Consumer staples ETFs offer steady, defensive exposure to companies selling everyday necessities like food, household products, and beverages. These funds provide stability during market downturns and consistent dividend income, making them valuable portfolio additions for both conservative and growth-oriented investors seeking diversification.

What Are Consumer Staples ETFs?

Consumer staples ETFs invest in companies that produce and sell essential goods that people buy regardless of economic conditions. These include:

- Food and beverages (Coca-Cola, PepsiCo)

- Household products (Procter & Gamble, Colgate-Palmolive)

- Retail chains (Walmart, Costco)

- Tobacco products (Philip Morris, Altria)

- Personal care items (Johnson & Johnson consumer division)

Unlike technology or luxury sectors, consumer staples companies tend to maintain stable revenues during recessions because demand for basic necessities remains relatively constant.

Why Invest in Consumer Staples ETFs?

Defensive Characteristics

Consumer staples ETFs typically show less volatility than the broader market. During the 2020 market crash, many consumer staples ETFs declined far less than the S&P 500, then recovered more quickly.

Consistent Dividends

Most consumer staples companies pay regular dividends, often with a history of annual increases. This makes these ETFs attractive for income-focused investors.

Inflation Protection

As inflation rises, consumer staples companies can often pass increased costs to consumers, helping maintain profit margins.

Portfolio Diversification

Adding consumer staples ETFs can reduce overall portfolio volatility while maintaining growth potential.

Top 10 Consumer Staples ETFs for 2025

| ETF | Name | Expense Ratio | Top 5 Holdings |

|---|---|---|---|

| XLP | Consumer Staples Select Sector SPDR Fund | 0.09% | Walmart (10.04%), Costco (9.81%), Procter & Gamble (8.13%), Coca-Cola (6.13%), Philip Morris (5.93%) |

| VDC | Vanguard Consumer Staples ETF | 0.09% | Costco (13.04%), Walmart (12.73%), Procter & Gamble (10.92%), Coca-Cola (8.18%), Philip Morris (4.82%) |

| IYK | iShares U.S. Consumer Staples ETF | 0.40% | Procter & Gamble (14.66%), Coca-Cola (11.20%), Philip Morris (10.78%), PepsiCo (8.23%), Altria Group (4.94%) |

| FSTA | Fidelity MSCI Consumer Staples Index ETF | 0.08% | Walmart (13.20%), Costco (12.63%), Procter & Gamble (10.28%), Coca-Cola (7.95%), PepsiCo (4.96%) |

| KXI | iShares Global Consumer Staples ETF | 0.41% | Walmart, Costco, PepsiCo, Coca-Cola, Procter & Gamble |

| FXG | First Trust Consumer Staples AlphaDEX Fund | 0.62% | CVS Health, Pilgrim’s Pride, Molson Coors Beverage, Performance Food Group, Sprouts Farmers Market |

| RSPS | Invesco S&P 500 Equal Weight Consumer Staples ETF | 0.40% | Dollar Tree, Kroger, Kimberly-Clark, Monster Beverage, Kellanova |

| PSL | Invesco Dorsey Wright Consumer Staples Momentum ETF | 0.60% | Casey’s General Stores (3.92%), Stride (3.86%), Monster Beverage (3.83%), Costco (3.52%), BJ’s Wholesale Club (3.50%) |

| PBJ | Invesco Food & Beverage ETF | 0.62% | DoorDash (6.30%), Sysco (5.55%), Kroger (5.45%), Keurig Dr Pepper (5.21%), Corteva (5.01%) |

| PSCC | Invesco S&P SmallCap Consumer Staples ETF | 0.29% | Cal-Maine Foods, WD-40 Company, Simply Good Foods, Village Super Market, Ingles Markets |

Analysis of Top Consumer Staples ETFs

1. Consumer Staples Select Sector SPDR Fund (XLP)

- Assets Under Management: $16.6 billion

- Expense Ratio: 0.09%

- 5 Year Trailing Return: 7.71% (7.13% Category Returns)

- Top 5 Holdings:

- Walmart Inc. (10.04%)

