The XOVR ETF, officially known as the ERShares Private-Public Crossover ETF, is a unique investment fund that lets people invest in both public and private companies.

This means you can own a piece of big, well-known companies like NVIDIA or Meta, and also get access to private companies like SpaceX, which are not usually available to regular investors123.

The XOVR ETF is traded on the NASDAQ stock exchange, so you can buy and sell it just like a regular stock45.

We’ll cover what the XOVR ETF aims to do, what investments it holds, how it performs, costs, risks, and more.

What Does the XOVR ETF Aim to Do?

The main goal of the XOVR ETF is long-term capital appreciation. In other words, it tries to help your money grow over time by investing in companies that are expected to become more valuable in the future614.

The fund focuses on companies that are considered “entrepreneurial,” meaning they are fast-growing, high-risk, high-reward opportunities.

The XOVR ETF is special because it is a crossover ETF.

This means it invests in both:

- Public companies: These are companies whose shares are traded on stock exchanges, like NVIDIA, Meta (Facebook), and Tesla.

- Private companies: These are companies that are not listed on stock exchanges, like SpaceX, Klarna, and Anduril. Normally, only very wealthy people or big institutions can invest in these, but XOVR makes it possible for regular investors too12.

What Assets Does XOVR Hold?

The XOVR ETF mainly holds stocks (shares of companies). As of July 2025, it has about 34 different holdings. Here are some of the top ones23:

| Rank | Company Name | Type | % of Fund |

|---|---|---|---|

| 1 | SpaceX (private) | Private | 9.23% |

| 2 | NVIDIA | Public | 6.14% |

| 3 | Oracle | Public | 5.50% |

| 4 | Meta Platforms (Facebook) | Public | 5.35% |

| 5 | Robinhood Markets | Public | 4.89% |

| 6 | Alphabet (Google) | Public | 4.72% |

| 7 | Netflix | Public | 4.69% |

| … | … | … | … |

The fund is heavily weighted toward technology companies, but it also includes firms from industries like healthcare, industrials, consumer discretionary, and financials12.

Benchmark: What Does XOVR Try to Match or Beat?

The XOVR ETF uses a special benchmark called the ER30TR Index. This index is made up of 30 large U.S. companies that are considered highly entrepreneurial.

The ETF tries to match or beat the performance of this index by holding most of its assets in the same companies as the index, and the rest in private companies17.

Historical Returns

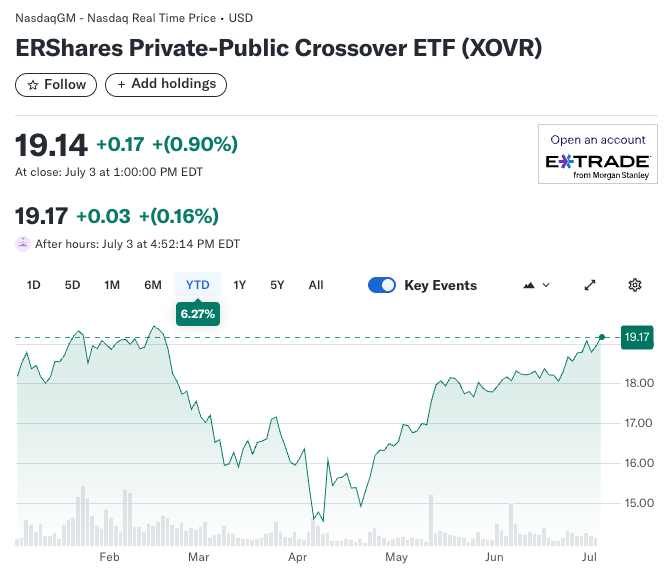

Let’s look at how the XOVR ETF has performed over time. Here are some key numbers as of July 2025158:

| Time Period | NAV Return | Market Price Return |

|---|---|---|

| Year-to-Date (YTD) | 6.06% | 6.00% |

| 1 Year | 22.69% | 22.53% |

| 3 Years (annualized) | 26.32% | 26.50% |

| 5 Years (annualized) | 8.67% | 8.66% |

| Since Inception (2017) | 10.98% | 10.97% |

- NAV Return: This is the return based on the value of the fund’s assets.

- Market Price Return: This is the return based on the price you would get if you bought or sold the ETF on the stock market.

The XOVR ETF has done especially well in the last few years, with over 22% growth in the past year and more than 26% per year over the last three years158.

