Mexico ETF funds are investment products that let investors buy into a basket of Mexican stocks easily and at a low cost.

These funds are managed by experts and are designed to follow the overall performance of Mexican companies.

Over the last 3 to 5 years, several Mexico ETFs have proven to be stable and well-rated choices for people wanting to invest in this dynamic country.

This article covers the three top Mexico-focused ETF funds:

- iShares MSCI Mexico ETF (EWW)

- Franklin FTSE Mexico ETF (FLMX)

- Vanguard FTSE BIVA Mexico Equity ETF (VMEX19.MX)

For each fund, the article explains:

- What makes them valuable investments

- Their most important metrics

- Five of their biggest holding companies

What is an ETF?

An ETF, or Exchange-Traded Fund, is a collection of stocks that are grouped together and traded like one stock. This makes it easy for investors to buy shares of many Mexican companies without picking each one individually.

Why Invest in Mexico ETFs?

Mexico is an emerging market with strong growth, a growing middle class, and important trading ties to the United States. By investing in a Mexico ETF, investors can benefit from the country’s growth without the need to research every company in Mexico.

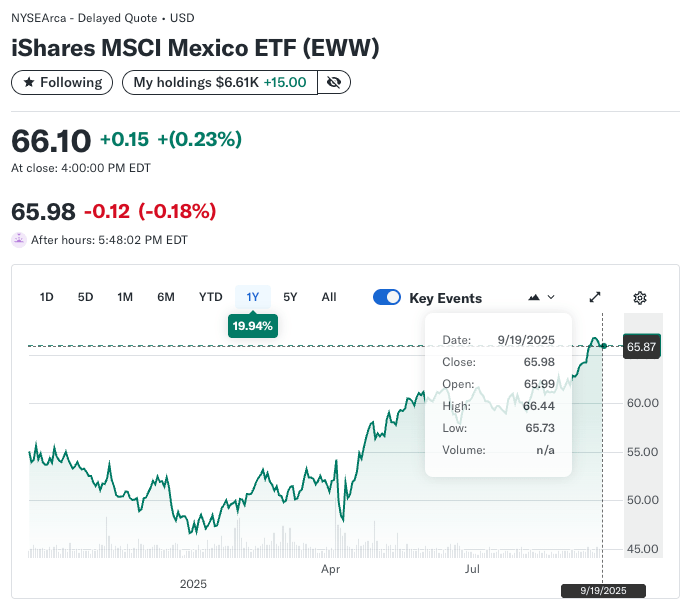

iShares MSCI Mexico ETF (EWW)

The iShares MSCI Mexico ETF (EWW) is one of the largest and most popular Mexico ETFs. It tracks the MSCI Mexico Index and invests in major Mexican companies across several industries including finance, retail, communications, and materials.

Performance Metrics

- Three-Year Average Return: About 12.95% per year.

- Five-Year Average Return: About 17.26% per year.

- Expense Ratio: 0.5% (lower fees mean investors keep more of their profits).

- Assets Under Management: Over $1.8 billion (shows investor confidence and fund stability).

- PE Ratio: Around 12.56 (shows how much investors are willing to pay compared to the company’s profits).

Ratings and Value

EWW is rated highly because it offers diversified exposure to Mexico’s biggest companies, has a long track record, and keeps costs relatively low. Its consistent returns and size make it a favorite choice for investors wanting to tap the Mexican market.

Top 5 EWW ETF Holdings

Here are the five biggest companies currently held in EWW:

- Grupo Financiero Banorte – One of Mexico’s biggest banks and a leader in financial services (10.95% of the fund).

- Grupo Mexico SAB de CV – A top mining company, especially in copper production (9.69%).

- America Movil SAB de CV – The largest telecom company in Latin America, led by Carlos Slim (8.01%).

- Wal-Mart de México – Mexico’s largest retailer, operating many stores across the country (7.16%).

- Fomento Economico Mexicano (FEMSA) – A consumer business that owns convenience stores, bottling, and more (6.60%).