- Costco Wholesale Corporation (9.81%)

- The Procter & Gamble Company (8.13%)

- The Coca-Cola Company (6.13%)

- Philip Morris International Inc. (5.93%)

XLP is the largest and most liquid consumer staples ETF, tracking the Consumer Staples Select Sector Index. It focuses exclusively on large-cap S&P 500 companies, providing concentrated exposure to established market leaders.etfdb+1

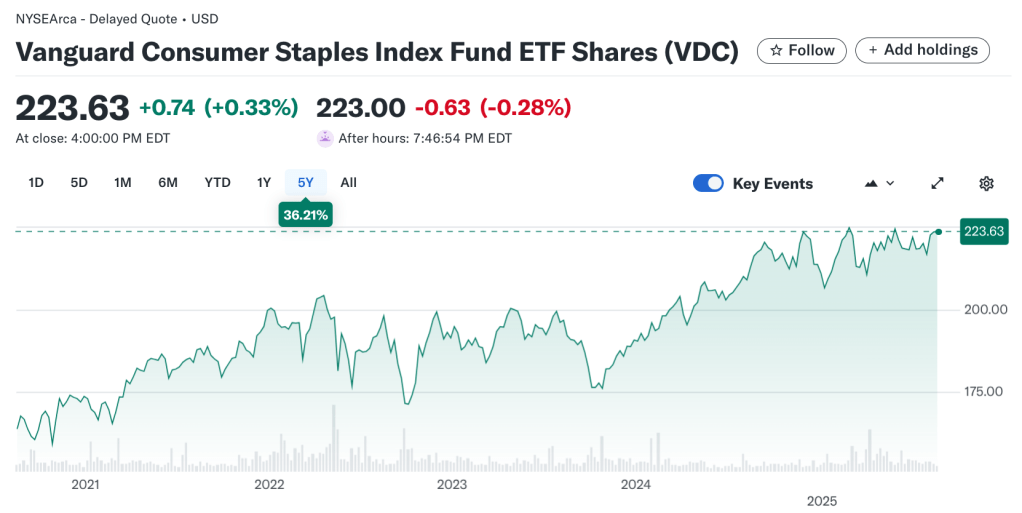

2. Vanguard Consumer Staples ETF (VDC)

- Assets Under Management: $7.7 billion

- Expense Ratio: 0.09%

- 5 Year Return: 8.86% (7.13% Category Return)

- Top 5 Holdings:

- Costco Wholesale Corporation (13.04%)

- Walmart Inc. (12.73%)

- The Procter & Gamble Company (10.92%)

- The Coca-Cola Company (8.18%)

- Philip Morris International Inc. (4.82%)

VDC tracks the MSCI US Investable Market Index and includes approximately 112 holdings, offering broader exposure than XLP by including mid-cap and small-cap companies.stockanalysis

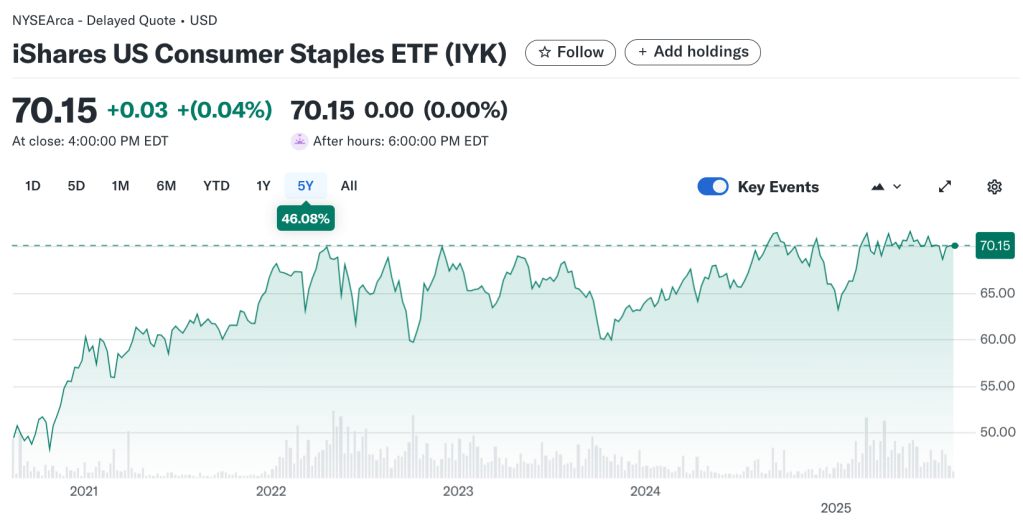

3. iShares U.S. Consumer Staples ETF (IYK)

