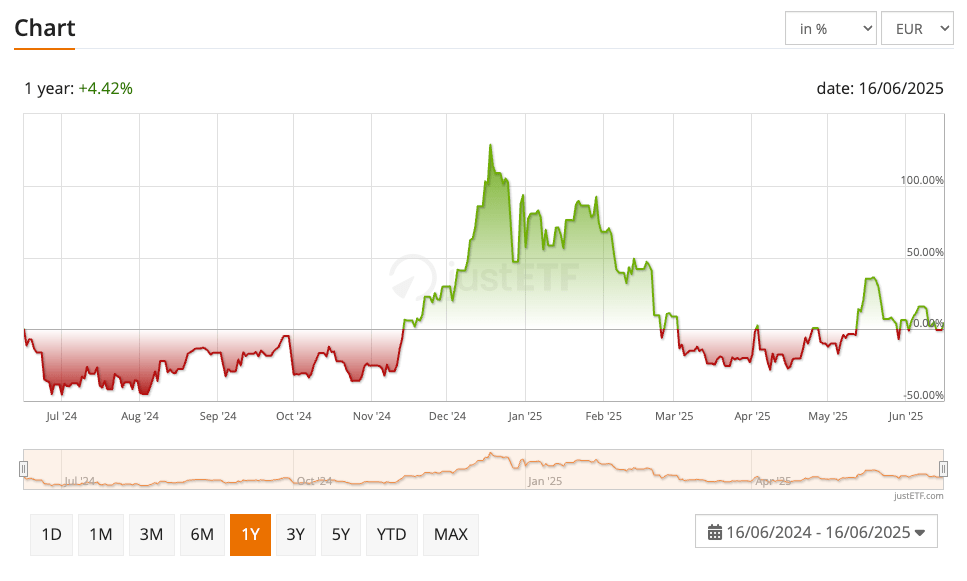

WisdomTree Cocoa 2x Daily Leveraged

- 2025 YTD Return: -44.90%

- 2024 Return: +1,062.92%

- 1-Year Return: +28.19%

- Expense Ratio: 0.99%

- Strategy: Seeks to deliver twice the daily return of the Bloomberg Cocoa Index

- Key Features:

- Extremely high volatility and risk

- Suitable for experienced traders only

- Performance Summary:

The 2x leveraged product saw spectacular gains during the 2024 cocoa price surge but suffered outsized losses in 2025’s correction.

Risks and Considerations

1. Volatility and Drawdowns

Cocoa ETFs can experience wild swings. For example, COCO’s 1-year volatility is over 58%, and its maximum drawdown since inception is over 53%.

2. Contango and Roll Costs

Because cocoa ETFs roll futures contracts, they can suffer from “contango”—when longer-dated futures are more expensive than spot prices—leading to performance drag over time.

3. Leverage Risks

Leveraged ETFs like COCO2 amplify both gains and losses, making them unsuitable for most investors.

4. Liquidity and Spreads

Some cocoa ETFs have limited trading volume, which can lead to wider bid-ask spreads and higher trading costs.

Frequently Asked Questions

What is the best cocoa ETF in 2025?

WisdomTree Cocoa is the most prominent and liquid cocoa ETF in 2025, though its performance has been negative YTD after a historic rally in 2024.

Why did cocoa ETFs perform so well in 2024 and poorly in 2025?

A supply shock in West Africa sent cocoa prices soaring in 2024, but prices corrected in 2025 as supply concerns eased and speculative excesses unwound.

Are there leveraged cocoa ETFs?

Yes, WisdomTree Cocoa 2x Daily Leveraged offers double the daily return of the cocoa futures index, but with much higher risk and volatility.

Can US investors buy cocoa ETFs?

After the delisting of NIB, US investors have limited direct options and may need to access European-listed ETCs via international brokerage accounts.

What are the main risks of cocoa ETFs?

Key risks include price volatility, contango, roll costs, leverage, and liquidity issues.

Conclusion: Should You Invest in Cocoa ETFs?

Cocoa ETFs offer a unique way to gain exposure to one of the world’s most volatile and dynamic commodities.

While 2024 saw record-breaking returns, 2025 has been marked by sharp corrections and heightened risk.

Investors should approach cocoa ETFs with caution, understanding the drivers of cocoa prices, the mechanics of futures-based products, and the potential for both outsized gains and losses.

Diversification, risk management, and a long-term perspective are essential for anyone considering this sector.

Performance data as of June 2025. Always verify the latest figures before investing.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

Note: This article is for informational purposes only and does not constitute financial advice. Always consult a qualified financial advisor before making investment decisions.

- https://www.ebc.com/forex/top-cocoa-etfs-for-commodity-investors-in

- https://www.justetf.com/en/etf-profile.html?isin=JE00B2QXZK10

- https://www.justetf.com/en/market-overview/

- https://etfdb.com/etfs/commodity/cocoa/

- https://www.justetf.com/en/etf-profile.html?isin=JE00B2NFV803

- https://www.dividend.com/etfs/nib-ipath-bloomberg-cocoa-subtr-etn/

- https://www.investing.com/etfs/ipath-dj-ubs-cocoa-subindex-tr

- https://www.trackinsight.com/fr/etf-news/cocoa-etfs-to-play-the-chocolate-crisis

- https://www.mutualfunds.com/alternatives-categories/cocoa-commodity-funds-and-etfs/

- https://www.morningstar.com/etfs/xlon/coco/quote

- https://www.investing.com/etfs/etfs-cocoa-it

- https://finance.yahoo.com/quote/NIB/

- https://www.bloomberg.com/quote/NIB:US

- https://finance.yahoo.com/quote/NIB/performance/

- https://www.forbes.com/sites/investor-hub/article/best-commodity-etfs-2025/

- https://www.marketwatch.com/investing/future/ccn25

- https://www.perplexity.ai/app/finance/NIB

- https://www.trackinsight.com/es/etf-news/cocoa-etfs-to-play-the-chocolate-crisis