Unlock growth in digital infrastructure with the best data center ETFs for 2025. Compare top funds, see 1-year performance charts, understand key holdings, and learn how data centers are reshaping global tech.

Investing in data center ETFs means buying into the backbone of today’s digital world. These funds focus on companies that build, own, or support data centers. Over the past year, several ETFs have delivered strong returns as demand for cloud services, AI, and digital storage surges.

What Is a Data Center ETF?

A data center ETF is a type of exchange-traded fund that puts your money into multiple companies linked to the data center industry. That includes:

- Data center REITs (real estate companies owning data centers)

- Digital infrastructure firms (fiber, towers, cabling)

- Hardware providers (servers, networking gear)

- Cloud and connectivity partners

When you buy a share of a data center ETF, you’re investing in a basket of these companies, making it easy to diversify in a fast-growing field.

Why Invest? Top Trends in Data Centers

Why Are Data Centers So Important?

Every time you stream a video, upload a photo, or use AI tools, your data travels through a network of global data centers. These facilities hold the servers and network systems powering:

- Cloud computing (like Google, Amazon, Microsoft Azure)

- Artificial intelligence (AI) training and inference

- Gaming, social media, streaming, and FinTech

Fast Growth Areas in 2025

- Artificial Intelligence: Explosive demand for data and processing power for AI models means mammoth investments in server farms and power upgrades.

- Cloud Expansion: With more companies relying on cloud services, hyperscale data center construction is increasing across the globe.

- Digital Infrastructure: New fiber cables, satellites, cellular towers, and edge computing hubs connect us faster every year.

- Renewable Energy: Future data centers are prioritizing green power sources, improving energy use, and shrinking carbon footprints.

2025’s Best Data Center ETFs

Use the list below as a starting point. Click each ETF’s name for its official fund profile to review holdings, fees, and more.

| ETF Ticker | Name | ETF Profile Link | Launch Year | Expense Ratio | 1-Year Return [%] |