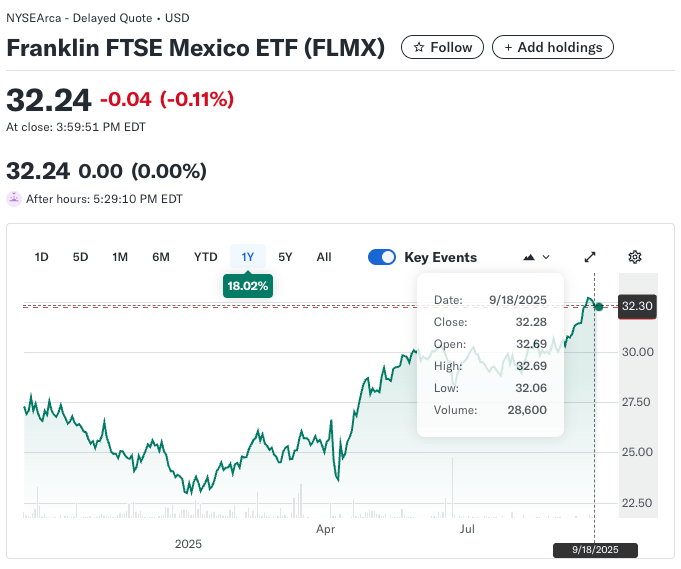

Franklin FTSE Mexico ETF (FLMX)

The Franklin FTSE Mexico ETF (FLMX) is a lower-fee ETF that focuses on Mexico’s leading businesses. Known for its competitive expense ratio and strict focus on Mexican equities, it’s a solid choice for cost-conscious investors.

FLMX Performance Metrics

- Three-Year Average Return: Recent returns suggest strong performance in line with EWW and other leading funds.

- Five-Year Average Return: Competitive with other Mexico ETFs, showing consistent growth.

- Expense Ratio: About 0.19%–0.39% (very low, which means investors keep more profits).

- Assets Under Management: Over $60 million; smaller than EWW but still significant.

- PE Ratio: About 11.68 (lower than EWW, meaning slightly more value for money).

FLMX Ratings and Value

FLMX is considered well-rated for its low cost and focus on long-term growth. While smaller than EWW, it is praised for efficient management and good sector diversification.

Top 5 FLMX ETF Holdings

Here are five of the biggest companies in FLMX:

- Grupo Financiero Banorte – Leading Mexican financial institution (12.07% of the fund).

- Grupo Mexico SAB de CV – Main mining and transportation business (9.32%).

- America Movil SAB de CV – Telecommunications giant serving Mexico and Latin America (7.67%).

- Wal-Mart de México – Dominant retailer in Mexican markets (7.47%).

- Cemex SAB de CV – A global cement and building materials company based in Mexico (6.71%).

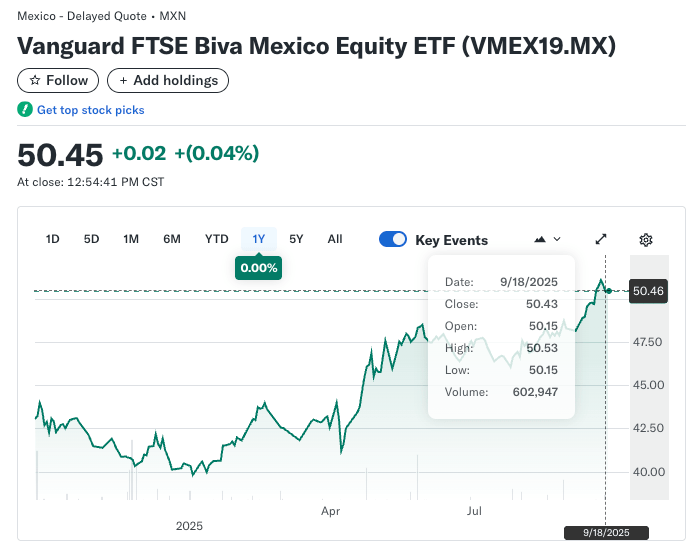

Vanguard FTSE BIVA Mexico Equity ETF (VMEX19.MX)

The Vanguard FTSE BIVA Mexico Equity ETF (VMEX) provides exposure to the full range of Mexico’s economy, including big companies in finance, telecom, and consumer products. Vanguard is known for its commitment to low costs and investor-friendly policies.

VMEX Performance Metrics

- Three-Year Average Return: Similar to leading competition, with strong emerging markets performance.

- Five-Year Average Return: Reliable returns, often above the Mexico market average.

- Expense Ratio: About 0.25%–0.30% (very low, another cost-effective fund).