- Assets Under Management: $1.4 billion

- Expense Ratio: 0.40%

- 5 Year Return: 10.59% (7.13% Category Returns)

- Top 5 Holdings:

- The Procter & Gamble Company (14.66%)

- The Coca-Cola Company (11.20%)

- Philip Morris International Inc. (10.78%)

- PepsiCo, Inc. (8.23%)

- Altria Group, Inc. (4.94%)

IYK differs from XLP and VDC by excluding some major retailers like Costco and Walmart, instead including healthcare-adjacent companies like McKesson and CVS Health.stockanalysis

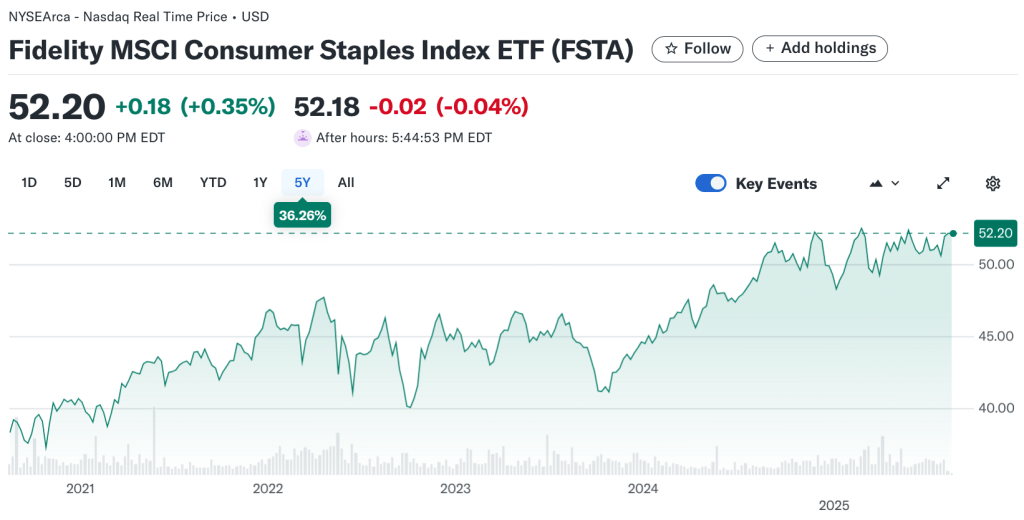

4. Fidelity MSCI Consumer Staples Index ETF (FSTA)

- Assets Under Management: $1.4 billion

- Expense Ratio: 0.08%

- 5 Year Return: 8.83% (7.13% Category Returns)

- Top 5 Holdings:

- Walmart Inc. (13.20%)

- Costco Wholesale Corporation (12.63%)

- The Procter & Gamble Company (10.28%)

- The Coca-Cola Company (7.95%)

- PepsiCo, Inc. (4.96%)

FSTA offers the lowest expense ratio among major consumer staples ETFs and tracks an MSCI index similar to VDC, making it a cost-effective choice for broad sector exposure.stockanalysis