|---|---|---|---|---|---|

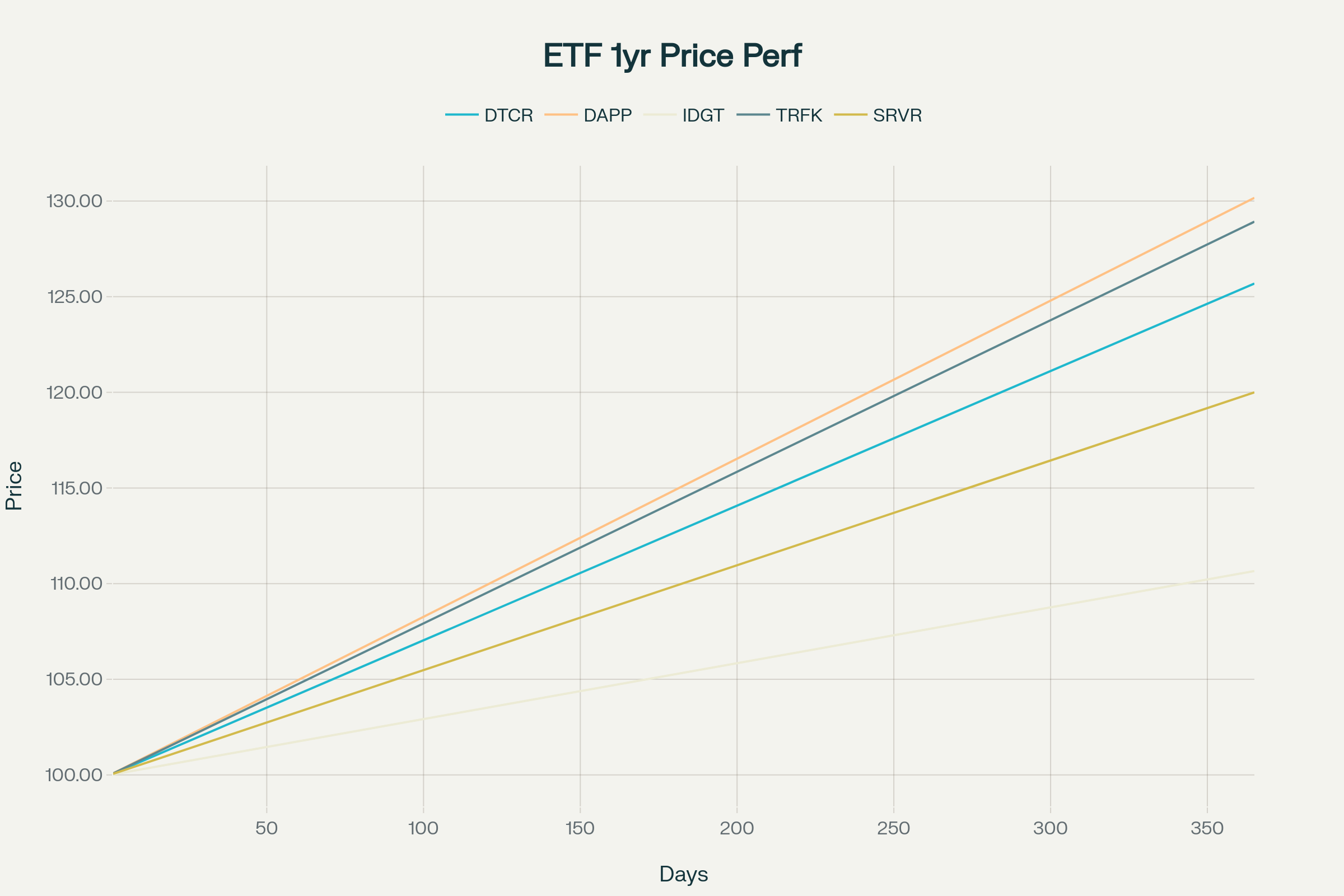

| DTCR | Global X Data Center & Digital Infrastructure ETF | DTCR Profile | 2020 | 0.50% | 25.69 |

| DAPP | VanEck Digital Transformation ETF | DAPP Profile | 2021 | 0.51% | 30.17 |

| IDGT | iShares U.S. Digital Infrastructure & Real Estate ETF | IDGT Profile | 2001 | 0.41% | 10.66 |

| TRFK | Pacer Data and Digital Revolution ETF | TRFK Profile | 2022 | 0.60% | 28.92 |

| SRVR | Pacer Benchmark Data & Infrastructure Real Estate SCTR ETF | SRVR Profile | 2018 | 0.60% | 20.00 |

| CLOU | Global X Cloud Computing ETF | CLOU Profile | 2019 | 0.68% | 13.31 |

| VPN | Global X Data Center & Digital Infrastructure ETF | VPN Profile | 2020 | 0.45% | 17.78 |

| AIQ | Global X Artificial Intelligence & Technology ETF | AIQ Profile | 2018 | 0.68% | 17.01 |

| WTRE | WisdomTree New Economy Real Estate Fund | WTRE Profile | 2020 | 0.34% | 11.21 |

| HECO | SPDR Galaxy Hedged Digital Asset Ecosystem ETF | HECO Profile | 2020 | 0.30% | 16.80 |

Returns as of July 2025. Always verify before you invest.123

1-Year Performance: ETF Comparison Charts

The chart below shows how 5 major data center ETFs have performed over the last 12 months. All lines start at the same point, making it easy to spot leaders and trends.

Past Performance Highlights and Key Stats

Let’s break down the past year and beyond for leading data center ETFs.

1-Year Returns

Multi-year Averages

| ETF | 3-Year Avg % | 5-Year Avg % | Dividend Yield % |

|---|---|---|---|

| DTCR | 9.8 | 6.4 | 1.4 |

| DAPP | 19.0 | N/A | 3.1 |

| IDGT | 11.5 | 11.4 | 1.5 |

| TRFK | 24.7 | N/A | 0.03 |

| SRVR | 10.1 | 8.3 | 2.8 |

Note: Returns are annualized; N/A means new fund with not enough history.

Top Holdings Example (DTCR)

- American Tower Corp (AMT)

- Digital Realty Trust (DLR)

- Crown Castle Inc (CCI)

- Equinix Inc (EQIX)

- GDS Holdings (GDS)

These companies build and lease data centers, cellular towers, and cloud infrastructure—key pieces of digital connectivity worldwide.12

Understanding Fund Holdings and Structure

What’s Inside a Data Center ETF?

Most data center ETFs hold three types of assets:

- REITs: Like Equinix (EQIX) and Digital Realty (DLR) that own/lease data center buildings.

- Infrastructure Firms: Companies building the fiber, cables, power systems, or cooling units for data centers.

- Tech Suppliers: Chipmakers or hardware firms critical to server farms (sometimes weighted more in broader “cloud” ETFs).

Are These Funds Diversified?

Absolutely. Most invest in 20 to over 80 unique companies, spreading risk across regions (US, Europe, Asia) and tech sub-sectors. The top 10 holdings often make up 65–70% of the fund’s total assets, keeping a balance between big leaders and growth newcomers.12

Risks and Factors to Know Before Investing

What Can Affect Data Center ETF Performance?

- Tech Market Volatility: ETFs are sensitive to big swings in technology stocks.

- Interest Rates: Higher rates can hurt REITs by shrinking property values or increasing borrowing costs.

- Disruption Risk: New tech (like edge computing) or demands for greener power could change which companies win or lose.

- Geopolitical Events: Supply chain issues, global politics, or local regulations can impact stock prices and ETF value.

Always read the fund’s prospectus and check its recent performance before investing.

Frequently Asked Questions

What Is the Expense Ratio?

This is the annual fee for managing the ETF, shown as a percent. Most data center ETFs range from 0.30% to 0.68%. Lower is generally better, but also look for good returns and low trading costs.

