High-yield exchange-traded funds (ETFs) are investment products that let people buy a collection of stocks, similar to mutual funds, but they are traded on stock exchanges like individual stocks.

These ETFs usually focus on generating high income from dividends, which are payments made by companies to their shareholders.

One particular ETF that has gained attention is the Defiance Nasdaq 100 Enhanced Options & 0DTE Income ETF, abbreviated as QQQY. This fund has an historical dividend yield of 73%, which is the percent of money it pays out relative to its price.1

This guide will help you understand how QQQY pays dividends, its overall performance, and how it fits into the larger world of ETFs.

What is QQQY and How Does It Work?

QQQY is the first ETF to use zero days to expiration (0DTE) options for income generation2.

Launched on September 14, 2023, by Defiance ETFs, the QQQY has established itself as a unique player in the options income space3.

The ETF combines treasury securities with daily options trading on the Nasdaq 100 Index4.

Rather than following traditional covered call strategies, QQQY sells in-the-money put options that expire on the same day they are written, capitalizing on rapid time decay to generate income5.

QQQY Investment Objective and Exposure

Primary Investment Goals

QQQY invests in a diversified portfolio of securities, in addition to technology and growth companies listed on the Nasdaq 100 Index.

This two-part strategy aims to offer investors regular monthly payments while still being somewhat connected to how the overall stock market is doing.6

Asset Holdings and Structure

The fund’s holdings reveal its unique approach to income generation. As of recent 2025 data, QQQY holds approximately:

- Treasury Securities (80-90%): Short-term U.S. Treasury notes and bills ranging from 6 months to 2 years

- Cash and Equivalents (10-20%): Maintained as collateral for options positions

- Options Positions: Daily put options on the Nasdaq 100 Index

The fund’s top holdings include United States Treasury Note/Bond 3.875% (24.82%), United States Treasury Note/Bond 3% (20.86%), and various Treasury bills with different maturity dates4.

Benchmark and Strategy

Unlike traditional ETFs that track specific indices, QQQY employs an active strategy centered on the Nasdaq 100 Index5.

The fund doesn’t aim to replicate index performance but rather seeks to generate a minimum daily income of 0.25% through options premiums7.

This approach fundamentally differs from passive index tracking, making QQQY more of an income-focused tactical investment than a broad market exposure tool.

Performance Analysis

Historical Returns and Distribution Patterns

QQQY’s performance story is complicated and shows the trade-offs that come with high-yield investment strategies.8

In the past 12 months, the fund has been able to provide investors with significant payouts, offering $18.70 per share and currently delivering a dividend yield of 73.04%.1

However, it’s important to note that this high income comes with drawbacks.

So far in YTD 2025, the fund’s performance has dropped by about 1.8%, which is in sharp contrast to the overall market, which has been performing better.9

This recent decline highlights the limits of a specific investment strategy called put-writing, which can restrict potential gains while still leaving investors vulnerable to losses.6

Weekly Distribution Schedule

QQQY has a unique schedule for paying out its dividends, and are given to shareholders every Thursday.

Recently, the amount paid out in dividends has varied, ranging from $0.0757 to $0.3397 for each share.

This weekly payment schedule is appealing to investors who want to receive regular cash payments.

Tracking Error Considerations

Traditional tracking error metrics don’t apply to QQQY since it doesn’t track a specific benchmark10.

Instead, the fund’s “tracking” relates to its ability to generate the targeted 0.25% daily income through options premiums7.

The success of this strategy depends more on options market conditions and volatility levels than on index performance matching.

Costs and Fees Structure

Expense Ratio

QQQY carries a 1.00% annual expense ratio, which is relatively high compared to traditional passive ETFs, but reasonable for actively managed options strategies3.

This fee covers the intensive daily management required for the 0DTE options strategy and the fund’s active approach to Treasury security selection.

Trading Costs and Liquidity Considerations

The fund’s trading costs extend beyond the expense ratio11. Investors should consider:

- Bid-ask spreads: Can vary based on market conditions and trading volume

- Options trading costs: Built into the fund’s operations but affect overall returns

- Intraday volatility: May create premium/discount situations relative to net asset value

Liquidity Profile

Trading Volume and Market Presence

QQQY maintains reasonable liquidity with daily trading volumes typically ranging from 50,000 to 75,000 shares9.

While not as liquid as major broad-market ETFs, this volume generally supports efficient trading for most retail and institutional investors.

Assets Under Management

With approximately $161.27 million in assets under management, QQQY represents a mid-sized specialty ETF3.

While smaller than broad-market funds, this AUM level suggests sufficient investor interest and operational viability, though closure risk remains a consideration for smaller specialized funds.

Structure and Tax Considerations

ETF Structure

QQQY operates as a traditional ETF structure rather than an exchange-traded note (ETN) or commodity fund4.