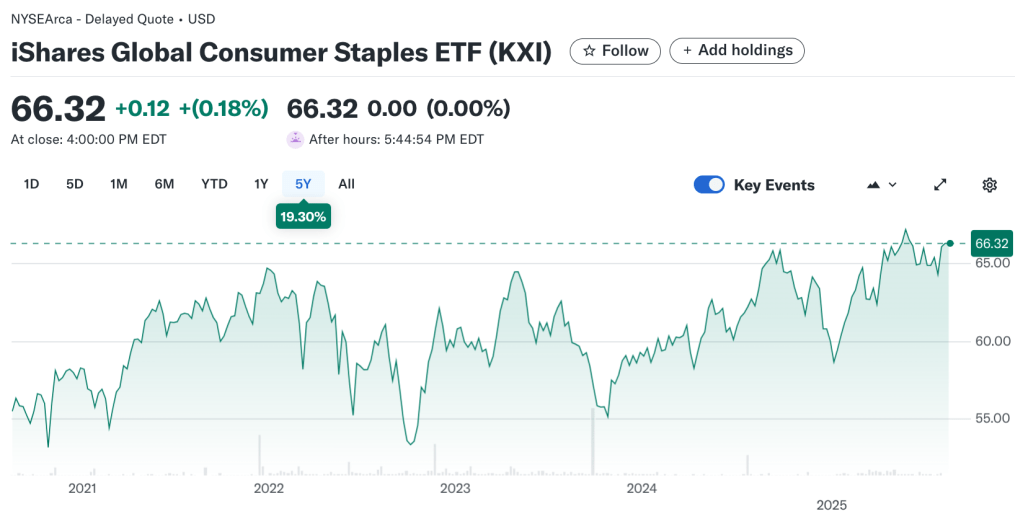

5. iShares Global Consumer Staples ETF (KXI)

- Assets Under Management: $853 million

- Expense Ratio: 0.41%

- 5 Year Trailing Returns:

- Top 5 Holdings: Walmart, Costco, PepsiCo, Coca-Cola, Procter & Gamble

KXI provides global exposure to consumer staples companies, including international brands like Nestlé, Unilever, and L’Oréal alongside U.S. giants.blackrock

6. First Trust Consumer Staples AlphaDEX Fund (FXG)

- Assets Under Management: $297 million

- Expense Ratio: 0.62%

- 5 Year Trailing Returns: 7.08% (7.13% Category Returns)

- Top 5 Holdings: CVS Health, Pilgrim’s Pride, Molson Coors Beverage, Performance Food Group, Sprouts Farmers Market

FXG uses a multifactor approach, selecting stocks based on growth and value factors rather than market capitalization, resulting in different holdings than traditional market-cap-weighted funds.etftrends

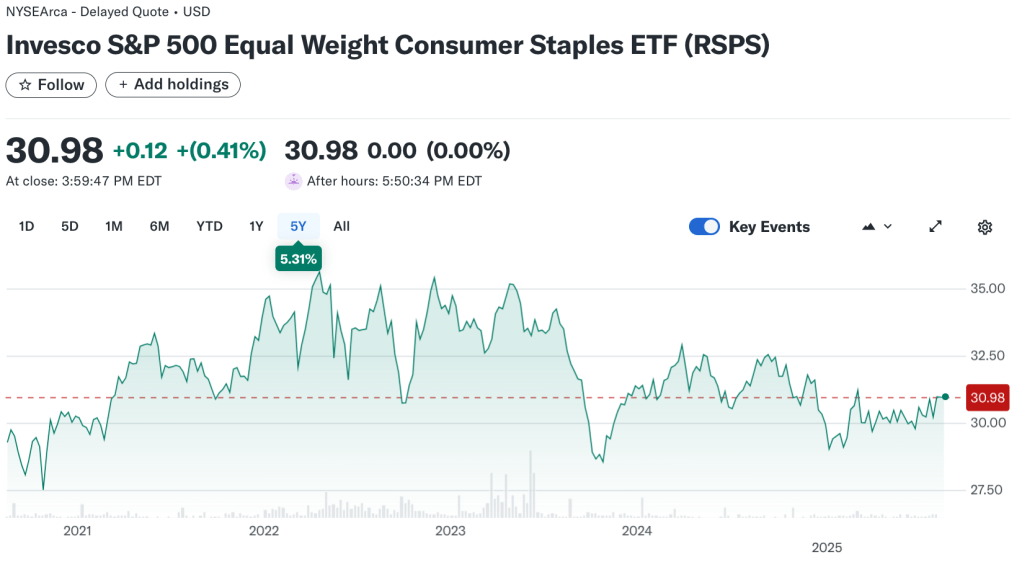

7. Invesco S&P 500 Equal Weight Consumer Staples ETF (RSPS)

- Assets Under Management: $260 million

- Expense Ratio: 0.40%

- 5 Year Trailing Returns: 3.63% (7.13% Category Returns)