Tracking Error

Tracking error measures how closely the ETF matches its benchmark’s returns. XOVR invests about 85% of its assets in the ER30TR Index, so its returns are usually very close to the index.

However, because it also invests in private companies, there can be some differences. The tracking error is generally small, but it can be a bit higher than regular index funds because of the private equity part17.

Expense Ratio

The expense ratio is the annual fee the fund charges to manage your money. For XOVR, the expense ratio is 0.75%195. This means if you invest $1,000, you’ll pay $7.50 per year in fees. This is a bit higher than some basic index ETFs, but it’s reasonable for a fund that gives access to private companies.

Trading Costs

When you buy or sell the XOVR ETF, you might pay a brokerage commission (depending on your broker) and a bid-ask spread (the difference between the price you can buy and sell at).

XOVR has a median bid/ask spread of about 0.0551%, which is very tight and means trading costs are low for most investors1.

Other Fees

XOVR does not use leverage (it doesn’t borrow money to try to boost returns), and it doesn’t have special currency hedging fees. There are no extra costs beyond the expense ratio and normal trading costs5.

Trading Volume

Liquidity means how easy it is to buy or sell the ETF. XOVR has a daily trading volume of about 117,000 shares. This is a healthy amount, so you should be able to trade without much trouble195.

Assets Under Management (AUM)

XOVR has about $365 million to $370 million in assets. This is a good size for an ETF and means it’s less likely to be shut down or closed957.

ETF Type

XOVR is a traditional ETF (exchange-traded fund).

It is not an ETN (exchange-traded note) or ETC (exchange-traded commodity). This means you own shares in a fund that holds real stocks, both public and private17.

Tax Efficiency

ETFs are usually tax-efficient because of the way they are structured. XOVR pays out qualified dividends and capital gains, which are taxed at lower rates than regular income for most investors.

However, if the fund sells private company shares at a profit, you might have to pay capital gains taxes7.

Market Risk

Like all investments in stocks, the value of the XOVR ETF can go up or down depending on how the companies it owns perform. If the stock market drops, XOVR’s value will likely drop too15.

Tracking Risk

Because XOVR invests in both public and private companies, its returns might not always match its benchmark exactly. This is called tracking risk.

The private companies might perform differently than the public ones, which can cause the ETF’s returns to be a bit different from the ER30TR Index17.

Closure Risk

If an ETF is very small or unpopular, it might be closed by the company that runs it. XOVR is a medium-sized fund, so this risk is low, but it’s always something to keep in mind95.

7. Transparency and Holdings

Daily Holdings Disclosure

Most ETFs, including XOVR, publish their holdings daily. This means you can always see exactly what companies you own a piece of when you invest in the fund1210.

Rebalancing and Changes

The XOVR ETF rebalances its holdings every quarter (every three months). This means it adjusts the amount it owns in each company to keep the fund in line with its strategy.

The turnover (how much the fund changes its holdings) is about 15-20% each quarter17.

Intra-day Trading

You can buy and sell XOVR ETF shares at any time during the trading day, just like a regular stock. This makes it easy to get in or out whenever you want45.

Premium/Discount to NAV

Sometimes, ETFs trade at a price that is a little higher (premium) or lower (discount) than the value of the assets they hold (NAV).

For XOVR, the premium/discount is usually very small, so you’re paying close to the real value of the fund15.

9. Fit in Your Portfolio

Diversification

The XOVR ETF gives you diversification by investing in a mix of public and private companies across different industries. This can help reduce risk compared to owning just a few stocks12.

Role in a Portfolio

- Core Holding: XOVR could be a core part of your portfolio if you want exposure to innovative, fast-growing companies.

- Tactical Play: It can also be used as a tactical investment if you want to bet on the success of private companies like SpaceX.

- Hedge: Because it includes private companies, it might behave differently than regular stock funds, which can help balance your portfolio111.