This structure provides certain investor protections and regulatory oversight while maintaining the tax efficiency generally associated with ETFs.

Tax Implications

The tax treatment of QQQY distributions can be complex12. Distributions may include:

- Ordinary dividends: Taxed at regular income rates

- Return of capital: Not immediately taxable but reduces cost basis

- Short-term capital gains: Taxed at ordinary income rates

Approximately 30-50% of QQQY’s distributions have historically been classified as return of capital, which affects the tax efficiency of the investment6.

Risk Analysis

Market Risk Exposure

QQQY faces significant market risk, particularly during sharp market declines6.

The fund’s put-writing strategy means it participates fully in market downturns while having limited upside capture during rallies.

This asymmetric risk profile makes the fund particularly vulnerable to bear markets or sudden market corrections.

Strategy-Specific Risks

The 0DTE options strategy introduces unique risks6:

- Rapid decay risk: While time decay benefits the fund, sudden market moves can overwhelm premium collection

- Liquidity risk: During market stress, options markets may become illiquid

- Model risk: The daily targeting of 0.25% income may not always be achievable

Closure Risk

As a specialized fund with limited AUM, QQQY faces potential closure risk if investor interest wanes or performance disappoints.

Fund closures can force investors to realize losses and disrupt investment strategies.

Transparency and Holdings

Daily Disclosure

QQQY provides daily disclosure of its holdings, allowing investors to monitor the fund’s Treasury positions and cash levels.

However, the options positions may not be as transparently reported due to their short-term nature and daily turnover.

Rebalancing Approach

The fund rebalances daily through its options strategy, selling new put positions each trading day5.

This constant rebalancing ensures consistent exposure to the income-generation strategy but also creates ongoing transaction costs and complexity.

Trading Characteristics

Intraday Trading

Like all ETFs, QQQY can be traded throughout market hours, providing liquidity advantages over mutual funds11.

However, investors should be aware that the fund’s net asset value (NAV) can fluctuate significantly during volatile market periods.

Premium/Discount Dynamics

QQQY occasionally trades at small premiums or discounts to its NAV, particularly during periods of high market volatility.

The current NAV stands at approximately $25.68, with the market price typically trading within a narrow range of this value13.