- Top 5 Holdings: Dollar Tree, Kroger, Kimberly-Clark, Monster Beverage, Kellanova

RSPS gives equal weight to all holdings rather than market-cap weighting, reducing concentration in mega-cap stocks and potentially enhancing returns from smaller positions.etftrends

8. Invesco Dorsey Wright Consumer Staples Momentum ETF (PSL)

- Assets Under Management: $103 million

- Expense Ratio: 0.60%

- 5 Year Trailing Returns: 9.21% (7.13% Category Returns)

- Top 5 Holdings:

- Casey’s General Stores Inc. (3.92%)

- Stride Inc. (3.86%)

- Monster Beverage Corp. (3.83%)

- Costco Wholesale Corp. (3.52%)

- BJ’s Wholesale Club Holdings Inc. (3.50%)

PSL selects stocks based on relative strength and momentum factors, rebalancing quarterly to maintain exposure to outperforming consumer staples stocks.invesco

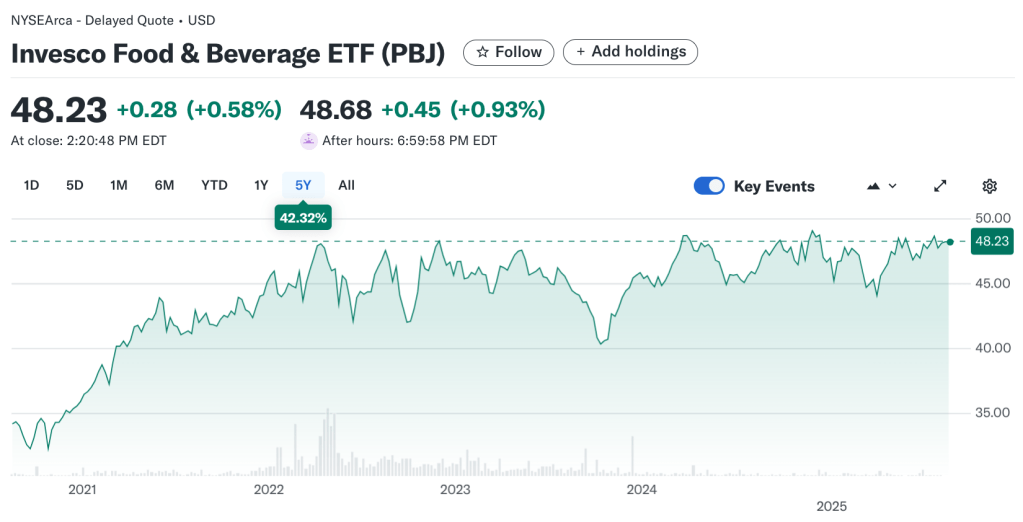

9. Invesco Food & Beverage ETF (PBJ)

- Assets Under Management: $98 million

- Expense Ratio: 0.62%

- 5 Year Trailing Returns: 9.18% (7.13% Category Returns)

- Top 5 Holdings:

- DoorDash Inc. (6.30%)

- Sysco Corp. (5.55%)

- Kroger Co. (5.45%)

- Keurig Dr Pepper Inc. (5.21%)

- Corteva Inc. (5.01%)

PBJ focuses specifically on food and beverage companies, including restaurant chains, food distributors, and agricultural businesses, providing targeted exposure within the broader consumer staples sector.invesco

10. Invesco S&P SmallCap Consumer Staples ETF (PSCC)

- Assets Under Management: $42 million

- Expense Ratio: 0.29%

- 5 Year Trailing Returns: 8.71% (7.13% Category Returns)

- Top 5 Holdings: Cal-Maine Foods, WD-40 Company, Simply Good Foods, Village Super Market, Ingles Markets

PSCC focuses on small-cap consumer staples companies, offering exposure to smaller, potentially faster-growing businesses in the sector.etftrends

How Do Consumer Staples ETFs Compare?