- Assets Under Management: Large enough to ensure good liquidity and fund stability.

- PE Ratio: In line with Mexico ETF market averages, showing sensible growth potential.

VMEX Ratings and Value

VMEX is valued for its low cost and wide coverage. It is suitable for investors who want exposure across the full variety of Mexican industry, not just banks or retailers.

Top 5 VMEX Holdings

The top five companies in VMEX are:

- Grupo Financiero Banorte – The largest bank in the fund (11.95%).

- Fomento Economico Mexicano (FEMSA) – Leading consumer services and bottling group (10.42%).

- America Movil SAB de CV – The region’s leader in communications (10.17%).

- Wal-Mart de México – Top retail giant in Mexico (9.32%).

- Grupo Mexico SAB de CV – Main mining and infrastructure company (9.03%).

Comparing Top Mexico ETF

Here is a simple table comparing the three ETFs based on their most important metrics.

| ETF | 3-Year Return | 5-Year Return | Expense Ratio | Largest Holding | PE Ratio | Asset Value |

|---|---|---|---|---|---|---|

| iShares MSCI Mexico | 12.95% | 17.26% | 0.50% | Grupo Financiero Banorte | 12.56 | $1.8B+ |

| Franklin FTSE Mex | ~13% | ~17% | 0.19%-0.39% | Grupo Financiero Banorte | 11.68 | $60M+ |

| Vanguard BIVA Mex. | ~13% | ~17% | 0.25%-0.30% | Grupo Financiero Banorte | ~12 | $627M+ |

ETF Ratings: What Matters Most

Mexico ETF Expense Ratio

A lower expense ratio means the investor pays less in fees. FLMX and VMEX stand out with lower fees than EWW.

Diversification

Each ETF holds around 40–60 Mexican companies. Top sectors include finance, consumer, communications, mining, and materials.

Size and Liquidity

Larger ETFs like EWW tend to be more stable and easier to buy and sell, which is helpful for investors who want flexibility.

Track Record

Long-term performance (3–5 years) is strong for all three funds, while recent returns have been affected by global market conditions. All ETFs have recovered well from past market drops.

Mexico ETF Sector Breakdown

All three top ETFs are diversified across major Mexican industries. Here’s a breakdown of the most common sectors:

- Financial Services (Banking): About 20% of most ETF portfolios.

- Consumer Defensive (Retail, Groceries): About 22%, led by companies like Wal-Mart de México and FEMSA.

- Basic Materials (Mining, Cement): About 19%.

- Communication Services: About 9% with leaders like America Movil.

- Industrials, Real Estate, Others: Around 20% combined, rounding out exposure to airports, infrastructure, and real estate.

ETF Holdings Details

iShares MSCI Mexico ETF (EWW)

- Grupo Financiero Banorte (10.95%)

- Grupo Mexico SAB de CV (9.69%)

- America Movil (8.01%)

- Wal-Mart de México (7.16%)

- FEMSA (6.60%)

Franklin FTSE Mexico ETF (FLMX)

- Grupo Financiero Banorte (12.07%)

- Grupo Mexico SAB de CV (9.32%)

- America Movil (7.67%)

- Wal-Mart de México (7.47%)

- Cemex SAB de CV (6.71%)

Vanguard FTSE BIVA Mexico Equity ETF (VMEX)

- Grupo Financiero Banorte (11.95%)

- FEMSA (10.42%)

- America Movil (10.17%)

- Wal-Mart de México (9.32%)

- Grupo Mexico SAB de CV (9.03%)

Important Mexico ETF Metrics Explained

Average Annual Return

Shows how much money the fund has made each year, on average. Used for measuring growth and success.

Expense Ratio

Tells how much of the investment is used to pay fund managers and operating expenses. Lower is better.

PE Ratio (Price/Earnings)

Shows how much investors are paying for each peso of profit. Lower PE can mean better value, but high growth funds can have higher PE ratios.

Assets Under Management (AUM)

The total value of money managed by the ETF. High AUM means more trust from investors.

Top Holdings

Shows which companies make up most of the ETF. Heavily weighted companies have a bigger effect on ETF returns.