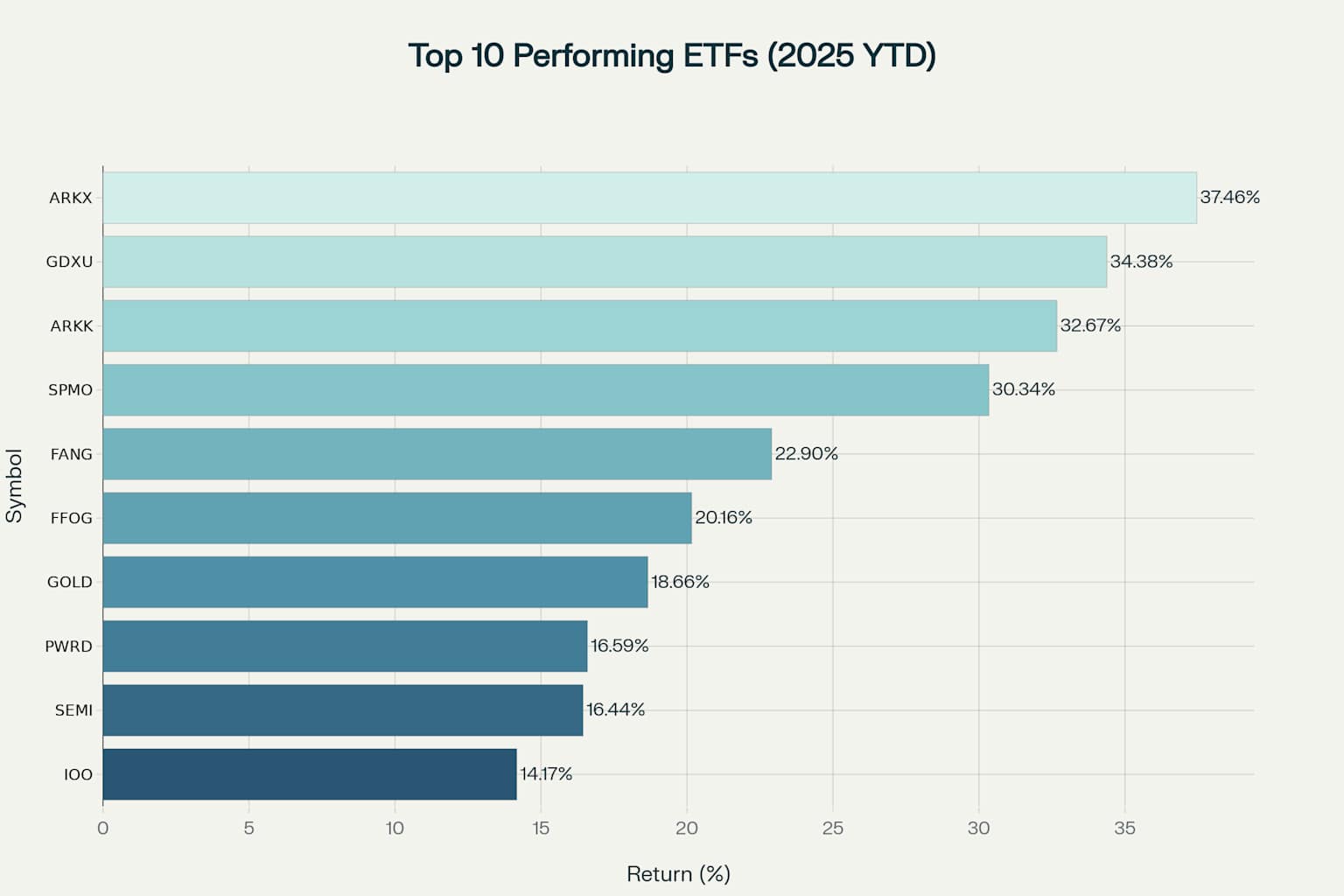

Top Performing ETFs of 2025

To provide context for QQQY’s performance, here are the top-performing ETFs for 2025 year-to-date returns:

Top 10 Performing ETFs by 2025 YTD Return

Leading ETFs by 2025 YTD Performance:

- ARKX – ARK Space Exploration & Innovation ETF: 37.46% YTD return14

- GDXU – MicroSectors Gold Miners 3X Leveraged ETN: 34.38% YTD return15

- ARKK – ARK Innovation ETF: 32.67% YTD return14

- SPMO – Invesco S&P 500 Momentum ETF: 30.34% YTD return14

- FANG – Global X Fang+ ETF: 22.90% YTD return16

- FFOG – Franklin Focused Growth ETF: 20.16% YTD return14

- GOLD – Global X Metal Securities Australia Ltd: 18.66% YTD return16

- PWRD – TCW Transform Systems ETF: 16.59% YTD return14

- SEMI – Global X Semiconductor ETF: 16.44% YTD return16

- IOO – iShares Global 100 ETF: 14.17% YTD return16

Comparison with Traditional Options Income ETFs:

For context, here’s how QQQY compares to other income-focused ETFs in 2025:

- JEPI (JPMorgan Equity Premium Income ETF): 0.51% YTD return17

- QQQY (Defiance Nasdaq 100 Enhanced Options Income ETF): -1.80% YTD return9

- QYLD (Global X NASDAQ 100 Covered Call ETF): -4.04% YTD return18

Broad Market Benchmarks:

- VTI (Vanguard Total Stock Market ETF): 1.80% YTD return19

- SCHG (Schwab U.S. Large-Cap Growth ETF): 0.57% YTD return20

- SPY (SPDR S&P 500 ETF Trust): 13.21% YTD return16

Portfolio Fit and Diversification

Role in Portfolio Construction

QQQY is like a savings account that earns you money regularly, but it also comes with some risks. It should not be the main part of your investment strategy, but instead a way to make some extra cash, in addition to your main investment portfolio.

Here’s a simple breakdown:

- Income-Generating Satellite Holding: Think of it as a side job. It helps you earn more money, but it’s not your main source of income.

- High Dividend Yield: This means it pays out money regularly, like getting a paycheck. If you like having consistent cash flow, this is appealing.

- Limited Upside Participation: This is a fancy way of saying that while it might pay you regularly, it doesn’t have a lot of potential for growth. Imagine it’s like a car that drives well but doesn’t go very fast.

- High Volatility: This means the value of your investment can go up and down a lot, like a rollercoaster ride. This can be risky if you’re counting on it to stay stable.

In summary, QQQY can give you regular earnings but isn’t the best choice if you want growth and stability in your investments.

Diversification Considerations

While QQQY provides exposure to the Nasdaq 100 through its options strategy, it doesn’t offer true diversification.

The fund’s performance correlation with the underlying index means it doesn’t provide hedge-like characteristics during market stress. Instead, it amplifies certain risks while capping upside potential.

Strategic Applications

QQQY may fit into portfolios as:

- Income supplement: For investors seeking enhanced current income

- Tactical allocation: Short-term plays during periods of high volatility

- Yield enhancement: Alternative to traditional dividend stocks or bonds

However, the fund is generally unsuitable as a buy-and-hold core position due to its capital erosion characteristics6.

Future Outlook and Strategic Changes

Upcoming Strategy Modification

QQQY will shift its strategy on May 27, 2025, moving from put-writing to call spreads on the Nasdaq 100. It will aim for a 30% distribution yield rather than the current yield levels22.