Performance Characteristics

Consumer staples ETFs typically deliver:

- Lower volatility than broad market indices

- Steady dividend yields ranging from 2-3%

- Modest but consistent price appreciation

- Better downside protection during market corrections

Key Differences Between Funds

- Market Cap Focus: XLP (large-cap only) vs. VDC (all market caps)

- Geographic Scope: KXI (global) vs. others (U.S.-focused)

- Weighting Strategy: RSPS (equal weight) vs. most others (market-cap weighted)

- Sector Focus: PBJ (food/beverage only) vs. broad sector exposure

Which Consumer Staples ETF Should You Choose?

For Core Holdings

XLP or VDC offer the best combination of low costs, high liquidity, and broad sector exposure. Choose XLP for large-cap focus or VDC for broader market-cap exposure.

For Cost-Conscious Investors

FSTA provides the lowest expense ratio at 0.08%, making it ideal for long-term buy-and-hold strategies.

For Global Exposure

KXI includes international consumer staples giants, providing geographic diversification beyond U.S. markets.

For Active Strategies

FXG or PSL use factor-based approaches that may outperform during certain market conditions, though with higher fees and volatility.

FAQs About Consumer Staples ETFs

Are consumer staples ETFs good for beginners?

Yes. Their stability, defensive characteristics, and steady dividends make them excellent foundation holdings for new investors learning about market cycles.

Do consumer staples ETFs perform well during recessions?

Generally yes. While they may still decline during severe market downturns, they typically fall less than growth sectors and recover more quickly due to steady demand for essential products.

What’s the difference between consumer staples and consumer discretionary?

Consumer staples include necessities (food, toothpaste, soap) while consumer discretionary covers optional purchases (restaurants, clothing, electronics). Staples are more defensive; discretionary is more cyclical.

How much of my portfolio should be in consumer staples ETFs?

Most financial advisors suggest 5-15% allocation to consumer staples as part of a diversified portfolio, though this varies based on risk tolerance and investment goals.

Which consumer staples ETF pays the highest dividends?

Dividend yields are generally similar across major funds (2-3%), but IYK and KXI tend to offer slightly higher yields due to their specific holdings mix.

Risks and Considerations

Growth Limitations

Consumer staples companies typically grow slower than technology or healthcare sectors, potentially limiting long-term returns during bull markets.

Interest Rate Sensitivity

As dividend-paying stocks, consumer staples can be sensitive to rising interest rates, which make bonds more attractive relative to dividend stocks.

Currency and Commodity Exposure

Many consumer staples companies face input cost pressures from commodity price changes and currency fluctuations affecting international operations.

Regulatory Risk

Tobacco holdings in many consumer staples ETFs face ongoing regulatory pressures and declining consumption trends.

Building Your Consumer Staples Strategy

Core-Satellite Approach

Use a large, diversified fund like XLP or VDC as your core holding, then add specialized funds like PBJ or PSL for targeted exposure.

Dollar-Cost Averaging

Regular monthly investments in consumer staples ETFs can help smooth out market volatility while building long-term wealth.

Rebalancing Considerations

Monitor your allocation quarterly, as consumer staples may underperform during strong bull markets, requiring rebalancing to maintain target weights.

Conclusion: Consumer Staples ETFs in Your Portfolio

Consumer staples ETFs offer valuable portfolio benefits through their defensive characteristics, steady dividends, and exposure to companies with predictable business models. While they may not deliver the explosive growth of technology stocks, they provide stability and income that becomes increasingly valuable during uncertain economic times.

The sector’s consistent performance, combined with low-cost ETF options like XLP, VDC, and FSTA, makes consumer staples an accessible and practical addition to most investment portfolios. Whether you’re seeking income, stability, or simply broader diversification, consumer staples ETFs deserve consideration in your long-term investment strategy.