How Do I Buy a Data Center ETF?

ETFs trade on stock exchanges—just like regular stocks. Search for the ticker symbol in your brokerage account and place an order. No need for special accounts or large minimum investments.

Can I Invest in Data Centers Through Regular Stocks?

Yes! You can buy shares of data center REITs like Equinix (EQIX), Digital Realty (DLR), or infrastructure names like Vertiv Holdings (VRT). ETFs simply make it easier to own a whole group at once.

Are Dividends Paid?

Most data center ETFs pay small dividends quarterly or annually, usually between 0.5% to 2.5%. This income gets deposited into your brokerage account—some funds let you reinvest automatically.

Action Steps: How to Choose and Buy a Data Center ETF

- Define Your Goals:

- Looking for growth? Prioritize funds with strong 1-year and 3-year returns.

- Want income? Look at dividend yields and REIT-heavy ETFs.

- Compare Fees:

- Lower expense ratios mean you keep more profit in the long run.

- Check Holdings:

- Review top holdings and sectors to ensure the fund matches your tech outlook.

- Read the Fund Profile:

- Use official pages (links above) for updated performance, yield, and portfolio data.

- Consider Diversification:

- Mix a data center ETF with broader tech or infrastructure funds for balance.

- Open or Log Into Your Brokerage:

- Search for the ETF ticker, review current price, and place your buy order.

- Monitor Performance Quarterly:

- ETFs track indexes, so check in regularly and adjust if needed.

Table: Key 2025 Data Center ETFs at a Glance

| ETF | Type | 1-Year Return | 3-Year Avg | Expense Ratio | # of Holdings | Dividend Yield |

|---|---|---|---|---|---|---|

| DTCR | Digital Infrastructure | 25.7% | 9.8% | 0.50% | 27 | 1.4% |

| DAPP | Digital Transformation | 30.2% | 19.0% | 0.51% | 22 | 3.1% |

| IDGT | Digital Infra/REIT | 10.7% | 11.5% | 0.41% | 26 | 1.5% |

| TRFK | Digital Revolution | 28.9% | 24.7% | 0.60% | 84 | 0.03% |

| SRVR | Real Estate/Infra REIT | 20.0% | 10.1% | 0.60% | 35 | 2.8% |

Glossary of Key Terms

- ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges, like a stock.

- REIT (Real Estate Investment Trust): A company that owns, operates, or finances income-generating real estate.

- Expense Ratio: The yearly fee charged by the fund, expressed as a percentage.

- Dividend Yield: The annual dividend income divided by the ETF’s price.

- AUM (Assets Under Management): Total market value of assets managed by the fund.

Summary

Data center ETFs offer a way to invest in the future of technology, riding the wave of cloud growth, AI, and digital infrastructure. With solid performance over the past year, these funds are popular choices for investors wanting growth, diversification, and exposure to tech’s backbone. Study fund profiles, compare options, and keep an eye on trends—digital infrastructure is a core piece of the modern economy.

Disclaimer:

Investment involves risk. Past performance does not guarantee future results. Always consult a financial advisor for personalized advice. All performance figures are for illustration and should be confirmed with the latest official sources.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

Citations

- https://www.globalxetfs.com/funds/dtcr/

- https://etfdb.com/etfs/industry/internet-infrastructure/

- https://swingtradebot.com/etfs-by-keyword/4579-data-center

- https://markets.ft.com/data/etfs/tearsheet/performance?s=DTCR%3AMEX%3AMXN

- https://swingtradebot.com/stocks-tagged-as/4579-data-center

- https://money.usnews.com/investing/articles/best-data-center-stocks

- https://markets.ft.com/data/etfs/tearsheet/performance?s=DTCR%3ANMQ%3AUSD

- https://wtop.com/news/2025/05/the-7-best-data-center-stocks-etfs-and-reits-to-buy-right-now/

- https://etfdb.com/compare/highest-ytd-returns/

- https://www.schwab.wallst.com/cgi-bin/upload.dll/file.pdf?z0f8f7d0az436539dbd2d243b5981afa4a0db6b06b

- https://etfdb.com/index/solactive-data-center-reits-and-digital-infrastructure-index/

- https://www.etf.com/sections/etf-basics/10-best-performing-etfs-last-10-years

- https://www.schwab.wallst.com/schwab/Prospect/research/etfs/reports/reportRetrieve.asp?reportType=etfrc&symbol=DTCR

- https://www.barchart.com/investing-ideas/datacenter/etfs/profiles

- https://finance.yahoo.com/quote/VPN/

- https://finance.yahoo.com/quote/DTCR/performance/

- https://bullishbears.com/data-center-stocks/

- https://finance.yahoo.com/quote/DTCR/

- https://markets.ft.com/data/equities/tearsheet/summary?s=DTCR%3ANMQ%3AUSD

- https://www.schwab.com/research/etfs/quotes/summary/DTCR