XOVR ETF: Key Facts Table

| Feature | Details |

|---|---|

| Ticker | XOVR |

| Fund Name | ERShares Private-Public Crossover ETF |

| Exchange | NASDAQ |

| Inception Date | November 7, 2017 |

| Assets Under Management | ~$365–$370 million |

| Number of Holdings | 34 |

| Expense Ratio | 0.75% |

| Top Holding | SpaceX (private) |

| Benchmark | ER30TR Index |

| Rebalancing Frequency | Quarterly |

| Median Bid/Ask Spread | 0.0551% |

| Daily Trading Volume | ~117,000 shares |

| Sector Focus | Technology, Industrials, Healthcare, etc. |

| Structure | Traditional ETF |

| Tax Treatment | Qualified dividends, capital gains |

Sector Allocation

The XOVR ETF invests in several sectors. Here’s a breakdown1:

- Information Technology: 32.76%

- Industrials: 16.66%

- Health Care: 13.84%

- Communication Services: 12.55%

- Consumer Discretionary: 11.66%

- Financials: 8.90%

- Energy: 2.56%

Frequently Asked Questions About XOVR ETF

What Makes XOVR ETF Unique?

- Access to Private Companies: Most ETFs only invest in public companies. XOVR lets you invest in private companies like SpaceX, which is rare for regular investors12.

- Entrepreneurial Focus: The fund picks companies that are innovative and led by strong entrepreneurs.

- Blend of Public and Private: This mix can offer different growth opportunities and risks compared to regular ETFs.

How Do I Buy XOVR ETF?

You can buy XOVR ETF through any brokerage account that lets you trade stocks on the NASDAQ. Just search for the ticker “XOVR” and place your order45.

Does XOVR ETF Pay Dividends?

XOVR pays out qualified dividends when the companies it owns pay dividends. The amount can change from year to year7.

Is XOVR ETF Safe?

All investments have risks. XOVR is less risky than owning just one stock, but it can still lose value if the market drops or if its companies do poorly. The private company part adds some extra risk because those companies are harder to value and can be less liquid17.

Pros and Cons of the XOVR ETF

Pros

- Access to Private Companies: Lets regular investors own shares in private firms like SpaceX.

- Strong Recent Performance: Has delivered high returns in recent years.

- Diversification: Invests in many companies across different sectors.

- Daily Liquidity: Can be bought and sold any time the market is open.

- Transparency: Publishes holdings daily.

Cons

- Higher Expense Ratio: Costs more than some basic index funds.

- Private Company Risk: Private companies can be riskier and harder to value.

- Tracking Error: May not always match its benchmark exactly.

- No Guaranteed Dividends: Dividend payments can vary or be skipped.

Conclusion: Is the XOVR ETF Right for You?

The XOVR ETF is a modern, innovative fund that gives investors a chance to own both public and private companies, especially those that are entrepreneurial and fast-growing. It’s a good choice if you want to diversify your investments and get access to companies you can’t buy anywhere else.

However, it’s important to remember that all investments have risks. The XOVR ETF has done well recently, but past performance doesn’t guarantee future results. Make sure to consider your own financial goals, risk tolerance, and investment timeline before buying any ETF.

If you’re interested in technology, innovation, and the future of business, the XOVR ETF could be a smart addition to your portfolio. Just be sure to do your own research and talk to a financial advisor if you have questions.

Disclaimer: This article is for educational purposes only and is not investment advice. Always do your own research before investing in any fund or stock.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

References:

Information in this article is based on data from ERShares, Yahoo Finance, Stock Analysis, TradingView, and other financial sources as of July 2025149257311810.

- https://entrepreneurshares.com/ershares-etfs/entr-etf/

- https://stockanalysis.com/etf/xovr/holdings/

- https://seekingalpha.com/symbol/XOVR/holdings

- https://finance.yahoo.com/quote/XOVR/

- https://www.tradingview.com/symbols/NASDAQ-XOVR/

- https://www.schwab.com/research/etfs/quotes/summary/xovr

- https://www.tradingview.com/symbols/NASDAQ-XOVR/analysis/

- https://www.dividend.com/etfs/xovr-entrepreneurshares-series-trust-ershares-private-public-crossover-etf/

- https://stockanalysis.com/etf/xovr/

- https://www.morningstar.com/etfs/xnas/xovr/portfolio

- https://www.sofi.com/invest/stock/XOVR/

- https://www.marketwatch.com/investing/fund/xovr

- https://www.morningstar.com/etfs/xnas/xovr/performance

- https://www.marketwatch.com/investing/fund/xovr/holdings

- https://etfdb.com/etf/XOVR/

- https://www.etf.com/XOVR

- https://www.schwab.wallst.com/schwab/Prospect/research/etfs/schwabETF/index.asp?type=holdings&symbol=XOVR

- https://www.schwab.wallst.com/Prospect/Research/etfs/summary.asp?symbol=entr

- https://www.zacks.com/funds/etf/XOVR/holding