Quick Reference: 2025 Consumer Staples ETF Summary

| Best Overall | XLP – Largest, most liquid, lowest cost |

|---|---|

| Best Value | FSTA – Lowest expense ratio at 0.08% |

| Best Global | KXI – International diversification |

| Best for Income | IYK – Slightly higher dividend yield |

| Most Diversified | VDC – Includes small and mid-cap stocks |

All data current as of August 2025. Always verify current holdings and performance before investing.

Related Articles:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- Data Center ETFs: Complete 2025 Guide to Digital Infrastructure Investments

Citations:

- https://etfdb.com/etfdb-category/consumer-staples-equities/

- https://stockanalysis.com/etf/xlp/holdings/

- https://stockanalysis.com/etf/vdc/holdings/

- https://stockanalysis.com/etf/iyk/holdings/

- https://stockanalysis.com/etf/fsta/

- https://www.blackrock.com/us/individual/products/239740/ishares-global-consumer-staples-etf

- https://www.etftrends.com/innovative-etfs-channel/consumer-staples-etfs-defensive-strength-uncertain-times/

- https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=PSL

- https://www.invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=PBJ

- https://money.usnews.com/investing/articles/best-consumer-staples-etfs

- https://www.justetf.com/en/how-to/invest-in-consumer-staples.html

- https://www.reddit.com/r/Bogleheads/comments/14zazdu/100_consumer_staples_etf_instead_of_total_market/

- https://www.sectorspdrs.com/mainfund/xlp

- https://www.nerdwallet.com/article/investing/consumer-staples-stocks

- https://www.ssga.com/us/en/intermediary/etfs/the-consumer-staples-select-sector-spdr-fund-xlp

- https://advisors.vanguard.com/investments/products/vdc/vanguard-consumer-staples-etf

- https://www.morningstar.com/best-investments/consumer-defensive-funds

- https://www.ishares.com/us/products/239505/ishares-us-consumer-staples-etf

- https://finance.yahoo.com/research-hub/screener/sec-ind_sec-top-etfs_consumer-defensive/

- https://investor.vanguard.com/investment-products/etfs/profile/vdc

- https://money.usnews.com/funds/etfs/consumer-defensive/fidelity-msci-consumer-staples-etf/fsta

- https://www.schwab.wallst.com/schwab/Prospect/research/etfs/schwabETF/index.asp?type=holdings&symbol=XLP

- https://www.tradingview.com/symbols/BMV-VDC/holdings/

- https://www.schwab.wallst.com/Prospect/Research/etfs/portfolio.asp?symbol=iyk

- https://www.schwab.wallst.com/Prospect/Research/etfs/portfolio.asp?symbol=xlp

- https://www.zacks.com/funds/etf/VDC/holding

- https://marketchameleon.com/Overview/XLP/Holdings/

- https://www.morningstar.com/etfs/xmex/vdc/portfolio

- https://www.blackrock.com/us/individual/products/239505/ishares-us-consumer-staples-etf

- https://finance.yahoo.com/quote/VDC/holdings/

- https://www.morningstar.com/etfs/xsgo/iyk/portfolio

- https://finance.yahoo.com/quote/VDC/

- https://etfdb.com/etf/IYK/

- https://www.morningstar.com/etfs/arcx/xlp/portfolio

- https://etfdb.com/etfs/sector/consumer-staples/

- https://www.marketbeat.com/stocks/NYSEARCA/PBJ/holdings/

- https://www.marketbeat.com/stocks/NYSEARCA/FSTA/institutional-ownership/

- https://swingtradebot.com/etfs-by-keyword/389-pizza

- https://www.schwab.wallst.com/Prospect/Research/etfs/portfolio.asp?symbol=fsta

- https://www.etfrc.com/PBJ

- https://etfdb.com/compare/highest-5-year-returns/

- https://advisorshares.com/etfs/eatz/

- https://etfdb.com/etf/FSTA/

- https://etfdb.com/etf/RSPS/

- https://www.blackrock.com/ca/investors/en/products/239838/ishares-sptsx-capped-consumer-staples-index-etf