This change aims to provide better balance between income generation and capital preservation.

Name Change

QQQY will be renamed the “Defiance Nasdaq 100 Target 30 Income ETF” to emphasize its new 30% yield goal.

Conclusion

QQQY dividend offers a unique income generation method within the ETF space, utilizing innovative 0DTE options strategies to achieve high yield levels.

However, this comes with trade-offs, including limited upside, significant volatility, and possible capital erosion over time.

While QQQY is an intriguing option for income-focused investors comfortable with these risks, it should be viewed as a tactical allocation rather than a core equity holding.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

Citations:

- https://stockanalysis.com/etf/qqqy/dividend/

- https://www.tipranks.com/etf/qqqy/dividends

- https://seekingalpha.com/symbol/QQQY/momentum/performance

- https://www.youtube.com/watch?v=8jCD5nKQQyQ

- https://seekingalpha.com/symbol/QQQY/dividends/history

- https://stockanalysis.com/etf/qqqy/

- https://seekingalpha.com/article/4720426-qqqy-surprisingly-solid-strategy-but-overambitious-distributions

- https://seekingalpha.com/article/4782766-qqqy-strategic-shift-analyzing-the-potential-of-the-new-income-approach

- https://www.investopedia.com/the-world-s-first-0dte-options-based-etf-is-here-7969649

- https://www.tradingview.com/symbols/NASDAQ-QQQY/

- https://www.mutualfunds.com/etfs/qqq-invesco-qqq-trust/

- https://www.businesswire.com/news/home/20230913165646/en/Defiance-Launches-QQQY-the-First-ETF-to-Utilize-Daily-Options-0DTE-for-Enhanced-Income

- https://www.tradingview.com/symbols/LSE-QQQY/

- https://money.usnews.com/investing/articles/qqq-vs-qqqm-whats-the-difference

- https://www.justetf.com/en/market-overview/the-best-etfs.html

- https://www.morningstar.com/funds/top-performing-stock-etfs

- https://www.morningstar.com/funds/3-top-us-etfs-2025-beyond-2

- https://www.marketwatch.com/picks/this-etf-saw-a-34-return-just-in-the-past-month-and-9-more-funds-with-the-best-returns-of-january-2025-d7f8e980

- https://www.youtube.com/watch?v=dFXPLzjRax0

- https://diversiview.online/blog/top-10-etfs-by-expected-performance-january-2025/

- https://totalrealreturns.com/n/SCHG

- https://www.lazyportfolioetf.com/etf/schwab-u-s-large-cap-growth-etf-schg/

- https://totalrealreturns.com/n/VTI

- https://totalrealreturns.com/n/QYLD

- https://totalrealreturns.com/n/JEPI

- https://totalrealreturns.com/s/SCHG?end=2025-01-17

- http://www.lazyportfolioetf.com/etf/vanguard-total-stock-market-vti/

- https://marketchameleon.com/Overview/QQQY/ETFProfile/

- https://marketchameleon.com/Overview/QQQY/Summary/

- https://www.schwab.com/learn/story/etfs-and-taxes-what-you-need-to-know

- https://seekingalpha.com/article/4682508-qqqy-still-a-mammoth-yield-of-57-percent-but-risks-remain

- https://www.defianceetfs.com/wp-content/uploads/funddocs/qqqy/QQQY-Prospectus.pdf

- https://www.nasdaq.com/market-activity/etf/qqqy

- https://www.youtube.com/watch?v=OshH76pbwAc

- https://www.tastylive.com/news-insights/what-is-zero-day-options-qqqy-etf-how-does-it-work

- https://www.reddit.com/r/YieldMaxETFs/comments/171xylq/yieldmax_or_qqqy/

- https://www.invesco.com/qqq-etf/en/etf-insights/how-does-invesco-qqq-fit-your-portfolio.html

- https://www.reddit.com/r/IndiaInvestments/comments/lwzvto/what_is_tracking_error_how_to_interpret_tracking/

- https://www.youtube.com/watch?v=tqgVV0Xqav0

- https://etfdb.com/compare/dividend-yield/

- https://www.defianceetfs.com/qqqy/

- https://www.nasdaq.com/market-activity/etf/qqqy/dividend-history

- https://www.merrilledge.com/investment-products/options/0dte-options-trading

- https://www.bankrate.com/investing/best-etfs/

- https://finance.yahoo.com/markets/etfs/top-performing/

- https://etfdb.com/compare/highest-ytd-returns/

- https://www.nerdwallet.com/article/investing/vanguard-etfs

- https://www.schwabassetmanagement.com/products/schg

- https://finance.yahoo.com/quote/SCHG/performance/

- https://www.morningstar.com/etfs/arcx/schg/performance

- https://www.cnbc.com/quotes/QQQY

- https://www.schwab.com/research/etfs/quotes/summary/qqqy