Quick Summary Table: Key Mexico ETF Holdings

| Company Name | EWW (%) | FLMX (%) | VMEX (%) |

|---|---|---|---|

| Grupo Financiero Banorte | 10.95 | 12.07 | 11.95 |

| Grupo Mexico SAB de CV | 9.69 | 9.32 | 9.03 |

| America Movil | 8.01 | 7.67 | 10.17 |

| Wal-Mart de México | 7.16 | 7.47 | 9.32 |

| FEMSA | 6.60 | 5.43 | 10.42 |

Conclusion

Mexico ETFs like EWW, FLMX, and VMEX make it easy to invest in some of Mexico’s biggest, fastest-growing companies through one simple package. They are well-rated, have shown consistent performance over several years, and have relatively low costs.

Each fund holds a mix of top Mexican banks, telecom companies, retailers, and industrial giants, giving investors broad exposure to the Mexican economy and its future potential.

For young investors, families, and anyone interested in Mexico’s growth, these ETFs are a smart way to start building wealth and learning about international markets in a safe, affordable way.

Related Posts:

- Top Mexico ETF Funds

- SGOV ETF: Simple Guide for Beginners

- Consumer Staples ETFs: Your Complete 2025 Investment Guide

- Dividend ETF to Maximize Your Income in 2025

- XOVR ETF: The First Crossover ETF Combining Public and Private Equity

- Cocoa ETF: A Complete Guide for 2025

- European Defense ETF: A Comprehensive Guide for 2025

- YieldMax ETFs: High-Yield, High-Risk Income Strategies

- Defiance ETF

- Investing 101: ETF vs Stocks

All data as of August–September 2025, using best available public ratings and fund reports.

Citations:

- https://www.justetf.com/en/how-to/invest-in-mexico.html

- https://stockanalysis.com/etf/eww/holdings/

- https://stockanalysis.com/etf/flmx/holdings/

- https://www.morningstar.com/etfs/xmex/vmex/quote

- https://www.morningstar.com/etfs/xmex/vmex/portfolio

- https://etfdb.com/etf/EWW/

- https://www.ishares.com/us/literature/fact-sheet/eww-ishares-msci-mexico-etf-fund-fact-sheet-en-us.pdf

- https://finance.yahoo.com/quote/FLMX/holdings/

- https://www.vanguardmexico.com/en/product/etf/equity/9590/vanguard-ftse-biva-mexico-index-etf

- https://etfdb.com/etfs/country/mexico/

- https://www.ishares.com/us/products/239670/ishares-msci-mexico-capped-etf

- https://money.usnews.com/funds/etfs/miscellaneous-region/ishares-msci-mexico-etf/eww

- https://www.blackrock.com/us/individual/products/239670/ishares-msci-mexico-capped-etf

- https://www.justetf.com/en/market-overview/the-best-etfs.html

- https://www.schwab.wallst.com/schwab/Prospect/research/etfs/reports/reportRetrieve.asp?reportType=etfrc&symbol=eww

- https://www.investing.com/etfs/mexico-etfs

- https://www.justetf.com/en/market-overview/the-best-country-etfs.html

- https://www.lazyportfolioetf.com/etf/ishares-msci-mexico-etf-eww/

- https://finance.yahoo.com/quote/EWW/

- https://danelfin.com/mexico-stocks

- https://markets.ft.com/data/etfs/tearsheet/performance?s=EWW%3AMEX%3AMXN

- https://etfdb.com/country/mexico/

- https://money.usnews.com/investing/articles/best-performing-etfs

- https://finance.yahoo.com/quote/EWW/performance/

- https://www.morningstar.com/etfs/xsgo/eww/performance

- https://www.msci.com/documents/10199/255599/msci-mexico-index-usd-net.pdf

- https://www.franklintempleton.com/investments/options/exchange-traded-funds/products/26354/SINGLCLASS/franklin-ftse-mexico-etf/FLMX

- https://finance.yahoo.com/quote/EWW/holdings/

- https://www.morningstar.com/etfs/arcx/eww/portfolio

- https://finance.yahoo.com/quote/HEWW/holdings/

- https://www.tipranks.com/etf/eww/holdings

- https://sg.finance.yahoo.com/quote/FLMX/holdings/

- https://sg.finance.yahoo.com/quote/VMEX19.MX/insider-roster/

- https://seekingalpha.com/symbol/EWW/holdings

- https://www.morningstar.com/etfs/arcx/flmx/portfolio

- https://seekingalpha.com/symbol/VMEXF/holdings